Why Did My Collision Car Insurance Rates Go Up?

Quick Answer

Higher costs for replacement parts are a key factor driving up car insurance rates. Your collision insurance rates could be higher if you recently filed a claim for auto accident damage.

You may have noticed a higher premium on your latest car insurance renewal notice. If so, you're not alone. According to the U.S. Bureau of Labor Statistics, the price of auto insurance has soared more than 20% over the past year.

So what's behind the substantial premium increase? Let's go over some of the reasons why your collision insurance costs have gone up recently, and what you can do about it.

What Affects Collision Insurance Rates?

Collision insurance is the portion of your coverage that covers damage costs from a crash that involves another vehicle or object. Collision insurance rates are based, in part, on the likelihood you'll get in an accident that requires repairs or replacement of your car and how much those expenses will cost.

Risk factors that influence the cost of your premiums include:

- Your driving record: A history of moving violations or claims could drive up your rates.

- Your vehicle: The make and model of your car can influence the rates you receive. Since more expensive cars are typically more costly to repair or replace, insurance rates are often higher on pricey luxury cars.

- Your location: Your premium may be higher if you live in an area with higher accident rates than a safer location.

- Your driving activity: Insurers may factor in the number of miles you drive when setting premiums.

- Age and gender: Statistically, younger drivers and males pay higher premiums.

What Does Collision Insurance Cover?

Collision insurance covers damage your car sustains in an automobile accident or collision with an object. This type of insurance is often paired with comprehensive coverage, which strictly covers incidents such as theft, fire damage and natural disasters.

Collision insurance pays for repairs or replacement costs resulting from collisions, such as:

- A collision with another vehicle

- A collision with a tree, fence or building

- A single-car accident in which the car rolls over

While collision insurance can help pay for expensive damage from a car accident, it doesn't cover everything. Here are some examples of incidents collision insurance doesn't cover:

- Damage to another driver's vehicle: Collision insurance only covers the costs to repair or replace your car, not another vehicle in an accident.

- Damage your car sustains when you're not driving it: This could include damage from hail or a falling tree branch—that's covered by comprehensive auto insurance.

- Medical care: Medical bills for you or someone else—collision insurance covers your vehicle only.

- Theft: Since theft is not a collision, it isn't covered by collision insurance. Instead, it falls under comprehensive insurance.

Do I Need Collision Coverage?

If you're still paying on your vehicle loan or lease, you likely don't have the option to forego collision insurance. Most lenders require you to carry full coverage car insurance, which includes both comprehensive and collision coverage. This requirement helps lenders protect their investment. It also helps protect your financial interests, since you'd still need to pay off your loan even if your vehicle is totaled.

If your vehicle is paid off, however, you can drop certain coverage—including collision insurance. This is a personal choice, and many drivers opt for liability-only insurance while others determine full coverage better suits their needs.

Consider the following factors before canceling collision insurance:

- Your car's value: The most your insurer will pay on a claim is the value of your car minus your deductible. If your car's value is relatively low, it may not be enough to offset your collision insurance costs. Keep in mind, collision insurance runs $723 per year on average, according to Insurance.com. Check your policy to see what you're currently paying for comprehensive and collision insurance.

- Your financial situation: While you might save money by dropping your collision insurance, you'd inherit considerable financial risk if your car is damaged in an accident. Could you afford the out-of-pocket costs to repair or replace your vehicle? If you'd have a tough time coming up with more than your deductible amount, it may be worthwhile to keep your collision insurance.

How to Save Money on Car Insurance

Costs for collision insurance can vary by insurer, but thankfully, there are steps you can take to lower your auto insurance premiums, such as:

- Increase your deductible. Your deductible, which typically ranges from $0 to $2,500, is the amount you pay from your own funds before your insurance coverage kicks in. Generally, higher deductibles result in premium savings, but understand you'll pay more out-of-pocket when you make a claim.

- Reduce the amount of coverage you carry. You could reduce unnecessary coverage to lower your monthly premiums. For example, you may not need roadside assistance if your auto club or credit card already covers it. Similarly, gap insurance covers the difference between your car loan balance and the vehicle's actual cash value if your car is totaled. You may not need this coverage if you've paid off your loan or owe less than the vehicle's worth.

- Choose the right vehicle. The type of vehicle you drive significantly impacts the price you pay for car insurance. Lower-priced economy cars have more affordable premiums since their replacement parts are typically less costly than those of more expensive luxury cars.

- Scoop up discounts. Bundling your homeowners and auto insurance policies with the same insurer can help you save money on your premiums. Along the same lines, you may qualify for a discount for insuring more than one vehicle with your insurance company. However, some car insurance discounts are not widely known, so it pays to ask your insurer what discounts you may qualify for. For example, some insurers offer a premium discount if you park your car inside a garage. This is because cars parked in garages aren't statistically as likely to be stolen or damaged than those parked on the street.

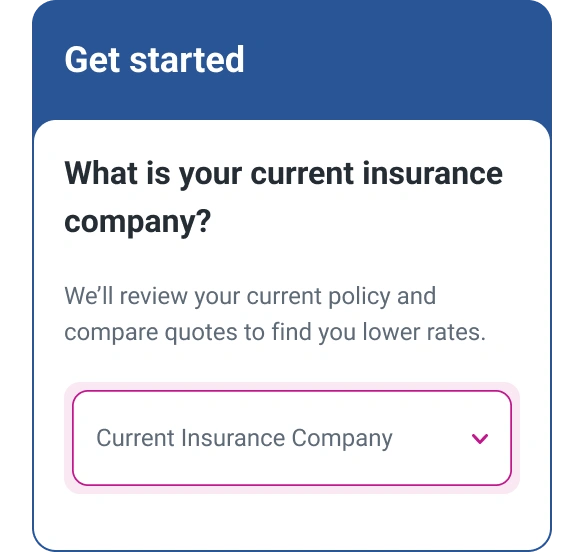

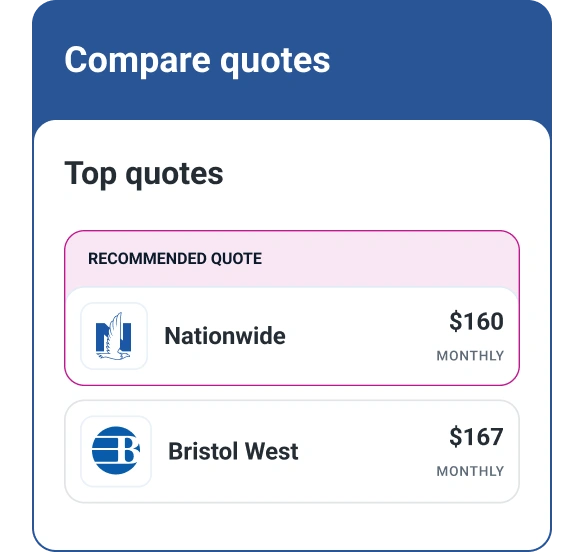

- Shop and compare providers. The Insurance Information Institute recommends comparing policies from at least three providers. Shopping different providers can help you dial in the scope of coverage you want at the best available price. Most auto insurers enable you to get a quote on their website or over the phone. You may streamline the process by utilizing an online comparison platform like Experian's auto insurance comparison tool. Provide some basic information about yourself and your vehicle once to view multiple car insurance quotes side-by-side.

Don't Forget About Your Credit Score

Your auto insurer raises your collision insurance if you've recently filed a claim for an accident or have other insurance risk factors. By following the steps above, you may be able to reduce your auto insurance costs. Also, consider speaking with your agent about your options to lower your premiums. Remember, insurance rates vary from insurer to insurer, so if your current carrier can't reduce your rates, getting quotes from other providers could help you find better options.

Before applying for a new auto insurance policy, you may want to check your credit report and credit score for free to spot any potential credit issues. Bear in mind, many states allow insurance companies to review your credit-based insurance score when calculating their premiums. By checking your credit report, you may spot any potential credit issues and take steps to improve your credit and possibly save money on your car insurance.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Tim Maxwell is a former television news journalist turned personal finance writer and credit card expert with over two decades of media experience. His work has been published in Bankrate, Fox Business, Washington Post, USA Today, The Balance, MarketWatch and others. He is also the founder of the personal finance website Incomist.

Read more from Tim