What Is a No-Down-Payment Mortgage?

Quick Answer

A no-down-payment mortgage is a type of home loan that offers 100% financing, meaning you're not required to pay anything at closing beyond closing costs.

A no-down-payment mortgage, also called a zero-down mortgage, is a type of home loan that offers 100% financing on your home purchase.

No-down-payment mortgage loans can make it easier for first-time and low-income borrowers to buy a home. However, they can be more expensive and come with added risk. If you're considering a mortgage loan with no down payment requirement, here's what you need to know before you apply.

What Is a No-Down-Payment Mortgage?

Most mortgage programs require you to make a down payment when buying a home, with many lenders requiring that you put down at least 3% to 5% of the purchase price—or more in some cases.

With a no-down-payment mortgage, however, you don't need to put any money down at closing, though you'll still need to pay closing costs set by your lender.

Compare now: Current Mortgage Rates

Compare mortgage rates

Check today’s rates to find the best loan offers. Staying updated on current rates helps you secure a competitive mortgage and save more over time.

Pros and Cons of a No-Down-Payment Mortgage

Buying a home with no down payment can be beneficial for certain borrowers, but it's important to understand the costs and potential risks. Here's what you need to know.

Pros

-

Saves money upfront: Having no down payment can minimize your upfront costs when buying a house. As an example, the median sales price of a home in the U.S. is $419,200, according to fourth-quarter 2024 data from the Federal Reserve Bank of St. Louis. With a 3% down payment requirement, you'd have to pay $12,576 in addition to closing costs. A zero-down mortgage saves you that money.

-

Helps you buy a home sooner: It can take several months and often years to save up enough money for a down payment on a home. With a no-down-payment home loan, you can become a homeowner more quickly.

-

Helps preserve your savings: Buying a home is an expensive endeavor, and the costs go beyond your upfront expenses and monthly payments. You'll also want to maintain reserves for moving costs, maintenance and repairs, which can be difficult if you also have to make a sizable down payment.

Cons

-

No home equity upfront: With 100% financing, you're starting out with no equity. This can increase your chances of being underwater on your mortgage, or owing more than the home is worth. What's more, if you have to sell after living in the home for only a short time, you may take a loss on the sale.

-

Higher mortgage payment: With no money down, you're borrowing more money, resulting in a higher monthly payment. Additionally, no-down-payment mortgages tend to have higher interest rates, which further increases your monthly payment.

-

Higher interest costs: Between a higher interest rate and a larger mortgage balance, you'll end up paying more in interest over the life of the loan.

Learn more: How Your Down Payment Affects Your Mortgage

Should You Get a No-Down-Payment Mortgage?

It's important to understand your situation, needs and goals to determine whether a zero-down mortgage loan is right for you. That said, here are some general situations where it could make sense:

- You qualify for a loan program with no down payment requirement.

- You want to buy a home soon but have limited savings.

- You need to preserve your savings for closing costs, moving expenses, maintenance, repairs and other costs of homeownership.

- You don't expect home prices to decline in the near future.

- You can afford a higher monthly payment.

In contrast, here are some scenarios where it could make sense to think twice about a zero-down mortgage loan:

- You don't qualify for a no-down-payment home loan program.

- You have sufficient savings to cover your closing costs, moving expenses and other homeownership costs.

- You want to minimize your monthly mortgage payment.

- You expect home prices to decline in the near future, and you're concerned about being underwater on your loan.

- You're willing to take the time to save up for a down payment.

Learn more: Are No Down Payment Mortgages a Good Idea?

How to Get a No-Down-Payment Mortgage

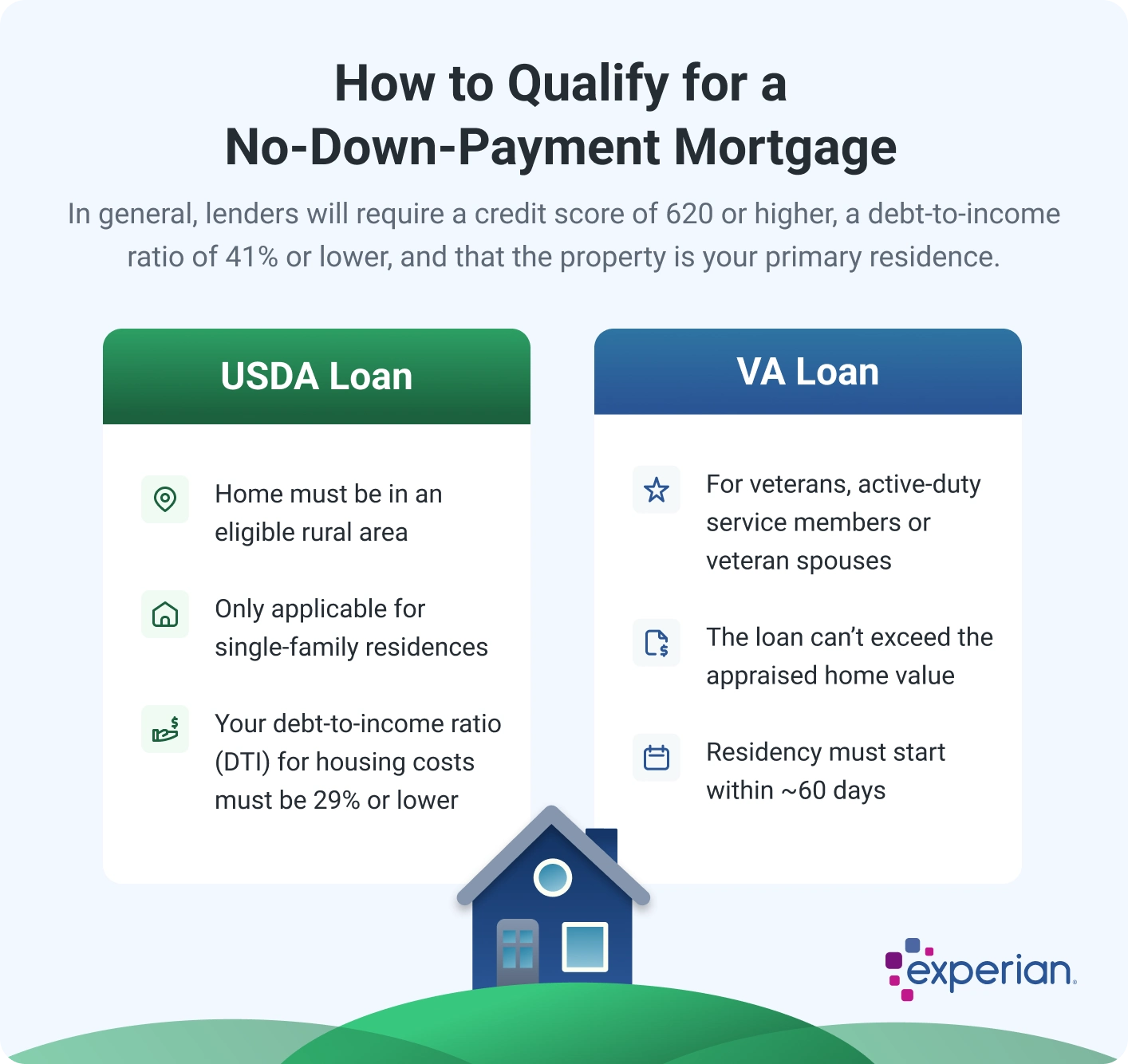

Zero-down mortgages aren't widely accessible. In fact, you typically need to meet certain criteria to qualify for one. Here are the different types of 0% down mortgages and how to qualify for each.

USDA Loan

The U.S. Department of Agriculture (USDA) offers two programs with no down payment requirement to low- and moderate-income homebuyers who plan to live in an eligible area. In addition to other closing costs, the USDA loan program requires you to pay an upfront guarantee fee of 1% of the loan amount. There's also an annual 0.35% guarantee fee.

Qualifications:

- You must buy a home in an eligible rural area.

- The property must be a single-family residence, and it must be your primary residence.

- The USDA doesn't set a minimum credit score, but lenders typically require a score of 620 or higher.

- Your debt-to-income ratio (DTI) generally must be 41% or lower, and your DTI for housing costs must be 29% or lower.

VA Loan

The Department of Veterans Affairs (VA) offers a zero-down loan program designed specifically for the military community. VA loans require a funding fee on top of other closing costs, which can range from 1.25% to 3.3% of the loan amount. However, there's no ongoing fee.

Qualifications:

- Must be an eligible veteran, active-duty service member, a member of the National Guard or Army Reserve, or a surviving spouse of a veteran.

- The loan amount cannot exceed the appraised value of the home.

- The property must be your primary residence.

- You must move into the home within a reasonable timeframe (usually 60 days from closing).

- The VA doesn't set a minimum credit score, but lenders typically require a score of 620 or higher.

- You'll generally need a DTI of 41% or lower.

Alternatives to a No-Down-Payment Mortgage

If you don't qualify for a 0% down mortgage loan, here are some potential alternatives you can pursue:

- FHA loan: Federal Housing Authority (FHA) loans allow a down payment of as little as 3.5% of the purchase price with a credit score as low as 580.

- Conventional mortgage: First-time homebuyers may be able to get a conventional loan with as little as 3% down.

- Good Neighbor Next Door (GNND) program: If you're a full-time law enforcement officer, pre-kindergarten through 12th grade teacher, firefighter or emergency medical technician, you may be eligible for the GNND program, run by the U.S. Department of Housing and Urban Development (HUD). It offers a minimum down payment of $100 and a discount of up to 50% on the purchase price of the property.

- Down payment assistance: Some government agencies and community organizations offer down payment assistance in the form of a grant, forgivable loan, deferred payment loan, low-interest loan or matched savings program. They're typically available to first-time homebuyers, but some repeat buyers may qualify.

Learn more: How to Get Down Payment Assistance

The Bottom Line

It's generally recommended for homebuyers to put some money down on their home purchase. However, it can be difficult for some to come up with enough cash to make that happen.

If you're considering a zero-down mortgage, review your credit report and check your credit score first to evaluate your chances of qualifying for a loan with a good interest rate. While there's no minimum credit score, lenders typically require a credit score of 620 or higher. Then, if necessary, take steps to get your credit in the best shape possible before applying for a mortgage loan.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben