When Should You Downgrade Your Car Insurance?

Car insurance is designed to protect you financially if you're involved in a car accident or if something else unfortunate happens to your vehicle or your belongings inside it.

Depending on your financial situation and other factors, though, you may not need all the coverage you're carrying. Downgrading your car insurance can save you on your monthly premiums—but it will also reduce how much financial protection you receive from your insurance company if something happens.

Here are some factors to consider when deciding whether to reduce your auto insurance coverage.

What Are the Different Types of Car Insurance Plans?

Auto insurance policies come with a variety of coverage options. While some are required by law in some states, others are optional. Here's a quick breakdown of the main types of car insurance coverage:

- Liability coverage: If you cause an accident, your liability coverage will pay for injuries sustained by the people in the other vehicle, as well as property damage.

- Collision coverage: This will pay to repair or replace your vehicle if you get in an accident with another vehicle or object.

- Comprehensive coverage: If your car is vandalized, stolen, damaged by acts of nature, or you hit an animal, comprehensive coverage will pay for repairs.

- Medical payments coverage: Regardless of who caused the accident, this coverage will pay for your medical bills and some other related expenses.

- Personal injury protection: Called PIP for short, this coverage may help pay for medical bills, lost wages and other accident-related expenses.

- Uninsured motorist coverage: If you get in an accident where the other driver is at fault, and they don't have enough liability coverage—or they have no coverage at all��—this feature will pay your medical expenses.

- Other optional coverages: Depending on the insurance company, you may also get the option to purchase rental reimbursement coverage, roadside assistance, mechanical breakdown insurance and more.

Choosing the right auto insurance policy involves picking the right coverage types for your needs, along with the right amounts of coverage for each.

What Car Insurance Coverage Are You Required to Have?

General requirements for auto insurance differ from state to state. But most states require that you have at least a minimum amount of liability coverage.

The only state that doesn't require liability coverage is New Hampshire, but the state does require drivers to demonstrate that they can pay for damages if they cause an accident.

Some states may also require that you carry medical payments coverage, personal injury protection or uninsured motorist coverage.

Note that you may need to maintain these required coverages even if you're not driving on a regular basis. Check with your state's insurance department to learn which coverages are required in your state and how much you need to have.

While collision and comprehensive coverage aren't required by law, your lender may require this coverage if you're financing your vehicle. Coverage amounts for these options are based on the value of your vehicle, but you can control how much they cost by changing your deductible—the amount you pay out of pocket when you file a claim.

When Does It Make Sense to Downgrade Your Car Insurance?

An insurance policy is essentially a game of trade-offs. Paying for coverage means you have a monthly premium. But cutting coverage to save on those premiums could backfire if you end up needing to file a claim.

Depending on your needs, though, it's possible to have more coverage than you need on your car insurance policy. Here are some situations where it might make sense to reduce your coverage or even cut some coverages altogether:

- Your car is old with a lot of miles. If your car isn't worth much, you're more likely to be able to repair it or even buy a new one if you get in an accident.

- You have a large emergency fund. Regardless of how much your car is worth, if you have the savings required to repair or replace it in the event of an accident, you may not need some types of coverage or as much as you would otherwise.

- Your loan is paid off. If you own your car outright, you no longer have to worry about a lender requiring you to maintain collision and comprehensive coverage. While you may choose to retain that coverage, you do have the option to drop it if need be.

- You can afford higher deductibles. Even if it doesn't make sense to drop collision and comprehensive insurance, you could still reduce your premiums by increasing your deductible on those coverage options.

While saving money on your car insurance policy can be helpful, it's also important to consider whether you have enough coverage. If you cause an accident and don't have enough liability insurance, for instance, the other driver's uninsured motorist coverage will kick in, but then their insurance company may sue you to recoup their costs.

Also, if you choose not to buy comprehensive and collision coverage and your vehicle is damaged or totaled, you may have some serious financial problems if you can't afford to repair or replace the car.

Finally, keep in mind that some coverages provide more protection than others. For example, rental car reimbursement may save you a few hundred dollars if you get in an accident and need a rental car while yours is being repaired. But collision and comprehensive coverage could potentially save you thousands of dollars. So if you're looking for areas to cut, choose the ones that provide less value.

How to Lower Auto Insurance Costs Without Downgrading

If you're uncomfortable with reducing your car insurance coverage, don't fret. There are other opportunities to reduce your monthly premiums:

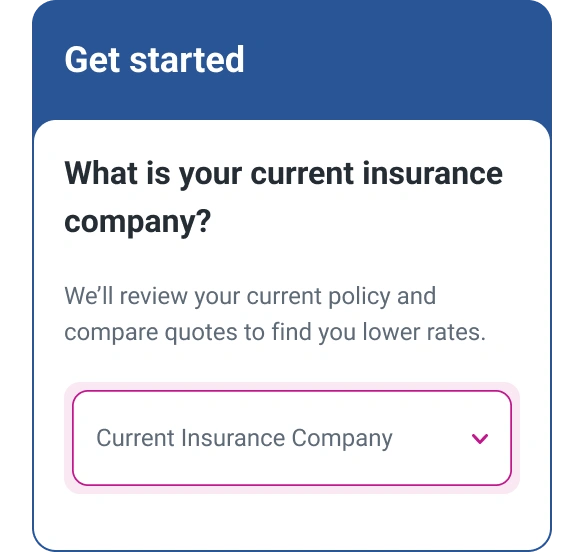

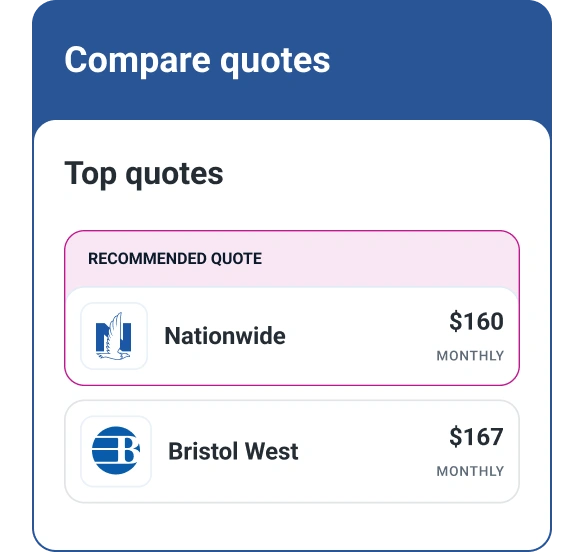

- Shop around. The cost of car insurance includes many factors that every insurer weighs differently. As such, one of the best ways to save money on car insurance is to compare quotes from multiple insurers. While there's no guarantee you'll find a better rate than what you currently have, the process could help you get the same coverage for less with another insurer.

- Raise your credit score. In most states, auto insurers use your credit report to create a credit-based insurance score. They use this score to help determine your premiums, and the better your credit looks, the more likely you'll save on your policy.

- Look for discount opportunities. All auto insurers offer discounts that can help reduce the cost of your policy. Check with your insurance company to see if it offers any discounts that you qualify for but haven't taken advantage of yet. Also, check for discounts with other insurers while you're shopping around to see if they can help you score a lower premium elsewhere.

- Bundle your policies. Many insurers offer reduced rates to people who insure multiple vehicles with the same company. You may also get a discount if you bundle your auto policy with other types of insurance, such as homeowners, renters, motorcycle and life insurance.

It can take some time to research some of these opportunities, but the long-term savings can be well worth the effort.

Continue to Monitor Your Credit to Maintain Good Rates

Every time you renew your policy, your insurance company will typically check your driving record to determine whether to make changes to your rates. At this time, you may also be able to ask them to run a credit check to see if an improved credit score can help lower your rates.

Because a higher credit score could help you save on auto insurance, it makes sense to monitor your credit regularly and watch out for anything that could impact your credit negatively. With Experian's credit monitoring tool, you'll get free access to your FICO® ScoreΘ, an updated credit report every day and real-time alerts about new credit inquiries and accounts.

Working on and keeping track of your credit can not only help you qualify for better insurance rates, but it could also improve your chances of qualifying for affordable credit when you need it.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben