Can Someone Check My Credit Without Permission?

Quick Answer

Federal law requires many entities to get written consent before checking your credit, but it also allows credit checks without permission under certain circumstances, including account management and preapproved offers.

Your written consent is required for conventional credit checks, such as those performed by employers, landlords and lenders to whom you apply for loans or credit cards. However, federal law allows credit checks without express permission under limited circumstances. Here's a rundown of who can and cannot check your credit without permission—and when.

Who Can Access My Credit Report?

The Fair Credit Reporting Act (FCRA), the law that governs credit reporting in the U.S., specifies legally permissible reasons for checking your credit, designates who is authorized to check your credit, and spells out procedures that must be followed when checking your credit.

In general, when you submit an application to a person or organization with a legitimate interest in gauging your financial reliability—when seeking a loan or credit card, renting an apartment or pursuing a new job with financial responsibilities, for instance—the recipient can legally review your credit.

The following entities may check your credit when processing an application you've submitted:

- Banks and other lenders

- Utility companies

- Insurance companies

- Landlords

- Employers hiring for jobs with certain types of financial responsibilities (though they are only allowed to check parts of your credit report, not your credit score)

Before checking your credit, they generally must obtain written permission. With lenders, credit card issuers and insurance companies, that permission is typically part of the application itself, which you must sign before submitting.

Landlords and employers generally provide separate consent forms for you to sign, granting permission to perform a credit check. Under those circumstances, refusal of written permission is legally acceptable grounds for rejecting your application.

Who Can Check My Credit Without Permission?

The FCRA notes a number of circumstances under which certain businesses can legally check your credit without your express permission. Here are some examples:

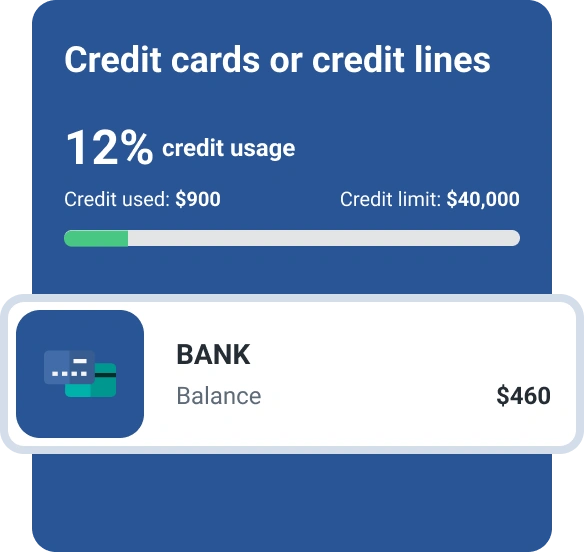

- Account management: Credit card companies with whom you have accounts may run periodic credit checks for account management purposes. If your credit scores increase (indicating improved creditworthiness), this could prompt an offer to increase your borrowing limit. If your credit scores decline, however, the lender could decrease your credit limit or even cancel your card.

- Preapproved offers: Lenders, credit card issuers and insurance companies you don't already work with can legally check your credit scores to determine eligibility for certain deals or products, as long as they're prepared to make a firm offer of credit or insurance if your score meets their qualifications. You have the legal right to forbid these credit checks by opting out of such offers.

-

Special circumstances: Other situations in which permission is not required to check your credit include:

- Checks triggered by a court order or grand jury subpoena

- Applications for certain professional licenses or jobs in regulated financial industries such as banking and securities trading

- To determine child support, under certain circumstances

- Potential investor assessing the risk of a current obligation

How Do I Know if My Credit Was Checked?

Whenever your credit report or credit score is checked, the request is recorded in the section of your credit report headed "Inquiries." Inquiries fall into two categories: hard inquiries and soft inquiries.

- A hard inquiry typically occurs anytime you seek to borrow money or otherwise obtain credit. It can have a temporary, minor effect on your credit scores because it indicates intention to assume a greater amount of debt or other financial obligation.

- A soft inquiry denotes a credit check performed for informational purposes. Examples include checks by potential employers or landlords, those used for marketing or account management purposes, and when you check your own credit scores. Soft inquiries have no effect on credit scores.

Why Does a Credit Inquiry Only Appear on One Credit Report?

Unlike debt payment information, which generally appears on your credit reports at all three national credit bureaus (Experian, TransUnion and Equifax), inquiries typically are recorded only on the report issued by the bureau that furnished the credit data used in the credit check.

So if, for example, your auto insurance company uses Experian as its sole source of credit data, its inquiries will appear on your Experian credit report but not on those from the other credit bureaus.

Some companies routinely check credit from two or even all three bureaus, so there can be overlap on inquiry reporting, but the only way to be sure you know about all requests for your credit information is to review credit reports from all three bureaus—or to use a credit monitoring service that spans all three bureaus and alerts you when an inquiry is made at any of them.

Learn more: Understanding Your Experian Credit Report

How Does a Credit Check Affect My Credit Score?

Any credit check that generates a soft inquiry does not affect your credit scores.

Hard inquiries—triggered when you seek new credit—typically cause a small dip in your credit scores, but the effect is usually temporary if you keep up with your debt payments.

Your score will typically fall fewer than five points after a single hard inquiry. Multiple inquiries can have an increasingly negative impact, however.

Both hard and soft inquiries remain on your credit report for two years. Most scoring models do not consider hard inquiries in credit score calculations after 12 months.

Learn more: Hard Inquiry vs. Soft Inquiry: What's the Difference?

What to Do if Someone Pulls Your Credit Without Permission

If you find a hard credit inquiry you don't recognize on one or more of your credit reports, it could be a sign of identity theft—criminals using your personal information to try to borrow money or obtain credit in your name. Notifying the credit bureaus and appropriate authorities quickly can help contain potential damage.

You have the right to dispute inaccurate hard inquiries with the credit bureaus and ask to have them removed.

If you've opted out of preapproved offers and discover soft inquiries that lead you to believe a company is still checking your credit for marketing purposes, the Consumer Financial Protection Bureau (CFPB) recommends contacting the company directly, but you can also file a complaint with the CFPB.

Learn more: How to Dispute Credit Report Information

What Can I Do to Keep Someone From Getting My Credit Report?

If you're concerned about unauthorized access to your credit report, consider the following options:

- Fraud alert: You have the right to place a fraud alert on your credit reports, which will advise any lenders who receive a credit application in your name to verify your identity before moving forward. An initial fraud alert lasts one year and is renewable. Placing a fraud alert at any one credit bureau automatically applies it to all three.

- Security freeze: You also have the right to place a security freeze on your credit reports at all three bureaus (you'll need to contact them separately). A freeze lasts indefinitely, until you "thaw" your credit file, and prevents access to your credit reports for purposes of processing new loan or credit applications. Before you apply for credit yourself, you should lift the freeze to enable the lender to check your credit.

The Bottom Line

Federal law limits access to your personal credit information and requires your permission for a credit check under most circumstances where it can affect your finances, employment or ability to rent equipment or a home. To help understand who's checking your credit, free credit monitoring from Experian can alert you when anyone checks your Experian credit report and also provide your Experian credit report and score for free anytime.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim