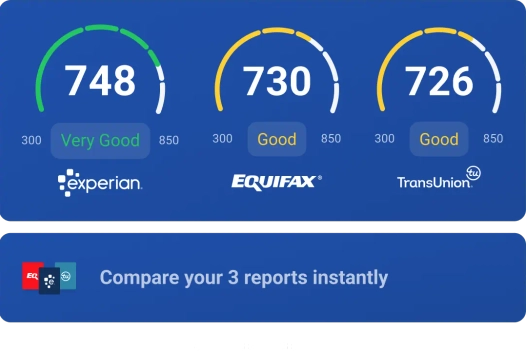

3-bureau credit report and FICO® Scores*

Compare and review your Experian, Equifax®, and TransUnion® credit reports and FICO Scores.

One-time cost of $39.99

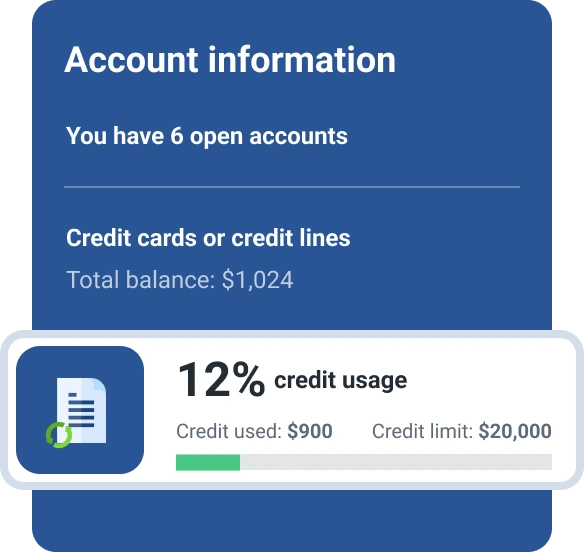

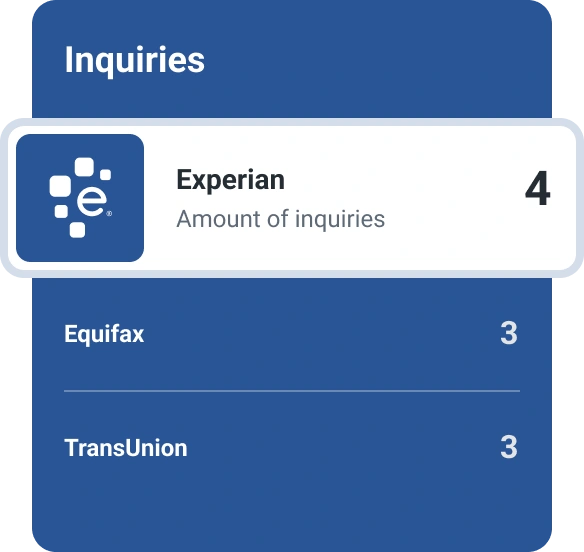

3-bureau credit report

See how you compare across all 3-bureau credit reports and see any differences that may have been reported by each bureau.

3-bureau FICO® Scores

Check key factors impacting each of your 3-bureau FICO Scores, including payment history, amount of new debt and more.

See what’s changed

Get insight into factors that may affect your overall credit, and learn about changes in your Experian credit report.

Why check all 3 credit reports and FICO® Scores?

What else can you do with Experian?

Establish and build your credit

You may not have a credit score at every bureau, but with Experian Go™ you can establish a credit profile with recommendations on your next steps.

Instantly raise your credit scores

Get credit for bills like your cell phone, utilities, rent and insurance with Experian Boost®.ø Only your positive payment history is used.

Dispute inaccurate information

Review and dispute any inaccuracies on your Experian credit report with information for disputing your Equifax and TransUnion credit reports.

Prevent unauthorized access to your credit files

If there is any suspicious activity on any of your 3 credit reports, you can add a fraud alert at Experian, which is also shared with Equifax and TransUnion.