What Is a Finance Charge?

A finance charge is an interest charge or other fees you may be required to pay on your credit card account. You can think of finance charges as the cost of borrowing money when you make purchases with your card.

While credit card finance charges generally refer to interest, a variety of other fees and penalties can fall under this term as well. But finance charges are not inevitable: It's possible to use and maintain a credit card account without ever paying finance charges.

Read on to understand how finance charges work, and how to keep them to a minimum.

How Does a Finance Charge Work?

Finance charges can include a combination of interest, fees and penalties:

- Interest: Interest charges typically accrue daily on card purchases, based on the annual interest rate spelled out in your cardholder agreement. Unlike mortgages and other installment loans, that annual interest rate is equal to the annual percentage rate (APR) used when promoting the card and for comparison to other card offers.

- Annual fees: If your credit card charges an annual fee, the amount of the fee is typically added to your purchase balance every year on the anniversary of the month when you opened your account. It typically appears on your card statement, and will also be reflected in the interest and fees section of your statement.

- Fees on cash advances and balance transfers: Credit cards that permit cash advances often charge a percentage of any amount issued as a cash advance. Similarly, cards offering balance transfers typically charge a percentage of each transferred sum as well. These fees are typically rolled into your credit card balance and can accrue interest over time.

- Penalties: Most cardholder contracts specify extra charges that apply if you make a late payment (after the due date) or pay by check or electronic payment from an account with insufficient funds. These fees typically range from $25 to $40 and can pile up fast. A single bounced check, for instance, can lead to both a late fee and a non-sufficient funds (NSF) fee. These fees are added to your total credit card balance and appear in the section of your statement that lists interest and fees charged to date.

Other charges applicable under the terms of your cardholder agreement could also be included in a finance charge.

How Are Finance Charges Calculated?

To understand how your interest charges apply to purchases, divide the annual interest rate by 365 to get the daily interest rate.

On a card with a 19% annual rate, the daily interest rate is 0.19 / 365 = 0.0005205, or 0.052%.

Using round numbers, let's say you buy a $2,000 laptop. Applying the daily rate the day of purchase will leave you with a balance of $2,000 + 0.52%, or $2,001.04; $2,000 in principal, and $1.04 in interest. The day following the purchase, because the interest compounds, the new balance becomes $2,001.04 + 0.52%, or $2,002.08; on day three the balance will be $2,002.08 + 0.52%, or $2,003.12, and so on. By day 30, assuming you haven't sent in a payment, your balance will have accumulated to $2,030.41—$2,000 in principal and $30.41 in interest.

If your card offers cash advances and you take one, the interest rate can be calculated in the same way, but a higher annual interest rate will likely apply. (That will, of course, translate to a higher daily interest rate.)

Conversely, if your card offers an introductory, or "teaser," interest rate, lower annual and daily interest rates may apply to purchases made within a certain number of months of opening the account. Note, however, that any outstanding balance left at the end of the introductory period will be charged interest at the regular purchase rate, as will all future purchases.

How to Avoid Credit Card Finance Charges

Finance charges are intrinsic to the credit card world, but that doesn't mean you should be eager to pay them—and fortunately, there are ways to avoid all of them:

- Interest: Thanks to a credit card's grace period, it's possible to avoid interest charges on most credit cards by paying off the balance in full by the due date specified on each monthly statement. If you cannot pay the balance in full, you're charged interest only on the portion that remains unpaid. Part of the convenience of using a credit card is being able to buy things you can't cover in a single payment. You normally have to pay a finance charge for the privilege of spreading payments across multiple card payment periods, but even that can be avoided if you make (and pay off) a purchase using a card with a 0% introductory APR.

- Annual fee: Avoiding the annual fee on a credit card is conceptually simple: Only apply for cards that don't have annual fees. As a practical matter that may be tricky, however: If you have a limited credit history or a spotty payment history that has lowered your credit score, you may only receive offers for cards that carry annual fees. If that's the case, before accepting a card with an annual fee, make sure you've shopped around with multiple lenders, including local financial institutions with which you have established accounts. If you aren't able to get a no-annual-fee card right away, you'll likely qualify for one after successfully managing a card with an annual fee for a year or so. When you qualify for a no-fee card, you can cancel the card that carries a fee, but be careful when doing so because it could affect your credit score.

- Fees on cash advances and balance transfers: Here again, the key to avoiding these fees is to refrain from taking cash advances, and to limit balance transfers to cards that don't charge fees for them. Study card offers and contracts carefully if you plan to make a balance transfer.

- Penalties: Avoiding late fees and other penalties, sometimes called situational charges, is a matter of good decision-making. Pay attention to your due dates, set reminders, arrange for automatic payments from your checking account, or do whatever else it may take to prevent late payments, bounced checks and other missteps. You'll save money by avoiding fees, and you'll also help protect your credit score.

Finance charges are baked into the credit card business—without them, it wouldn't be a business, and card issuers would have no incentive to offer credit. Paying occasional charges for use of credit is only fair, but so is doing all you can to avoid them. With a little strategizing and planning, you can keep finance charges to a minimum.

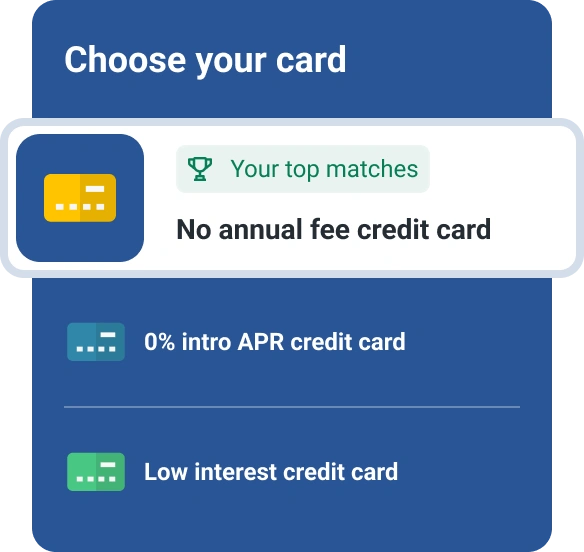

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim