Do New Cars Cost More To Insure?

If you're thinking about buying a new car—and especially if you plan to finance it—be sure to take insurance costs into account. Due to their value, cost to repair, risk of theft and other factors, it may cost more to insure a new car versus an older one. If your new vehicle is financed, your lender will likely require you to carry more insurance than the legal minimum, which typically results in higher premiums. We'll explain what to expect when you insure a new car.

How Much Does It Cost to Insure a New Car?

According to car insurance marketplace Gabi®, a part of Experian, the average cost to insure a new car is $1,852 a year. There are several reasons why a new car might be more expensive to insure than an old car. For instance, your new car might be more expensive to insure because new cars are more frequently targeted by thieves. And getting insurance on a new car often will cost more simply because it's more valuable than an older one.

One factor that goes into setting your auto insurance rates is the type of car you're buying. Generally, pricier cars cost more to insure because the cost to repair or replace them is higher. Other factors used to determine your auto insurance rates include:

- Your location

- Your age, gender and marital status

- The amount of coverage you pick

- Your deductible

- Your driving record

- Your history as an insurance customer

What Insurance Do You Need for a New Car?

Auto insurance requirements vary from state to state. Here's a rundown of which types of coverage you will likely be required to buy, and what extras you might want to purchase.

Car Insurance You May Be Required to Buy

In nearly every state, a motorist must buy liability insurance for a new car. The only exception is New Hampshire, where you aren't required to buy car insurance—but you must prove you have adequate assets to pay damages, medical bills and more if you cause an accident.

Liability insurance pays the cost of property damage and injuries to other people in an accident in which you're at fault.

Additional car insurance coverage you might need to buy includes:

- Comprehensive and collision coverage: If your car is leased or covered by a loan, you'll likely be required to purchase comprehensive and collision coverage. Comprehensive coverage pays for non-crash claims involving your vehicle. This can include theft, as well as damage due to weather, fire and fallen objects. Collision coverage pays for damage done to your vehicle in a crash.

- Uninsured and underinsured motorist coverage: Some states require drivers to carry uninsured motorist coverage, or both uninsured and underinsured motorist coverage. If you get into an accident with somebody who lacks car insurance or doesn't have enough car insurance, uninsured and underinsured motorist insurance will help pay for damage to your vehicle.

- Personal injury protection (PIP) coverage: Some states require motorists to carry personal injury protection (PIP) coverage. This covers medical bills, funeral expenses and lost income stemming from injuries suffered by your and your passengers, no matter who's at fault.

Car Insurance Extras You Might Want to Buy

Aside from liability, comprehensive and collision, uninsured and underinsured motorist coverage, and PIP coverage, you might want to further protect your new car by purchasing:

- Medical payments coverage: This coverage pays at least some of the medical expenses for you and passengers in your car if you're involved in an accident. Medical payments coverage is available only in no-fault states that don't have PIP coverage.

- Gap insurance: Gap insurance is designed to supplement comprehensive and collision coverage. If your car is stolen or totaled, gap insurance can help cover the difference between the payout provided by the insurance company (based on the depreciated value of your vehicle) and the amount you owe on your auto loan.

- Towing and labor coverage: This optional coverage can pay for things such as towing, tire changes and battery jump-starts.

- Rental reimbursement: This policy add-on covers the cost of a rental car if your vehicle can't be driven after an accident.

How to Get Insurance for a New Car

Follow these steps when purchasing insurance for a new car:

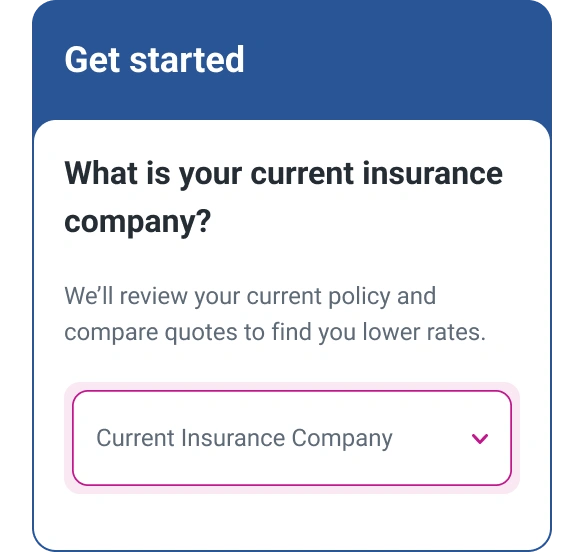

- Contact your current insurer. If you already have insurance on a vehicle, contact your insurance company before you buy a new car. In many cases, an insurer will give you a grace period for insuring a new car, depending on where you live. This will allow you to drive your new car home and give you some time to transfer your coverage to the new car or shop for a new policy. If you are financing your new car, you may have to pay for additional coverage to drive the car off the lot depending on the lender's requirements and your current coverage.

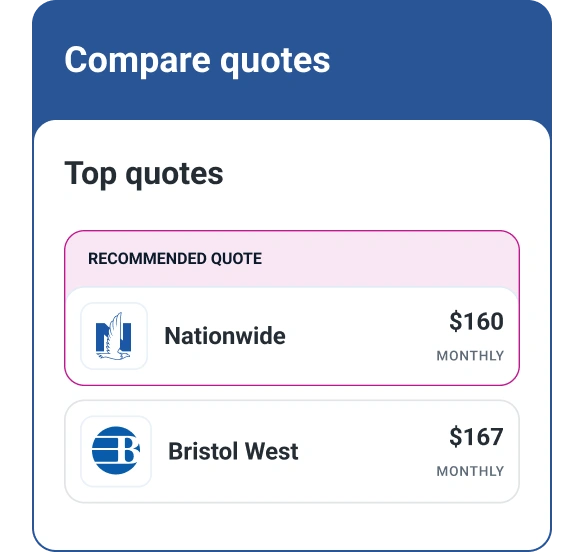

- Shop for insurance. If you don't already have coverage, don't put it off. You can buy coverage the same day you purchase your new car, but it's best to do your research ahead of time. The Insurance Information Institute recommends obtaining quotes from at least three auto insurance companies to find the right coverage at the right price.

Before signing up with a new insurer, make sure the company is licensed to sell coverage in your state. In addition, search online to see how customers rate its coverage, customer service and other factors, and find out how financially healthy the insurer is. Five independent agencies—A.M. Best, Fitch, Kroll Bond Rating Agency, Moody's and Standard & Poor's—assess the financial strength of insurers.

- Determine your coverage needs. Whether you plan to transfer your coverage or buy a new policy, you'll need to figure out what coverage to buy. Does your lender require comprehensive and collision coverage? Does your state insist that you buy PIP coverage? What extras would you like to have? You'll want to answer these and other coverage questions before purchasing a policy.

- Choose your deductible. A deductible is the amount you must pay toward a claim before your insurer will issue a payout. For example, if your claim adds up $2,000 and you have a deductible of $1,000, you'll have to cover the first $1,000 of your repair bill before your insurance coverage kicks in.

- Show the dealer proof of insurance. Dealerships will require you to show proof of insurance before you leave the premises. You may be able to simply use your current policy (as long as your insurer provides a grace period) or, if you're getting new insurance, contact the company and have them verify coverage.

The Bottom Line

There are a number of factors that determine the cost of insuring a new car, including your decision whether or not to add extra coverage. Make sure to shop around so that you can find coverage that's right for you. You can compare auto insurance coverage and costs with Experian.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

John Egan is a freelance writer, editor and content marketing strategist in Austin, Texas. His work has been published by outlets such as CreditCards.com, Bankrate, Credit Karma, LendingTree, PolicyGenius, HuffPost, National Real Estate Investor and Urban Land.

Read more from John