6 Alternatives if You Can’t Get a Credit Card

Quick Answer

If you’re rejected for a credit card, there are alternatives that can give you access to credit and the opportunity to build a solid credit history. Consider getting a secured card, becoming an authorized user on a family member’s account or working to improve your credit score before reapplying.

It's no fun having your credit card application turned down, but there are plenty of ways to remedy the situation. If you can't qualify for a credit card, consider becoming an authorized user on someone else's account, applying for a secured card or improving your credit score so you can get approved in the future.

Why You Could Be Denied a Credit Card

When a lender denies credit, the Fair Credit Reporting Act requires them to send you an adverse action notice. This notice may come by mail or email, explaining their reasons and stating which credit reporting agency (Experian, TransUnion or Equifax) provided the credit report they used to make their decision. This information can help you determine the areas to work on so you can get approved next time.

Common reasons why your credit card application can be denied include:

- You have a thin credit file or no credit history. You may not have a robust credit history if you've never used credit cards or taken out a loan, haven't used your credit accounts for a few years or your lender doesn't report to one of the major credit bureaus. Having fewer than five credit accounts is known as having a thin credit file. It can take up to six months of using credit to get a FICO® ScoreΘ, the credit score used by 90% of top lenders.

- You have bad credit. A FICO® Score of 580 to 699 is considered fair, while a score of 300 to 579 is considered poor. Checking your credit score before applying for credit can help you determine which cards you're likely to qualify for.

- You don't have a Social Security number. To verify your identity, credit card companies generally require a Social Security number (SSN). You can apply for an SSN or, if you're not eligible, you can apply for an individual taxpayer identification number (ITN).

- Your credit reports are frozen or locked. Credit bureaus let you put a security freeze or lock on your credit report to restrict access and foil identity thieves. However, this also blocks legitimate lenders from checking your credit when you apply for credit. Before applying for a credit card, unfreeze or unlock your reports online, by phone or by mail.

- Your credit report is inaccurate. If your lender reported a payment incorrectly, you paid off a collection account that's still showing a balance or you notice another inaccuracy on your credit report, it could affect your credit scores. You can file a dispute to have the information corrected, updated or removed if it's determined to be inaccurate.

- You've applied for too much credit recently. Applying for too many new credit accounts within a short time may imply you're having financial problems. Limit multiple applications for similar types of credit to a 14-day window and most credit scoring models will treat them as one inquiry (with the exception of credit card applications).

- Your income is too low. Credit card companies assess whether card applicants can repay the credit they extend. You may be denied if your income is below the card issuer's minimum.

6 Alternatives to a Credit Card

Other options for getting credit after you've been denied a credit card include:

Secured Credit Card

Secured credit cards are designed for people with no credit history or poor credit. You put down a cash deposit to open the account and typically receive a credit limit equal to your deposit amount. Should you stop making payments on the account, the card issuer uses the deposit to pay your balance.

Credit Card Authorized User

A trusted family member with good credit may agree to add you as an authorized user on one of their cards. You use the card to make purchases and pay your charges, but the primary user is ultimately responsible for paying the bill. Your credit score may suffer if they miss a payment, so be sure they're reliable.

Credit Card Cosigner

A credit card cosigner applies for a card with you. You're the primary cardholder, but the cosigner promises to pay the bill if you can't.

Alternative Credit Card

Some credit card companies use different benchmarks than your credit score to evaluate your creditworthiness. Such "alternative underwriting" can help people without credit histories get credit cards.

Retail Store Card

Many retail stores issue credit cards. Although they generally charge high interest rates and may limit you to purchases at the issuing store, they are often easier to obtain without good credit. Just don't let store discounts and rewards tempt you to overspend.

Subprime Credit Card

Subprime credit cards for those with poor (or subprime) credit are usually secured, but if you'd rather not put down a deposit, there are also unsecured subprime cards. Subprime cards generally have low credit limits and high interest, but if managed responsibly, can help you rebuild your credit.

Before getting any credit card, make sure the card issuer reports account activity to at least one of the three major credit bureaus, which will help you establish a credit history.

How to Improve Your Credit

The alternatives above are temporary solutions, but ultimately, you'll want to improve your credit. A higher credit score can make it easier to qualify for credit cards with lower interest rates and valuable perks. Follow these steps to improve your credit score.

- Check your credit report. You can get a free copy of your credit report from each of the three major credit bureaus at AnnualCreditReport.com. Check for inaccuracies and contact the appropriate credit bureau to dispute them.

- Bring late accounts current and make payments on time. Payment history is the biggest factor in your credit score; even one late payment can be detrimental. Get caught up on any overdue payments, then set up autopay or alerts to avoid missing due dates.

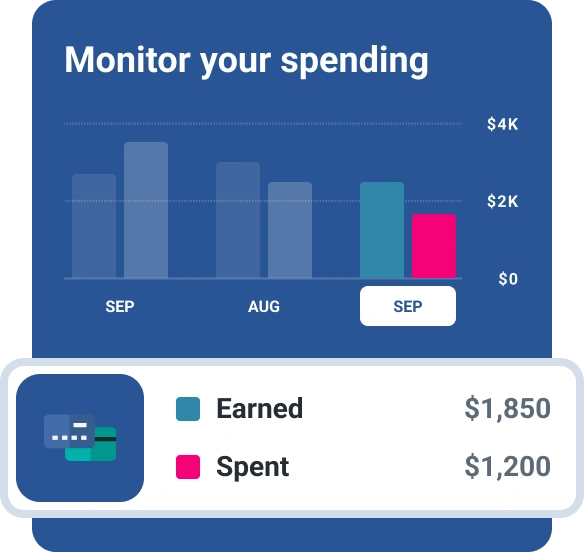

- Keep credit card balances under 30% of your limit. Your credit utilization ratio is the second biggest factor in your FICO® Score. Reducing your balances to less than 30% of your available credit can help avoid damaging your credit; for the highest credit scores, try to stay under 10%.

- Diversify your credit mix. Having various types of credit, such as personal loans, student loans and credit cards, can help your credit score. If you only have credit cards, for example, a credit-builder loan could help improve your credit.

- Sign up for Experian Boost®ø. Normally, utility, cellphone and streaming service payments aren't reported to credit bureaus and don't affect your credit score. Experian Boost is a free feature that gives you credit for making these payments on time, factoring them into your Experian credit score for a quick boost.

- Sign up for Experian Go™. Just starting out and eager to build credit fast? Sign up for a free Experian membership, download the app and answer a few questions. You'll get guidance on the best moves to establish credit.

Give Yourself Credit

Receiving a rejection from a credit card company can be disappointing, but you shouldn't let it get you down. There's a credit card out there for everyone—it's just a matter of finding yours. Experian's free comparison tool can help by matching you with credit cards that fit your credit profile, which can improve your odds of being approved.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen