In this article:

It's college graduation time again—when bright-eyed coeds finish their undergraduate degrees and enter the workforce armed with a brand new degree and, usually, at least some debt.

In fact, data from Experian indicates that as of the fourth quarter of 2018, recent college graduates ages 22 to 26 carried, on average, $27,661 in total debt, much of that in student loans.

Some carry credit card debt as well. College graduates in the 22-to-26 age range have an average of 2.3 credit cards in their wallet and an average of $3,521 credit card debt.

Carrying debt as you're just establishing yourself in your career can be tricky. If it's not managed strategically, it can prevent you from having a good credit score—which could keep you from achieving some of your financial goals.

The higher your credit scores, the more favorable the terms on loans, including both interest rates and credit limits. Better terms can save you big bucks on everything from credit card spending to car loans to mortgages. And if you think you're a long way off from buying a home and don't need to worry about credit, think again. Insurers and landlords, to name a few, will want to see your credit report.

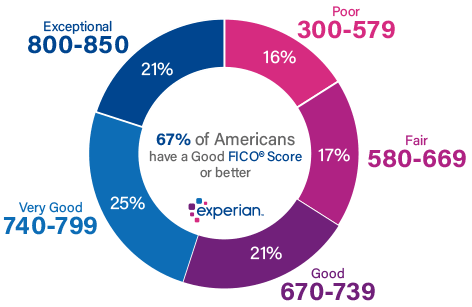

But there is some good news: College graduates in this age range have surprisingly high credit scores. Their average FICO® Score☉ is 689, just 12 points below the national average of 701. That's considered "good" on the FICO® scale. And there's still room for improvement: There are two tiers above this one, and getting into one of those tiers will save you the most money.

If you're a new graduate who wants to get ahead of your debt and manage your credit, check out tips on how to build credit after college. It includes detailed explanations on how credit scoring works and the best ways for you to manage your credit as a new grad. In the meantime, we've highlighted three things you can do right now get started on your credit journey.

1. Check Your Credit Reports and Scores

If you've ever had a loan or credit card, you have a credit report with at least one, if not all, the three credit bureaus (TransUnion, Equifax and Experian). A credit report is a historical record of how and when you pay your bills, how much debt you have, and how long you've been managing credit accounts.

If you're a recent graduate, it's possible that there's not a lot of information in your credit file just yet. That's OK. You have the opportunity to build a positive credit history by making smart decisions right now, like paying your bills on time. Over time, your credit file will grow—and you have the power to make sure it's free of blemishes.

You can get your free Experian credit report to see where you're at. There's no credit card needed to sign up, and you will have access to an updated report every 30 days. You're also entitled to a free report from each bureau once a week, which you can access at AnnualCreditReport.com.

When you check your reports, review them to make sure your identifying information is correct and the accounts are accurate. If you do find an error, you can dispute it with the bureau directly. Experian can help you initiate a dispute online.

You can also check your FICO® Score through Experian, which makes it easy to understand your progress. You'll get information on your score, along with explainers on why it stands where it does.

2. Get a Credit Card

If you don't already have a credit card, now is a good time to get one. It will help you build credit and demonstrate to future lenders that you can manage debt responsibly. Of course, make sure that you only use the card on purchases you can afford to pay off right away. If the card will tempt you to spend beyond your means, then that's a reason you might want to hold off.

If you don't have enough credit history to get a regular credit card, you might start with a secured credit card. A secured credit card is one that requires you to place a cash deposit with the card issuer as collateral for the card. That deposit typically serves as your credit limit.

You can use the card just like you would any other credit card, which means you can charge your purchases and then make payments on them on a monthly basis. Generally, if you make payments on time over the period of a year, your secured card can be converted to an unsecured one, or you will have built up enough credit to apply for a different unsecured card.

Check out a list of the best secured cards here, and a list of the best credit cards for beginners.

The key to using either credit card successfully? Paying it off on time every single month. That's the best way to increase your credit scores—and doing the opposite is the best way to send them plummeting.

3. Get Credit for Making Utility and Cell Phone Payments on Time

Utility and cell phone bills are not typically factored into your credit scores. But if you've been making utility and cell phone payments on time, there is a way for you to improve your FICO® Score by factoring in those payments through a new, free product called Experian Boost®ø.

Through this new opt-in tool, you can allow Experian to connect to your bank account to identify your utility and telecom payment history. After you verify the data and confirm you want it added to your Experian credit file, an updated FICO® Score will be delivered immediately.

On average, using Experian Boost increases credit scores by 14 points. If your score is around the 689 average, that could be enough to get you into the vaunted "700 club" of credit scores.

Visit experian.com/boost to register. By signing up for a free Experian membership, you will receive a free credit report and FICO® Score immediately.