Do You Need to Be Married to Share Car Insurance?

Quick Answer

You don’t need to be married to share a car insurance policy, but there are a couple of ways to share coverage and some considerations if one of you has a poor driving history.

If you live with your partner and both drive the same car, you can share car insurance. However, things get more complicated if you own and drive separate cars.

Ensuring that you have the correct coverage while driving each other's cars can help avoid a denial of expensive repairs later on. Check with your insurer or agent before adding your significant other to your policy.

How Does Car Insurance Work for Unmarried Couples?

You do not have to be married to share car insurance. You don't even have to be in a romantic relationship—you could share car insurance with a roommate. Reduced costs and multi-car discounts are major reasons people combine their car insurance. But each company and policy may have different rules about who can drive your car and who should be added to your policy.

You may also have reasons to keep your policies separate. Perhaps you don't want to mix financial accounts before marriage. Maybe your partner has a bad driving history that you are concerned could affect your rates. There are options for whichever situation you're in.

Living Together and Driving the Same Car(s)

If you share a home and vehicle, it may make the most sense to share a car insurance policy. This means you are both on the same policy and only paying for one plan. But depending on your insurer, you may not always be able to do this while unmarried.

If possible, you can purchase a policy together or add one partner to an existing policy by contacting your agent or insurer to set up the policy.

Living Together But Own and Drive Separate Cars

Merging insurance policies while unmarried may get sticky. This is especially true when you own and drive separate cars most of the time.

But you may want to occasionally drive your partner's car, such as on a road trip together. To make sure each partner has coverage if they happen to drive the other's vehicle, add your partner as a listed driver. This way you are each covered under the policy.

Adding a listed driver may increase your costs, which may mean it is ultimately less expensive to share a policy. But if it makes the most sense personally to opt for listing a new driver, this can be the safest move to ensure coverage.

To add someone to your car insurance, you can reach out to your insurer with the following information for the new driver:

- Name

- Date of birth

- Information about driving history, like accidents or tickets

- Driver's license information

Living Together But Don't Want to Share Policies At All

There are many reasons to choose to keep things like your insurance policies separate, especially while unmarried. You can specifically exclude your partner from your insurance. Excluding a driver notes that, even though you live together, the other person will not be covered when driving your car. This can help you avoid an increase in your rates due to their poor driving history.

To exclude a driver from your policy, reach out to your agent or insurer. If you live in a state where you can exclude someone from your insurance, you may need to fill out a form to do so.

Pros and Cons of Sharing Car Insurance

Sharing car insurance comes with pros and cons. Review these before deciding whether or not to share car insurance with your partner.

| Pros | Cons |

|---|---|

| Policy savings, including multi-car discounts, reduce car insurance bills for couples who share a policy and have good driving histories. | When you share car insurance, you each are subject to the other's driving record. You could ultimately end up paying more if your partner has a poor driving history. |

| Adding a listed user offers a flexible way to cover your partner under your policy without making major changes to your personal insurance. | Rates may increase even when just adding an occasional driver to your policy. |

| Sharing car insurance or at least adding a listed user on your policy makes it convenient to swap vehicles as needed and know you're both covered. | Opting to not share a policy or add your partner as a listed user means that letting them drive your car could end in catastrophe. Any accidents with them behind the wheel may not be covered. |

Should You Share Car Insurance?

If you trust that your partner is a safe driver, adding them to your car insurance to help you both cut costs can be a smart move. It's also safest if you may be driving each other's vehicles to at least add the other as a listed driver.

But if you're not so sure their driving record is clean—or will stay clean—take a pause. You're not currently married. You don't have to be financially responsible for other elements of one another's lives.

For now, it may be best to keep your car insurance separate and your individual costs low. This may even be a time to exclude your partner from your policy.

Even if you decide now is not the time to share car insurance, there are other ways to save on your car insurance policy. Consider:

- Reducing your coverage amounts: It may make sense to drop full coverage or reduce the amount of your current coverage options.

- Choosing a usage-based policy: Discuss with your agent or insurer if you may qualify for a usage-based policy, which will reduce your costs based on how much you actually use your car.

- Finding discounts: You may qualify for auto insurance discounts as a veteran, senior or student. If you get your car insurance and home insurance from the same provider, you could also qualify for a bundling discount.

- Improving your credit: Insurance rates may be influenced by credit scores in certain locations. A good credit-based insurance score can help lower your rates. Improving your credit, therefore, can help lower your insurance rates.

Sharing car insurance is a situational decision, but it can be key to protecting your financial situation. Make sure to make the decision logically to set both you and your partner up for financial success.

A Shared Cost Is Half the Cost

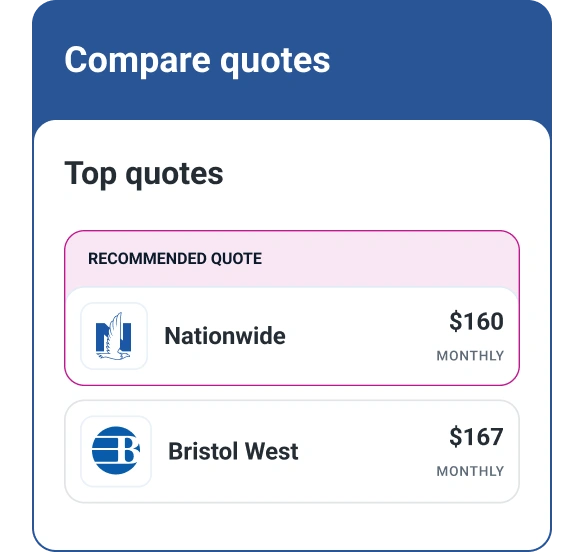

It's already established that a major pro of sharing car insurance is splitting the cost of your policy. But what if you could drop your costs even further? Shopping around to compare quotes could do just that.

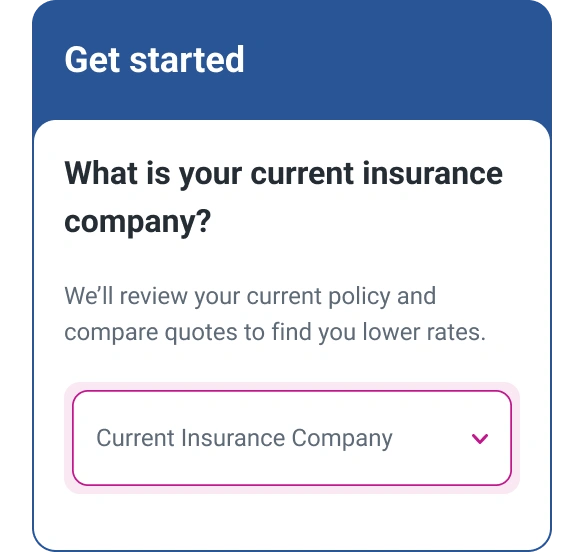

When you use an auto insurance quote aggregator like Experian's auto insurance comparison tool, you can get multiple quotes in minutes from top providers. With apples-to-apples coverage matches, you can be sure you've found the best savings available for the coverage you want.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Emily Cahill is a finance and lifestyle writer who is passionate about empowering people to make smart choices in their financial and personal lives. Her work has appeared on Entrepreneur, Good Morning America and The Block Island Times.

Read more from Emily