Do Secured Credit Cards Build Credit History?

Quick Answer

A secured credit card may help you build credit under the right conditions, especially if you can convert it to an unsecured card. Taking other steps to improve your credit may be effective, too.

Secured credit cards can be a good way to start building or improving your credit history, especially because they tend to be easier to qualify for than a traditional credit card. Here, we'll cover the important steps for using a secured credit card to build credit.

What Is a Secured Credit Card?

A secured credit card works the same as a regular credit card except that you make a deposit as collateral to open the account. The deposit lowers the card issuer's risk in extending credit to you, making secured cards easier to qualify for than many traditional credit cards.

Typically, your credit limit is equal to the amount of the security deposit. For example, if you make a $200 security deposit, your credit limit will be $200. If you default on payments, your cardholder will use the deposit to cover your outstanding balance. When you maintain timely payments, your deposit will be returned to you either when you close the card in good standing or you're upgraded to an unsecured card after several months of responsible use.

Using a secured credit card responsibly can help you improve your credit, as long as the account is reported to at least one of the major credit bureaus (Experian, TransUnion or Equifax), and preferably all three.

Learn more: How Secured Credit Card Deposits Work

How to Use a Secured Credit Card to Build Credit

Secured credit cards can help you build credit just like a traditional card. The key is using your card regularly and responsibly for the best results. Here's how to use a secured card to build credit.

1. Choose the Right Card

Look for a good secured credit card that reports to the major credit bureaus—this is essential for building a credit history. A card that offers the opportunity to upgrade to an unsecured credit card is also a good option. Additionally, choose a secured credit card with favorable terms, such as no fees and a low minimum deposit.

Learn more: How to Upgrade a Secured Card to an Unsecured Card

2. Use the Card Regularly

Simply having a secured credit card isn't enough; you need to actively use it if you want to build your credit. Make small purchases on your credit card regularly and pay them off. An inactive credit card may eventually be closed, which could have a negative impact on your credit.

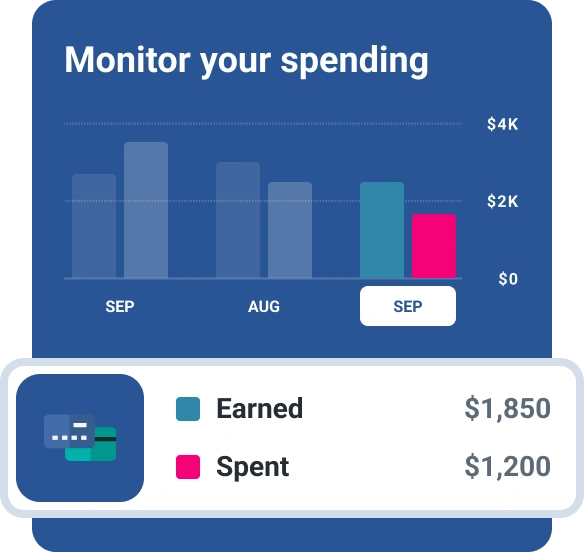

3. Keep a Low Balance

Avoid maxing out your credit card. High balances are harder to repay and can negatively impact your credit score because they'll reflect a high credit utilization rate, which can hurt your credit. Instead, use only a small amount of your credit limit to keep your balance low relative to your credit limit. Aim to keep your balance below 30% of your credit limit, but the lower, the better for credit scores.

4. Make All Payments on Time

On-time payments are crucial to building your credit. Payment history is the most significant factor in your credit score, and late payments can stay on your credit report for seven years. Ideally, pay your balance in full each month. If that's not possible, aim to make at least the minimum payment by the due date.

5. Monitor Your Credit Score

Regularly check your credit score to track how your credit card use is affecting your credit. An unexpected drop in your credit score could indicate an error on your credit report, which you should deal with right away. You can check your credit score for free anytime with Experian to see where you stand.

How Much Will a Secured Card Help Your Credit?

It's impossible to predict how much your credit can improve by using a secured credit card since it largely depends on the details in your credit history. But using a secured card responsibly can help you build credit over time.

Taking a look at the five primary credit scoring factors, here's how your secured credit card use could help boost your credit score.

- Payment history: Using a secured credit card can help you establish a track record of paying on time when your payment history is reported to the credit bureaus.

- Amount of debt: Keeping a low balance on your secured credit card helps you maintain a healthy credit utilization ratio.

- Credit age: Keeping your secured credit card open longer shows you have more experience with using credit.

- Credit mix: As you add other forms of credit, having a secured credit card will help diversify the types of credit you have.

- New credit: Opening a secured credit card may cause a short-term dip in your credit score due to the hard inquiry on your credit report, but your score can recover as the initial inquiry ages.

Learn more: Reasons to Keep a Secured Card After Improving Your Score

More Ways to Build Credit

In addition to using a secured credit card, there are several other ways you can build your credit.

- Become an authorized user. Consider asking a family member or friend to add you to one of their credit cards with a long, positive credit history. As an authorized user, you can benefit from a credit card's existing account history. You won't be responsible for making payments on the account, but if it's included on your credit report, your credit score may increase.

- Use a credit-builder loan. A credit-builder loan works in reverse to a typical loan: The loan amount is deposited into a bank account while you make monthly payments toward it that get reported to the credit bureaus. At the end of the loan's repayment term, the loan—possibly plus interest—is yours to keep. Just make sure the lender reports to all three credit bureaus before applying.

- Ask a family member or friend to cosign a loan. If you need to borrow money and have a trusted relationship with a family member with good credit, asking them to cosign a loan can help you build credit. Keep in mind that any late payments you make will appear on their credit report, too, so it's critical that you make every payment on time.

- Get a boost from your regular bills. You can benefit from timely payments on your regular bills by using a feature like Experian Boost®ø. With your authorization, qualifying bills including utilities, rent, insurance and streaming services can be added to your credit report and could help build your credit score. This can be especially beneficial if you have a thin credit file with few credit accounts.

- Don't close old accounts. Older accounts help boost your credit age, showing you have more experience using credit. It's best to leave these accounts open, using them periodically to keep them open and active.

Learn more: Ways to Build Credit if You Have No Credit History

The Bottom Line

A secured credit card is an excellent option if you've had trouble getting approved for a traditional credit card. Many of the best secured credit cards have a low security deposit, which makes it easy to get started.

As you use your credit card, monitor your credit score. Improvements in your score show that your responsible credit use is paying off.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

LaToya Irby is a personal finance writer who works with consumer media outlets to help people navigate their money and credit. She’s been published and quoted extensively in USA Today, U.S. News and World Report, myFICO, Investopedia, The Balance and more.

Read more from LaToya