Low APR Credit Cards: How to Pick the Right One

A low APR credit card is one that offers you the lowest possible interest rate, usually at the expense of other features such as rewards or benefits. Nobody likes to pay credit card interest, and if you need to carry a balance, then you should look for a credit card with the lowest possible interest rate.

How Low APR Credit Cards Work

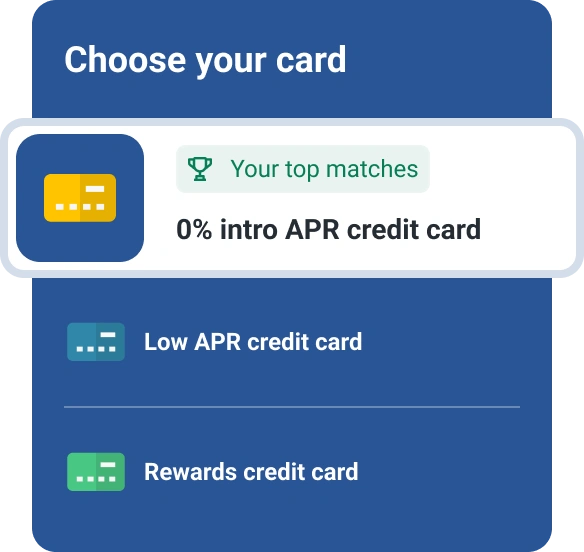

When you're looking for a credit card, there are several features that you can consider. Some might look for a card that offers the most valuable rewards or one that features travel benefits. However, many look to find a card with the lowest possible interest rate, which is expressed by the term APR or Annual Percentage Rate.

A credit card with the lowest possible APR will usually not offer rewards and will often include fewer benefits than a similar card with higher APRs. Like any company, credit card issuers need to make money on their products, and they will invariably impose higher interest rates on cards that offer generous benefits or valuable rewards.

Furthermore, some credit cards offer introductory rates as well as a regular interest rate. The introductory rate is often 0% APR but can occasionally be just an APR below the standard rate.

By law, these introductory rates must last for at least six months, although many of the most competitive offers last for 12 months or longer before the standard rate applies. Also, these introductory rates can apply to new purchases, balance transfers or both. When a 0% introductory rate is offered on balance transfers, there will usually be a balance transfer fee of 3% or 5% of the amount transferred.

But regardless of the rate you receive, nearly all credit cards now offer variable rates that can rise or fall with the Prime Rate. The Prime Rate itself is dependent on the Federal Funds rate, which can rise or fall with decisions made by the Federal Reserve's Open Market Committee. When the Prime Rate changes, nearly all of the credit card interest rates in the U.S. will change as well.

What Is a low APR?

The Board of Governors of the Federal Reserve System releases reports that compile the average credit card rates. In February 2018, the average rate on all accounts was 13.83% APR. If you find a credit card interest rate that is lower than these, then you know that you have a lower than average rate.

How to Find Credit Cards With the Lowest APRs

While some companies are allowed to hide the terms of their products in the fine print, the credit card industry is different. By law, credit card issuers are required to disclose their credit card rates and fees in a standard format, using a enlarged print. This format is called the Schumer Box, after New York Senator Charles Schumer who championed the provision requiring a standard table.

When you look for a card's APR, you'll find it in the Schumer Box, which will list the card's standard interest rate for purchases, balance transfers, and cash advances. When looking for a credit card online, you'll always find a link to this table labeled something like "rates and fees" or "terms and conditions." There might also be a penalty APR, which can apply when you fail to make your payments on-time.

But instead of listing a single interest rate for each of these types of balances, most credit cards will offer multiple rates or a range of rates. The rate you receive will depend on your creditworthiness when you open your account.

When you're looking to save money on interest charges, it's important to find a low APR credit card. By looking past the cards with attractive rewards and benefits, and focusing on a card's introductory and regular interest rates, you'll find the card with the lowest possible rate available to you.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Jason Steele is a journalist who specializes in covering credit cards, award travel, and other areas of personal finance. As one of the nation's leading experts in the credit card industry, Jason's work has been featured at mainstream outlets such as Yahoo! Finance, MSN Money, and Business Insider.

Read more from Jason