Why You Need Car Insurance Before Buying a Car

Quick Answer

You typically need car insurance before buying a car to comply with state laws and dealership requirements. However, some insurers may give you a window of time to add your new car to an existing policy.

You're revved up about buying a car. You've been saving for the down payment and you've spent months shopping for just the right ride. Now, you're ready to get the keys to your new car.

But before you get behind the wheel, you'll need to think about auto insurance. Depending on your situation, you may need to obtain a new policy or update your current policy.

Do You Need Car Insurance to Buy a Car?

Nearly every state requires you to carry a minimum amount of car insurance to legally drive. Therefore, you'll almost certainly need car insurance to buy a vehicle and drive it without breaking your state's laws.

In addition, many car dealerships require you to be insured before you drive off in your new car. Most car dealerships can provide a temporary insurance policy, but the length of time you're covered as well as the details of the insurance policy can vary. You may have anywhere from a week to a month after you purchase your vehicle before this temporary coverage expires and you have to find a long-term insurance policy.

If you already have car insurance, you can have your insurance company or agent update your policy with information about the new car. In fact, you should probably do this ahead of time if you already know which car you're buying.

Most insurers automatically give you a grace period—typically as long as 30 days—to add a new car to your existing policy. Coverage for your new car will be the same as the car listed on your current policy unless you elect to make changes. If you don't add your new car to your policy before the grace period ends, you could be subject to rate hikes or fines.

What Insurance Coverage Is Required?

Required coverage usually starts with liability insurance. These are the two types of liability insurance typically mandated by state law:

- Bodily injury liability: This covers medical expenses for treating people (other than those in your car) who are injured in an auto accident that you caused. It also covers lost income associated with those injuries.

- Property damage liability: This covers costs related to fixing a car (other than your own) that's damaged in an accident that you caused. It also covers damage you caused to someone else's property, such as a fence or utility pole.

Many states also require these two types of coverage:

- Personal injury protection (PIP) or medical payments coverage: This pays medical expenses for treatment of your injuries and your passengers' injuries in a car accident, regardless of who's at fault. It also covers wages lost as a result of the injuries.

- Uninsured motorist coverage and underinsured motorist coverage: Uninsured motorist coverage covers injuries or damage caused by a driver without any car insurance, as well as by a hit-and-run driver. Underinsured motorist coverage (normally paired with uninsured motorist coverage) covers injuries or damage caused by a driver whose policy falls short of paying your expenses.

On top of state-required coverage, you generally must buy two other types of coverage—collision and comprehensive—if you're financing a car with a loan or acquiring it with a lease:

- Collision coverage: Collision coverage takes effect when your car needs to be repaired or replaced after being damaged in a collision with a vehicle or object (such as a fence).

- Comprehensive coverage: Comprehensive coverage kicks in when your car is stolen or is damaged in an incident other than a collision. Incidents that normally qualify for comprehensive coverage include falling objects (such as a tree limb), fire and vandalism.

Here's the coverage you'll need in various situations:

Trading in Your Old Car

When you're trading in your current car for a new car, you may decide to transfer your insurance coverage. The buyer typically will obtain their own coverage for your old car.

Transferring your coverage involves applying your current insurance policy to your new car. In this process, you'll need to figure out whether your existing coverage is adequate for the new car or whether you need to change it. You may end up paying more to cover your new car than you did to cover your old car.

If you fail to transfer coverage, you may wind up with no insurance at all after the grace period expires. The grace period, often up to 30 days, lets you keep driving your new car under your existing policy. A lapse in coverage may make it tough for you to obtain new coverage. In addition, a lapse may leave you financially vulnerable if you're involved in a car accident and subject to citation if you're pulled over.

Your insurer may allow you to transfer coverage online or on its app. Or you may need to contact your insurer or your agent. Information you'll need to provide about the new car includes:

- Year, make and model

- Odometer reading

- Vehicle identification number (VIN)

- Title or registration details

The steps are similar if you decide to insure your new car with a different insurance company. In this case, though, you must start over and buy a new policy. You often can do this online or over the phone. Or you may choose to purchase coverage through an agent or an independent broker.

Buying an Additional Vehicle

Putting an additional vehicle on your current policy is much like the process for swapping out one car for another on your current policy. For example, you'll need to supply details about the new car, such as its year, make and model.

Oftentimes, you can put an additional vehicle on your existing policy either online or over the phone. Keep in mind that your insurer may limit the number of cars you can list on one policy.

When you're obtaining coverage for a second or third car, you should:

- Make sure the coverage meets your state's requirements.

- Look into whether your lender or leasing company requires collision and comprehensive coverage.

- Find out what your insurer requires. In some cases, you may need to maintain the same amount of liability coverage for each car on your policy.

- Ask whether you qualify for a multi-car discount.

Buying Your First Car

When you're buying your first car, you generally must buy brand-new car insurance. However, you may be able to put the car on your parents' policy or share a policy with a roommate, for instance.

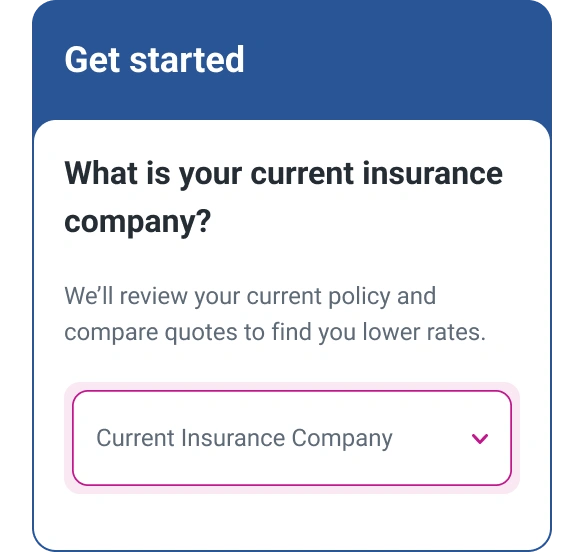

An insurer may let a first-time buyer get coverage online, over the phone or through an agent, or you might also use a comparison website or an independent broker to shop for insurance before heading to the dealership.

If you're not able to secure a policy before buying your vehicle, make sure the dealership you visit provides temporary insurance so you're legally able to drive while you search for a long-term policy. Whatever the case, you'll need coverage in place before you can head down the road in your new ride.

Ask these questions if you're buying your first car and need to get insurance:

- What types of coverage do I need? Your state may require liability coverage, for example, while your lender or leasing company might require collision and comprehensive coverage.

- Is the minimum required coverage enough? Purchasing liability coverage that sits at your state's minimum levels may save money on your premium. But should you increase the dollar limits on the coverage to give you financial peace of mind?

- What should my deductibles be? A car insurance deductible represents the amount of money, such as $500, that you pay out of pocket when you file a claim. Liability insurance doesn't come with deductibles, but other kinds of coverage do. The lower your deductible is, the more your premium will typically cost. Raising your deductible can reduce your premiums, but be warned: A higher deductible will result in you paying more out of pocket before your insurance coverage kicks in.

- Do I qualify for discounts? Common car insurance discounts include those for safe driving, good grades and car safety features.

Can You Drive a New Car Without Insurance?

Nearly every state requires that drivers be insured in order to legally drive on public roads. Therefore, you generally must have insurance before driving a new car—whether it's a new policy or existing policy. If you're caught driving without insurance, you may end up being fined or having your driver's license suspended.

How to Get Insurance Before Buying a Car

Here are four steps for getting insurance before buying a car:

- Settle on the car you want to buy. An insurer will need to know various bits of information about the car before it can provide a quote and issue a policy. This includes the year, make and model of the car, along with the VIN, odometer reading and vehicle history.

- Confirm details with the seller. Make sure everything is in order for you to complete the purchase, such as the lending arrangements.

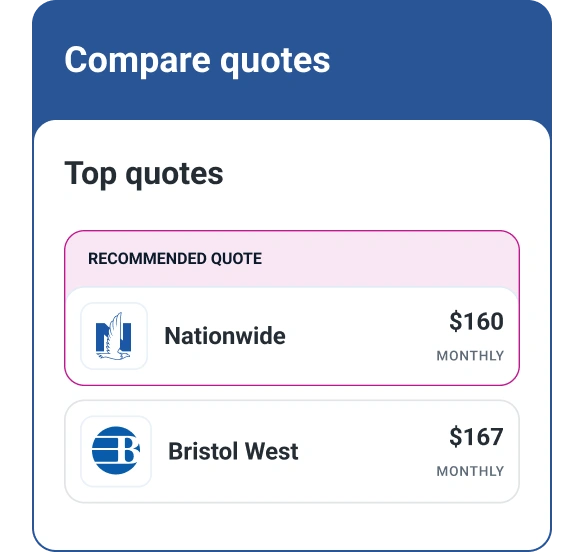

- Shop for insurance. You might pick an insurer that your family already does business with. Even so, it's a good idea to compare quotes from at least three insurers.

- Select an insurer. After you've compared factors such as pricing and customer service, you're ready to get a policy from your chosen insurer. At this point, you'll need to pick your coverage types and deductibles. You may be able to do all of this online, over the phone or in person.

The Bottom Line

It's easy to get swept up in the excitement of getting a new car. But don't let that excitement cloud your judgment when it comes to car insurance. Before you sit behind the wheel of your new car, find out whether your current coverage applies to the car or whether you need to buy new coverage. In addition, be sure the coverage meets the requirements of your state and your lender or leasing company. After all, you don't want the use of your new car to be stalled due to insurance issues.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

John Egan is a freelance writer, editor and content marketing strategist in Austin, Texas. His work has been published by outlets such as CreditCards.com, Bankrate, Credit Karma, LendingTree, PolicyGenius, HuffPost, National Real Estate Investor and Urban Land.

Read more from John