How Many Points Does an Inquiry Drop Your Credit Score?

Quick Answer

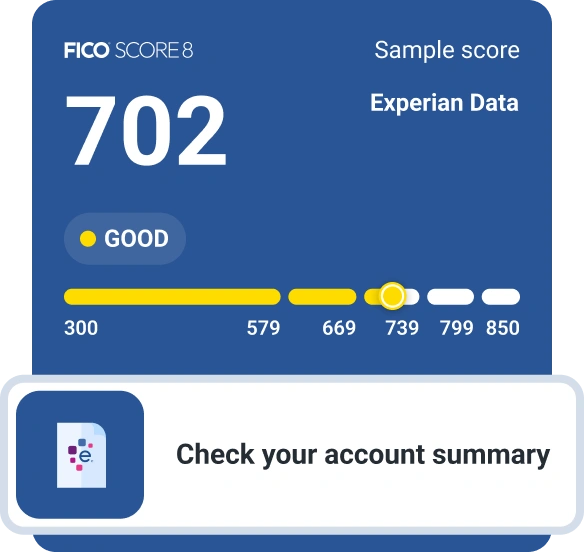

You can expect a hard inquiry to temporarily decrease your credit score by five points or less, according to FICO. But if you have good credit, your score may drop less than that.

Dear Experian,How many points does your credit score drop when a lender looks at your credit report?

- JOE

Dear JOE,

According to FICO, a hard inquiry from a lender will decrease your credit score five points or less. If you have a strong credit history and no other credit issues, you may find that your scores drop even less than that. The drop is temporary. Your scores will bounce back up again, usually within a few months, assuming everything else in your credit history remains positive.

What is the difference between a hard inquiry and soft inquiry?

There are two types of inquiries on a credit report, often referred to as "hard" and "soft:"

- Hard inquiries occur when a lender checks your credit report because of an application for goods or services, so they may affect your credit score.

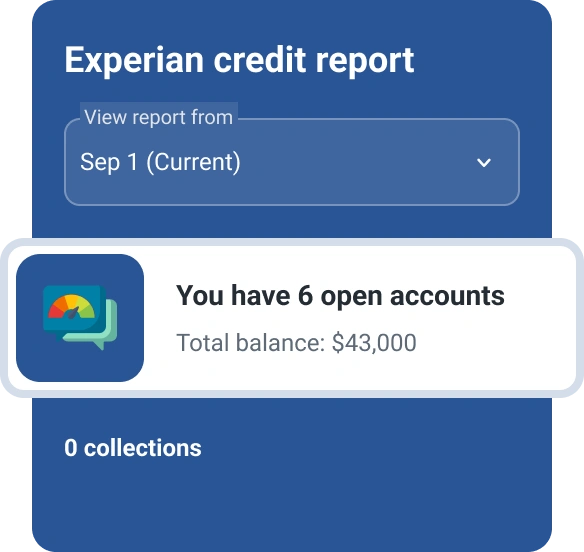

- Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use credit monitoring services from companies like Experian. These inquiries do not impact your credit scores.

What about when you are shopping for a loan?

When you are shopping for a new loan, such as for a home or a car, your information may be sent to multiple lenders to try to find you the best rates and loan terms. You will see a separate inquiry on your credit report from each of these lenders, but your credit score won't be penalized for each one. Most credit scores will count multiple inquires for mortgage or auto loans as one if they are made within a certain period of time (14-30 days). Some scores do the same for other types of lending.

When you request credit limit increase, is that a hard inquiry too?

Possibly. It depends on the lender and their policy for how they treat that request. Some lenders may treat it as an application for new credit or additional credit and require a new credit report be accessed, which will then display as a hard inquiry. Others may approve the request without pulling your credit report or by doing what's called an "account review," which will appear on your report as a soft inquiry. If you are concerned, it's best to ask your lender before applying for a higher credit limit.

Improving Your Credit Score

Generally speaking, the stronger your credit history and credit scores, the less you need to worry about the impact from a single inquiry. If your credit scores are marginal and you are looking to improve them, here are some things you can do:

- Make all payments on time. Your payment history is the biggest factor in your credit scores. The best thing you can do for your scores is to make sure every payment is on time and to bring any past due accounts current.

- Keep your credit card balances low. Your utilization rate is also an important factor in credit scores. The lower your balances on revolving accounts, the lower your utilization rate will be. Low utilization rates are good for credit scores.

- Sign up for Experian Boost®ø. Experian offers a free tool called Experian Boost that can help you increase your FICO® ScoresΘ instantly by giving Experian permission to link to your bank account and add your monthly utility and cell phone payments to your credit report. Signing up is fast and easy, and you'll get your new credit score right away.

Thanks for asking,

Jennifer White, Consumer Education Specialist

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Jennifer White brings nearly two decades of knowledge and experience to Experian’s Consumer Education and Awareness team. Jennifer’s depth of knowledge about the FCRA and how to help people address complex credit reporting issues makes her uniquely qualified to provide accurate, sound, actionable advice that will help people become more financially successful.

Read more from Jennifer