How Long Does a DUI Affect Car Insurance?

Quick Answer

A DUI conviction will hike your insurance rates for at least three years. How much and how long rates are affected depends on your driving record, the state where you live and insurance company practices.

A DUI conviction will raise your insurance rates for at least three years. Whether the hike lasts longer depends on the state where you live and your insurance company. Here's an overview of how it works.

The Many Costs of a DUI Conviction

A conviction for driving under the influence of alcohol or drugs (DUI), known in some states as driving while intoxicated (DWI) or operating under the influence (OUI), has numerous consequences. These can include steep fines, potential suspension of your driver's license, and even jail time if you're a repeat offender or if anyone is injured or killed.

A DUI conviction also marks you as a risky driver in the eyes of auto insurance companies. Some insurers may deny you coverage following a conviction; those that will insure you will charge you significantly higher rates than they would if you didn't have a DUI on your record.

What Determines How Long Your Rate Increase Lasts?

How long a DUI-related insurance rate hike lasts depends on several factors:

The State Where You Live

This is the main factor that determines the duration of your rate hike, and two separate but interrelated policies set by the state are responsible: How long convictions remain on your driving record, and how far back in time insurance companies are permitted to look when setting your rates.

In many states, a DUI remains on your driving record for seven years, and another conviction in that period is considered a repeat offense. Repeat offenses typically have far more severe consequences than a first offense, but a second offense after the seven-year "washout period" is treated as another first offense.

Some state regulations prevent insurance companies from looking back more than five years (or as little as three in some states), so a DUI conviction may stop affecting your insurance rates even before it drops off your driving record. To learn about policies in your state, consult your state DMV or check with an auto insurance agent.

Your Insurance Company

Car insurance companies also differ in how far back they look for violations and convictions when setting your insurance rates. Many look back up to five years for DUI convictions, but only three years for minor infractions such as speeding tickets, even if regulations allow them to look back further.

Insurers also differ in the way they manage rate hikes following a DUI. Some maintain a steady rate increase for as long as the DUI appears in their queries; others, if you have no other accidents or violations, will gradually reduce your premiums each year until the conviction falls off your record.

What Happens to Your Car Insurance After a DUI?

Following a DUI conviction, you'll likely be forbidden from driving for at least 90 days, and you may need to pay to install an ignition interlock—a breathalyzer that prevents your car from starting if you have alcohol in your system. This suspension period is a good time to investigate what comes next:

- File an SR-22 form. Following a DUI conviction, most states require you to file a certificate of financial responsibility, commonly called an SR-22 form (or, in Florida and Virginia, a similar document called an FR-44). The document is typically submitted to your state's department of motor vehicles after your suspension period when you apply for a restricted license. In addition to confirming your financial responsibility, it certifies that you have the minimum insurance coverage required by your state. It also obligates the insurer to notify the motor vehicles department if your policy lapses; that, in turn, typically triggers another suspension of your license.

- Ask your insurer what to expect. You're not required to notify your insurance company of a DUI conviction, but requesting an SR-22 essentially alerts them. They'll also find out before your next policy renewal when they pull up your driving record. Asking if they will refuse to renew coverage and getting an idea of how high they plan to hike your rates can give you time to look into coverage alternatives.

- Plan for a rate increase. The amount of your insurer's rate hike will depend on your state and driving history, but some estimates show a DUI conviction can lead to average annual premium hikes of around 80%.

Save Money on Insurance After a DUI

An increase in auto insurance rates is inevitable after a DUI conviction, but there are steps you can take to make your rates as affordable as possible:

- Keep a clean driving record. Additional accidents or citations for moving violations will only reinforce the insurance company's sense that you are a risky driver, and that could add to the length of time you must pay higher auto premiums. Drive carefully and do all you can to avoid another DUI.

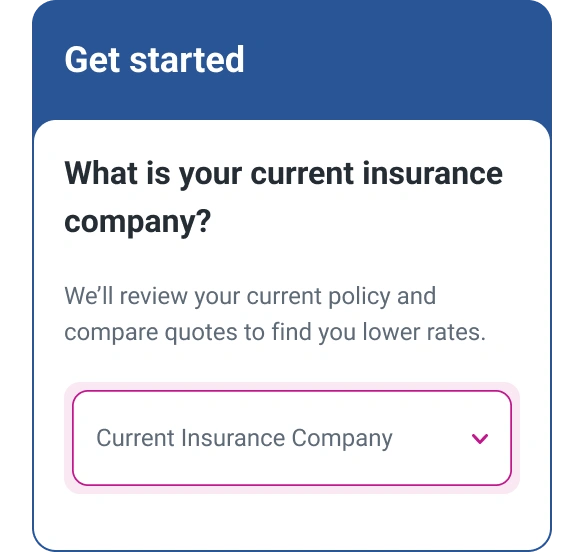

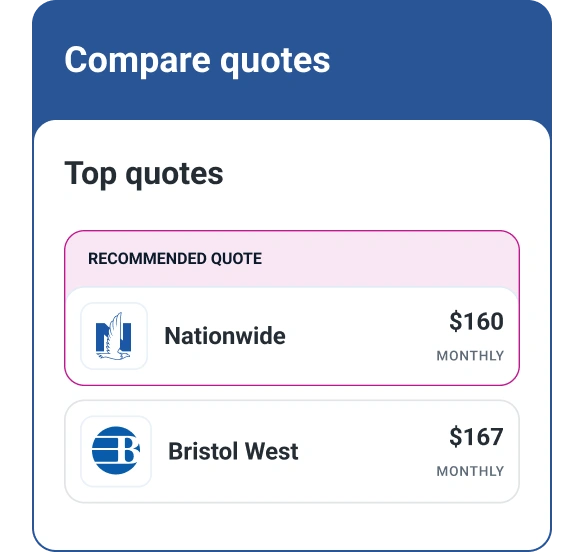

- Comparison shop every time your policy renews or sooner. A DUI conviction will affect your premiums for years, but some insurance companies may deny you coverage immediately after a conviction, and will accept you after six months or a year. When your current policy renews, get quotes from a variety of insurance companies. You'll still pay high premiums, but you may be surprised by the different rates that are offered.

- Improve your credit. Many auto insurers use specialized credit scores to help set premiums, assigning lower premiums to individuals who earn higher scores. These scores are not identical to the credit scores lenders use, but improving your credit score can boost your insurance-related scores as well. Check your credit score regularly to track your progress, and if your score improves, you may catch a break on your auto premiums.

A DUI conviction is serious and can cost you in many ways, not the least of which is a hike in car insurance rates. If you can avoid additional violations and shop carefully for insurance, you should be able to get back to manageable insurance rates within a few years.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim