Is Car Repair Insurance Worth It?

Quick Answer

Car repair insurance, sometimes called mechanical breakdown insurance, can help pay the costs of repairing mechanical breakdowns that your regular car insurance doesn’t cover. Find out how car repair insurance works and how to decide if you need the extra coverage.

When you get into a fender-bender, car insurance covers repairs. But what happens when your car's transmission gives out? Unless the failure is due to a covered risk, such as an accident damaging your transmission, car insurance won't cover it. If the manufacturer's warranty has expired, you'll be on the hook for repairs.

Also called mechanical breakdown insurance, car repair insurance can help pay for vehicle repairs resulting from a mechanical breakdown. To decide if car repair insurance makes sense for you, you should know how it works and what it does and doesn't cover.

What Is Car Repair Insurance?

Regular car insurance doesn't cover mechanical breakdowns of your car's parts or systems, unless those breakdowns are due to a covered risk, such as an accident that damages your engine.

Car repair insurance covers mechanical issues that regular car insurance does not. This may include engine or transmission issues, problems with steering or electrical systems and various other mechanical breakdowns drivers could encounter. There's a lot that car repair insurance doesn't cover as well.

What Does Car Repair Insurance Cover?

Car repair insurance is a type of repair agreement, similar to extended warranties or vehicle service contracts. But while extended warranties and vehicle service contracts are typically sold by auto dealers when you purchase your car, car repair insurance is usually sold by insurance companies, banks or credit unions.

What's covered by car repair insurance depends on your policy. Basic plans may only cover the vehicle's powertrain, such as the transmission, engine and drivetrain. Other mechanical breakdown policies cover electrical systems, steering, fuel systems, air conditioning, brakes and exhaust systems.

The most comprehensive car repair insurance plan covers all the vehicle's mechanical parts except those that are specifically excluded in the insurance contract. Some plans also include "extras" such as roadside assistance or trip interruption coverage.

What Does Car Repair Insurance Not Cover?

Read the details of a policy you're considering to see what's excluded from coverage. Typically, policies don't cover repairs for:

- Damage due to neglect or failure to maintain the car

- Normal wear and tear

- Rust or corrosion

- Non-mechanical or non-electrical parts, such as tires or trim

- Recalled parts

Car repair insurance won't cover damage from an accident. (Your regular car insurance covers that.) Nor will it pay to repair pre-existing damage or perform routine maintenance such as changing oil or spark plugs.

Even if a specific part or system is covered by your car repair insurance, your insurer might deny your claim based on how or why the breakdown occurred. For example, claims may be denied if:

- You can't prove that all required maintenance was performed.

- You performed maintenance on the car yourself.

- You've made aftermarket alterations to the vehicle.

- You used coolant or other fluids not recommended by the manufacturer.

- A covered part or system is damaged by the breakdown of a non-covered part or system.

- You keep driving after a dashboard warning light alerts you to a potentially serious problem.

You'll need to be meticulous about maintaining your vehicle and keeping records. And if your "check engine" light comes on at 3 a.m. on a deserted country road, you'll need to weigh the risk of pulling over to wait for a tow against the risk of driving to civilization and having your claim denied.

What Does Car Repair Insurance Cost?

Insurance carriers that sell mechanical breakdown insurance include Geico, Mercury and Progressive.

As with other types of insurance, you'll usually pay a deductible for car repair insurance claims. The deductible is the amount you pay out of pocket for the repair; the insurance company pays the rest. Deductibles can range from $100 to $500.

The cost of car repair insurance varies depending on factors including the coverage you choose, your vehicle and your deductible. Some car repair insurance can be found for as little as $30 per year, while other policies may run you closer to $120 per year.

In Southern California, Progressive's insurance rates for a 2015 Mazda 3 with 70,000 miles start at $30 per month for a $500 deductible, $54 per month for a $250 deductible or $79 per month for a $100 deductible. Progressive also requires joining the Good Sam Club for $29 per year to buy car repair insurance. If you chose Progressive's mid-range deductible, you'd pay $677 annually for the coverage. File a claim and you'll pay a $250 deductible, bringing your total annual cost to $927.

Is the cost worth the potential savings? That depends. In 2021, the average auto repair after a "check engine" light goes on cost from $349 to $418 nationwide, according to CarMD. Only 68% of American adults have the cash to cover an unexpected $400 expense, the Federal Reserve reports, and car repairs can cost much more. Kelley Blue Book estimates the average cost of replacing a 2015 Mazda 3's transmission in Southern California at $4,851 to $5,223.

Ultimately, you have to balance what you think you'd save by purchasing car repair insurance with the costs you might incur if paying for a repair out of pocket.

How to Decide Whether Car Repair Insurance Is Right for You

Weigh several different factors when deciding whether to buy car repair insurance.

Is Your Vehicle Eligible?

Car repair insurance is typically restricted to relatively new vehicles, so if your car is older or its manufacturer's warranty has expired, you may not qualify. Geico's mechanical breakdown insurance is only available for cars under 15 months old with less than 15,000 miles; once in place, it's renewable for up to seven years or 100,000 miles, whichever comes first.

Unfortunately, vehicles are most prone to mechanical problems after seven years or 100,000 miles, according to Car and Driver, so your mechanical breakdown insurance may end right when you need it. You can, however, find policies that may cover your car for longer. Progressive, for example, offers car repair insurance for model years 2007 onwards with mileage under 100,000. Once you get the coverage, you can renew it until your car is 18 model years old or has 150,000 miles, whichever comes first.

Is an Extended Warranty a Better Option?

If your car is too old for car repair insurance, extended warranties designed for older vehicles are another option. Auto dealerships typically sell vehicle service contracts for their used cars; some companies sell standalone extended warranties. Extended warranties generally cost more than car repair insurance because they aren't regulated like insurance is, however.

When buying an extended warranty, make sure you understand what the warranty covers and whether the protection is worth the cost. Most people who buy extended warranties never use them, according to Consumer Reports; those who do say they paid more for the plan than the warranty covered.

What Is Your Financial Situation?

Do you have other ways to pay for car repairs, such as an emergency fund? Depending on your car's age, it might make more sense to put repair costs toward a down payment on a newer car. If you could live without a car for a while, look for ways to save money or make extra money for a new vehicle.

Be Prepared

Every household needs an emergency fund for unexpected expenses. If you don't have one, a balance transfer card or credit card with a 0% introductory annual percentage rate (APR) could allow you to pay for car repairs over time without accruing interest. You'll need good credit, so check your credit report and credit score and take steps to improve your credit quickly if necessary.

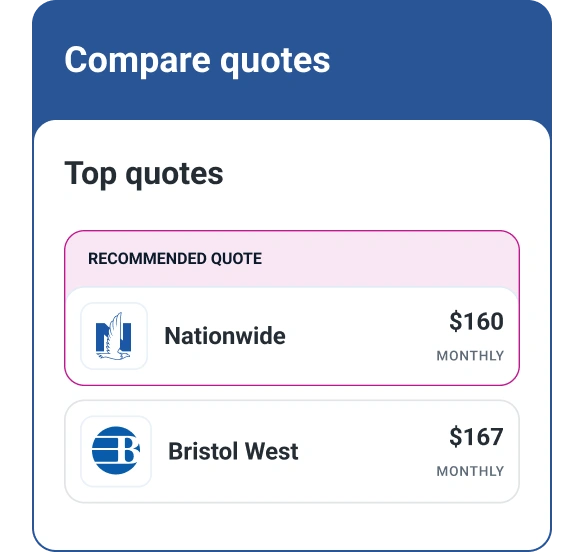

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen