Why You Should Check Your Credit Report Even If Your Credit Is Frozen

Have you put a credit freeze on your credit to prevent anyone from checking your credit report? Even if your credit is frozen, it's still important to check your credit report at least once a year. Here's why this matters and what you need to know to protect yourself.

Reasons for Freezing Your Credit

Also known as a security freeze, a credit freeze keeps lenders, creditors, businesses and others from gaining access to your credit report. If someone needs to check your credit—for instance, if you're buying a car and want to get an auto loan—you must personally lift the credit freeze and give permission for the creditor to see your credit report. Because companies need to see your credit report to extend credit, a credit freeze helps to keep thieves from opening fraudulent accounts in your name without your knowing about it.

People may place a credit freeze on their report for many reasons. Some do it after having suffered fraud or identity theft. Some do it to gain peace of mind after being notified that data they shared with a business, such as credit card information or Social Security numbers, has been breached in a hacking attack. Others do it as a pre-emptive measure to protect themselves or their children. (Parents can freeze the credit report of a child under age 16; if the child doesn't have a credit report, credit bureaus can create one for the child and then freeze it.)

Why You Need to Check Your Credit Report Even if You Have a Security Freeze

Placing a credit freeze is a helpful step toward protecting your good credit. However, having a credit freeze doesn't mean you can rest easy and not bother paying attention to your credit report. To maintain a good credit score, you still need to perform some regular maintenance by checking your credit report even if you have a security freeze.

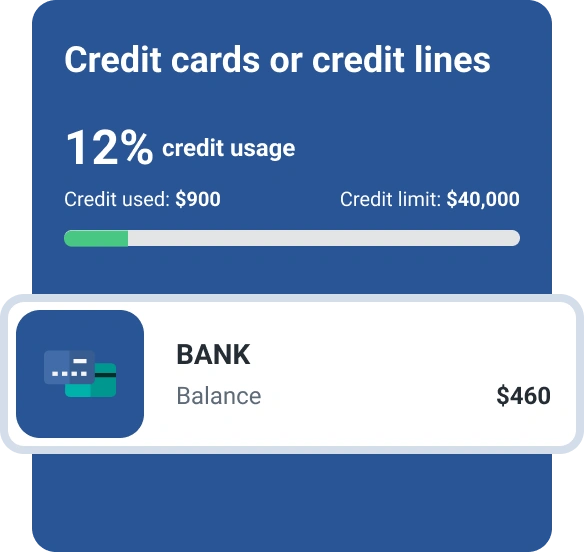

Why is this necessary? A credit freeze can prevent thieves from opening new accounts in your name—but it doesn't keep them from fraudulently using accounts you already have. For example, a thief couldn't open a new credit card in your name if you have a credit freeze, but they could gain access to your existing credit card information and use that to make fraudulent purchases. This type of fraud is actually more prevalent than opening new accounts, so it's important to be on the alert for it.

How to Check Your Credit Report When You Have a Credit Freeze

Good news: You don't have to lift your credit freeze to check your credit report. By law, individuals are allowed to check their own credit report even if they have a credit freeze in place. All you have to do is request a free credit report, just as you would if your credit were not frozen.

If you see anything suspicious on your credit report, such as inquiries from unfamiliar companies, let the credit bureaus know right away so they can take steps to correct the error. If necessary, you may want to take additional steps to protect your credit, such as placing a fraud alert on your credit file or locking your credit file.

By keeping a vigilant eye on your credit even when your file is frozen, you'll help protect your financial reputation. To get started, get your free Experian credit report.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen