Free credit score

Get your FICO® Score* for free and see how you can improve it.

No credit card required

Lenders like FICO® Scores

FICO® Scores are used by lenders more than any other brand of credit scores.

No credit card required

Sign up and get instant online access to your FICO® Score for free.

No impact to your score

Checking your own credit won’t lower your credit scores.

Check your FICO® Score for free

Get startedWhy get your free credit score with Experian?

View the specific factors that are impacting your FICO® Score.

Instantly raise your FICO® Score using bills like your utilities and streaming services.ø

See the same type of information that lenders see when requesting your credit.

What can you do with your credit score?

Get a loan

With a higher credit score, you could qualify for better loan products with better terms and higher loan amounts. Experian can help you find loans based on your FICO® Score.

Access personalized credit cards

Get credit card offers based on your unique credit and see if you’re matched before you apply. From rewards cards to balance transfer cards and more, Experian can help find the right card for you.

Save money on interest

When taking out a large loan, even a small difference in interest rates can save you thousands of dollars over the life of the loan. Borrowers with higher credit scores will find it easier to secure the lowest interest rates.

Find better insurance rates

Insurance companies often consider your credit history or a credit-based insurance score as one of many factors to determine your rates. Some states strictly limit or entirely prohibit insurance companies' use of credit information.

Frequently asked questions

A credit report is a record of your history managing your credit and debt. It includes how and when you paid your bills, how much debt you have and how long you’ve managed your credit accounts. Credit reports contain your positive information, such as on-time payments and accounts in good standing. They also show negative items, such as collections, bankruptcies and foreclosures.

A credit score is a three-digit number, often ranging from 300 to 850, that lenders use to evaluate your ability to repay any money you borrow. Credit scores are commonly based on information in your credit report, including your payment history, amounts owed, credit history length, credit mix and new credit. A credit score can also provide the model used (e.g., FICO®), the version number (e.g., 8.0), and the credit report data used (e.g., Experian). Scores can also include a risk factor range, from Poor to Exceptional, along with the score factors that are positively and negatively impacting your score.

Credit report vs. credit score

| What is it? | A detailed record and history of your credit management |

| Who creates it? | Experian®, Equifax® and TransUnion® |

| How can I see it? | From AnnualCreditReport.com and direct from Experian for free |

| What type of information is included? | Your credit report includes:

|

| What is it? | A numerical value, often ranging from 300 to 850, that estimates your creditworthiness |

| Who creates it? | FICO® and VantageScore® |

| What type of information is included? | Your credit score can include:

|

Why is a credit score important?

A credit score is important because it can affect your finances and ability to achieve your goals, such as owning a home and buying a car. With a higher credit score, you’re showing lenders that you’re a responsible borrower who can manage your finances well. While creditors look at many factors, showing good credit management can open doors to new opportunities, including offers for new services or products that could benefit you.

How often is a credit score updated?

With every new update from a creditor to your credit report, there can be a potential change to your credit scores.

How often should you check your credit score?

You can check it any time, but it’s especially important before you make a major purchase or apply for a loan or credit card.

How can you establish credit if you have no prior credit history?

If you’re just starting out, Experian can help you establish and get access to credit with Experian Go.

Your credit score is determined by a scoring model that analyzes your credit report and then assigns you a score. This score usually ranges from 300 to 850. FICO® and VantageScore® are the two main credit scoring models, and they use different factors when calculating your credit score.

FICO® Score factors

- 35%: your payment history, including positive history and late payments

- 30%: total amount of debt you owe

- 15%: length of your credit history

- 10%: your credit mix or the types of credit you have

- 10%: the amount of new credit you have

VantageScore® credit score factors

- Extremely influential: total credit usage, balance and available credit

- Highly influential: credit mix and experience

- Moderately influential: payment history

- Less influential: age of credit history

- Less influential: new accounts opened

Generally, a credit score of 670 or higher is considered a good credit score. A score higher than 800 is considered exceptional. The average credit score in 2020 in the United States was 710, with 67% of Americans having a good FICO® Score or better. Understanding your own credit score is the first step in maintaining and even improving your credit score. Experian can help you keep up to date with the changes that occur and show you what has changed, along with tips to guide you on the path to better credit.

| Score rating | Score range |

|---|---|

| Exceptional | 800-850 |

| Very good | 740-799 |

| Good | 670-739 |

| Fair | 580-669 |

| Poor | 300-579 |

Why do you need a good credit score?

Whether you are starting out with credit or retired, having a good credit score gives you access to more credit options and better control of your finances with better rates and terms. In the U.S., many consumers use credit:

- 90% have a credit card

- 62% have an auto loan

- 44% have a mortgage

- 22% have a personal loan

- 14% have a student loan

- 12% have a home equity line of credit (HELOC)

Credit is important at every stage in life, from getting your first apartment and buying your first car to refinancing your home and qualifying for a travel rewards card. Creditors will look at your entire financial profile, including your credit score, to determine your qualification and your rates or terms.

There are several different ways you can start to increase your credit score. Each credit situation will differ by individual, which is why we recommend using our FICO® Score Planner. But in general you can begin to improve your credit score by:

Paying all of your bills on time:

As payment history is the biggest factor in your FICO® Score, this will help move the needle the most. If you’ve been on time with your payments up until now, great. If not, start making sure that you’re paying all your bills on time–late or missed payments can stay on your credit report for 7 years. Over time, a late payment will decrease in impact, but several missed payments in a row or late payments on multiple accounts can hurt your credit.

Catching up on past-due accounts:

Even if you missed a payment before, getting all your accounts up to date can help improve your credit score. This will also prevent more late payments from being added to your credit history. Qualifying for new credit with a late payment on your credit report will depend on the lender and how much time has passed since your late payment. Some lenders might approve you sooner, but interest rates and terms may not be as favorable as they’d be for someone with exceptional credit.

Paying down your current accounts:

Even if you aren’t late or missing payments, paying down more of your account balances will decrease your credit utilization, which could improve your credit scores. In general, under 30% credit utilization is recommended, but under 10% indicates optimal credit management and can help your credit scores.

Limiting how often you apply for new credit:

Applying for new credit can lead to a hard inquiry, which could temporarily decrease your credit scores. One or two hard inquiries during the normal course of applying for a loan can have an almost negligible effect on your credit scores, but many hard inquiries outside of rate shopping could indicate a higher credit risk.

Adding bills you’re already paying:

With Experian Boost®, you can add on-time payments from your utility, cell phone and streaming service bills to help increase your credit score. 60% of Americans have seen their FICO® Score increase by an average of 12 points.

How can you improve your credit score if you have bad credit?

If you have bad credit, you should first check your free credit report and score to find what factors are affecting it the most. This will show you where you can make the biggest improvements to a bad credit score. You’ll be able to see the factors that are both helping and hurting your credit.

If you have excellent credit, what can you do to maintain it?

If you already have excellent credit, you can maintain your credit score by continuing to pay all of your bills on time, maintaining a credit utilization below 10%, keeping your oldest accounts open and only applying for new credit when needed.

No one likes to see their credit scores drop. But understanding the factors that affect your credit could help you get back on track. Credit scores continually change as your creditors provide information to your credit file. Small drops in your credit scores shouldn’t cause any alarm, but if you see a significant decrease to your credit scores it could be for one of the following reasons:

Late or missing payments:

Your payment history is the biggest factor in your FICO® Score. A single late payment will impact your scores, but over time, its impact on your credit will decline. Multiple missed payments can significantly damage your credit, and contacting your lender before that happens could help your situation. Managing your debt properly will only benefit your credit scores. In fact, most consumers who have the highest credit scores and pay their bills on time have the highest average amount of debt.

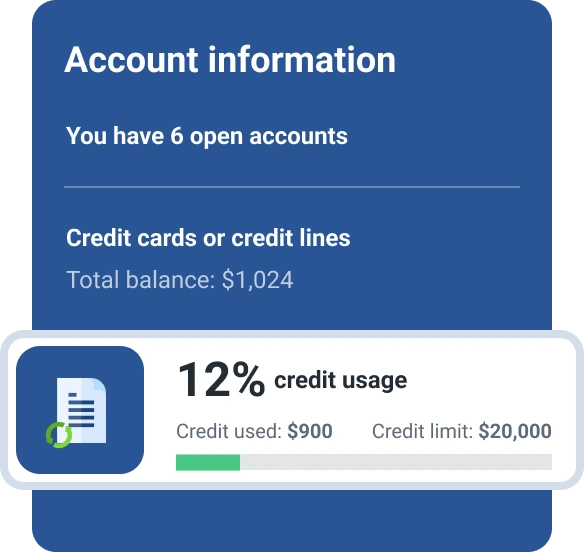

Credit utilization increased:

By using more of your credit you’ll increase your credit utilization ratio, which is the second most important factor in calculating your FICO® Score. To calculate your credit utilization, add up the total debt or balances on all your credit cards, then add up the credit limits on all your cards and divide the total balance by the total credit limit. You can then multiply this number by 100 to see your credit utilization percentage. For example, if you have a $200 credit balance and your credit limit is $500, you would divide $200 by $500 and multiply that by 100 to total 40% credit utilization.

Closed a credit card:

Closing a credit card will reduce your available credit, which can increase your credit utilization ratio and cause your score to decrease. Another way that closing a credit card can impact your credit score is by reducing the length of your credit history. A closed account in good standing will remain on your credit report for 10 years and will continue to benefit your credit score. Closing your credit card may initially drop your scores—but it’ll be temporary, and your scores will rebound as you continue healthy credit habits.

With the FICO® Score Simulator you can view the impact to your credit score if you miss a payment, close an account or increase your credit usage. Additionally, our "See What’s Changed" feature makes it easy to spot new information in your credit report. You’ll be able to quickly see changes in your total debt levels, modifications to accounts, the opening or closing of new loans and/or credit card accounts, new inquiries or credit checks in regard to applications for new loans or credit. These report changes will also include annotations so you can quickly see if they’re helping or hurting your FICO® Score.

How much does a credit check affect your scores?

When a company checks your credit report when you apply for new credit, such as a credit card or a loan, the process is called a "hard inquiry." This credit check remains on your credit for 2 years but has a short-term impact. After a few months, the impact to your credit scores should start to decrease. If you have multiple credit checks, outside of rate shopping, the impact to your credit scores could be greater.

Credit scores do not start out at the lowest number (e.g., 350) or at the highest (e.g., 850)—or even at zero. Everyone starts out with no credit score at all. A credit score can only be calculated if there’s an account on your credit report with recent credit activity.

Why don’t you have a credit score?

A FICO® Score will develop after you have at least one account open and recorded on your credit file for 6 months. A VantageScore® credit score could generate a score more quickly, as long as your credit report shows at least one account. If there are credit accounts on a credit report that haven’t been active in the last 6 months, it may also take several months of activity to calculate credit scores.

It’s common for your credit score to be different across the three bureaus. This can happen for many reasons. One reason is that while many companies often report to all three credit bureaus, some may only provide information to one or two, causing differences in the credit information between the bureaus. Another reason your scores can be different is because the creditor will likely pull one of your credit reports and not all three when you apply for new credit, causing a difference in the number of hard inquiries made on your credit.

What credit score do you need to buy a house?

The credit score you need to buy a house depends on the type of mortgage loan and who the lender is. There are different types of mortgages and each has its own minimum credit score requirement. Conventional loans typically require a minimum score of 620, with some requiring 600 or higher. Jumbo loans require scores of 700 or higher because of greater risks involved with larger loan amounts. FHA and USDA loans have lower score minimums of 500 or 580, respectively. When applying for a mortgage, it’s especially important to work on your credit well ahead of buying a home. The better your credit score, the better the rates and terms will be for you, which mean you could save a good amount of your hard-earned money.

What credit score do you need to buy a car?

There are no industry standards that dictate what credit score a lender should use or what minimum score is needed to buy a car. The most important thing to focus on is to plan for your purchase and make sure your credit score is where you’d like it to be. In 2020, consumers with bad credit paid an average interest rate of 13.97%. That would mean a $30,000 loan with a 60-month term would cost around $11,700 in total interest. On the other hand, consumers with excellent credit pay an average of 3.24%. For the same $30,000 loan and 60-month term, consumers would pay around $2,500 in total interest. That’s a difference of $9,200. To see how much total interest you could pay, try calculating your car payment.