5 Reasons to Keep Using a Secured Card After Improving Your Score

Quick Answer

It’s often wise to keep a secured credit card open even after you’ve established or improved credit. You can avoid the risk of hurting your credit score by closing the account.

When you get a secured credit card, you may have a goal of moving on to an unsecured card as quickly as possible. But even after you've improved your credit, there are some reasons to keep a secured credit card instead of closing your account.

Consider these five reasons for keeping a secured card in your wallet even long after you've improved your credit score and can qualify for other cards.

1. Continue Building Credit

A secured card will help build your credit indefinitely as long as you use it responsibly. Using a secured card while making payments on time and keeping your credit utilization low can net the best results.

That's because payment history and the amount you owe on your credit accounts (primarily represented by your credit utilization) make up 35% and 30% of your FICO® ScoreΘ, respectively. Just by continuing to have positive behaviors on these accounts, you can help your credit score.

2. Avoid Hurting Your Credit From an Account Closure

Some secured cards offer the option to convert to an unsecured card after some time. But if yours does not, you may be tempted to close the account and move on to another unsecured card elsewhere. But closing a credit card can actually have a negative effect on your credit score.

Closing a credit card will reduce your overall credit limit, which could boost your credit utilization and, by extension, decrease your credit score.

Additionally, after 10 years or so (assuming your account is in good standing when you close it), the account will be removed from your credit report and affect the length of your credit history, which accounts 15% of your FICO® Score. The account closure's effect on your credit history is of less concern, however, since you're likely to have other accounts that will make up for the secured account's history.

Instead, consider continuing to use your card for small, recurring purchases to keep it open.

3. Use as a Budgeting Tool

If you've acquired a new unsecured card and are unsure of what to do with your old, low-limit secured card, consider using it as a budgeting tool.

For example, you may put all of your entertainment and meals out on this card only. If you get close to your limit, cut off your spending in these categories for the rest of the billing cycle and pay your outstanding balance in full.

Remember to stay mindful of your credit utilization, which should ideally stay below 10% across all accounts for the best credit scores.

4. Option to Convert It to an Unsecured Card

At some point, you may have the chance to convert a secured card to an unsecured card. This may fit your financial needs better after you've improved your credit.

Converting your unsecured card may allow you to maintain any accrued rewards and qualify for an increased credit limit. Increased credit limits are desirable even if you don't plan to spend that much as they help to reduce your credit utilization ratio.

5. Can Limit Your Temptation to Spend

For some, having a credit card at all can be a huge spending temptation. But the convenience and safety of credit cards to make online purchases or schedule automated payments makes it hard to live without one.

It's possible to curb temptation but still take advantage of having a credit card by keeping your secured credit card. Secured cards often have a lower credit limit that's typically equivalent to the card's security deposit (though you could receive a credit limit increase with responsible card use). This lower limit can help restrict your spending and prevent you from amassing large amounts of debt.

Feeling Secure With Credit

Secured cards can be used as a tool to help you build or rebuild your credit. But if you are strategic with secured cards, you can find other uses too. After you have rebuilt your credit with a secured card, consider some of the above uses to help you on your continued credit journey.

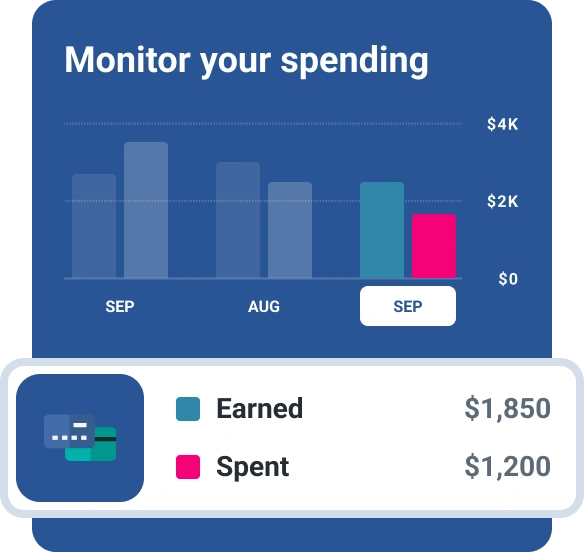

To make sure your spending and credit moves are still improving, you can take advantage of free credit monitoring from Experian. With free monitoring, you'll know as soon as your score changes. You can also get alerts for suspicious activity or monitor your financial account balances all in one place.

As you see your credit score improve, consider complementing your secured card with an unsecured card. With improved credit, you may qualify for some cards with perks like travel rewards or high cash back rates. Feel confident applying for unsecured cards with Experian's free comparison tool, which can help you gauge the odds of approval without hurting your score.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

Emily Cahill is a finance and lifestyle writer who is passionate about empowering people to make smart choices in their financial and personal lives. Her work has appeared on Entrepreneur, Good Morning America and The Block Island Times.

Read more from Emily