How to Get a Student Credit Card

Quick Answer

Student credit cards are specialized for the needs and habits of college students. Using one can help you establish your credit history and even get rewards and other benefits along the way. But getting one on your own can still be challenging.

As a college student, establishing a credit history now can pay off when it's time to graduate and begin your life as a young professional. A student credit card can help you get started on your credit journey, but being a student is just one of the requirements to get approved.

Understanding how student credit cards work, how to qualify for one and how to pick the right one can help you determine your eligibility and how to make one of these specialized credit cards work for you.

What Is a Student Credit Card?

A student credit card is a type of credit card that's designed specifically to help college students build credit. While they work the same as regular credit cards, student cards may be accessible if you have little to no credit history, and they may offer rewards and other benefits tailored to the needs of their users.

For example, you may qualify for a higher credit limit and even more rewards if you pay your bill on time every month. You may also get access to your credit score, so you can track your progress as you establish a positive payment history.

Student credit cards typically charge no annual fee, but they may also offer low credit limits and high interest rates, so it's important to avoid racking up a large balance and to pay off your bill in full every month to avoid interest charges.

How to Qualify for a Student Credit Card

While student credit cards are designed specifically for college students, you'll still need to meet certain criteria to get approved for one. Each credit card issuer sets its own rules for approval, but the following guidelines can give you an idea of what to expect.

Age

You typically need to be at least 18 years old to get approved for a credit card on your own. If you haven't reached that age yet, you can ask a parent or other loved one to add you as an authorized user on their credit card account.

As an authorized user, you won't be legally responsible for paying the account balance, but you'll benefit from the account history. Just make sure that the account holder uses the card responsibly and pays on time to avoid negative information on your credit reports.

Income

Before the age of 21, it can be challenging to get a student credit card on your own. Credit card issuers usually don't disclose minimum income requirements, but you can only use your own personal income to qualify.

Once you reach age 21, you can also use other forms of income that you have a reasonable expectation of access, which can include:

- Personal income

- Income from a spouse or partner

- Scholarships and grants

- Allowances and gifts

- Social Security income

- Retirement and trust fund distributions

Credit Score

Credit score and credit history requirements can vary wildly depending on the card issuer. While some don't require a credit score to apply, others may require that you at least have some credit history.

Note that some credit card issuers may allow you to apply with a cosigner if you can't get approved on your own, but that isn't an option with most major card issuers.

Citizenship

It is possible to get a student credit card as a non-U.S. citizen, but many credit card issuers require that you have a Social Security number (SSN)—or, in some cases, an individual taxpayer identification number (ITIN)—to verify your identity.

A small number of credit card issuers may offer student cards to international students without requiring a Social Security number, but options may be limited.

Do You Have to Be a Student to Get a Student Credit Card?

Generally, you need to be enrolled in a two- or four-year college or university to get approved for a student credit card. In some cases, though, the card issuer may not require proof of enrollment.

How to Choose a Student Credit Card

Student credit card options aren't as plentiful as regular credit cards, and your selection may depend on your credit and income situation. With that in mind, here are some features to consider as you shop around and compare different cards.

- Eligibility criteria: Focus on cards that you have a good chance of getting approved for. While some credit card issuers may disclose basic credit requirements online, you may need to call and speak to a representative to get more details.

- Rewards: Depending on which card you choose, you may get a flat rewards rate on everything, a tiered rewards system with bonus rewards on certain spending categories or even bonus categories that rotate every few months. Think about how you spend your money and choose a card that aligns with your habits.

- Fees and interest: While student credit cards typically don't charge annual fees, check for other potential fees that could impact you based on how you plan to use the card. Also, compare interest rates, particularly if you believe you may end up carrying a balance from month to month.

- Perks: Some student credit cards may offer value beyond their rewards program in the form of short 0% APR promotions, good standing rewards, credit limit increases, free credit score access and others. Think about what you want in a credit card and choose the one that offers the benefits and features you're looking for.

How to Apply for a Student Credit Card

You can generally apply for a credit card online through the card issuer's website. While the application process can differ slightly with each issuer, here's a general guide through an application:

- Visit the card's landing page on the issuer's website and click on "Apply Now."

- Provide your personal information, including your name, date of birth, SSN or ITIN, address and contact information.

- Share your housing status, employment and income information and college details (if applicable).

- Review the card's terms and conditions and submit your application.

Once you submit, the card issuer will typically provide you with a decision within a few seconds. If your application is pending instead of approved or denied, you may need to provide additional information before you can get a final decision. If this happens, call the credit card issuer's customer service line to learn more.

If your application is approved, you should receive the card within a week or two.

How to Use a Student Credit Card

Once you get approved for a student credit card, it's important to ensure that you use it responsibly for the sake of not only your credit history but also your wallet.

Here are some tips that can help you make the most of your new card without dealing with some of the potential pitfalls credit cards come with.

Set Up Automatic Payments

If you're not used to paying a bill every month, set up automatic payments on your card to avoid accidentally missing a payment.

If you do miss one, you could incur a late fee and potentially even a higher interest rate. And if your payment remains past due for 30 days, it could damage your credit history.

Make It a Priority to Pay in Full

While student credit cards can charge high interest rates, you can avoid interest charges entirely by paying your bill in full every month. If you carry some of your balance over to the next month, you'll be charged interest on that amount, and you may also be charged interest on new purchases starting on the transaction date until you pay off the balance in full.

Avoid a High Credit Utilization Rate

Your credit utilization rate is the percentage of your credit limit that you're using at a given time. If you have a $300 credit limit and a $150 balance, for instance, your utilization rate is 50%.

Your utilization rate is an important factor in your credit score, so it's important to keep it as low as possible. You can keep yours low by using your card sparingly, making multiple payments throughout the month or paying your bill before the monthly statement cycle ends.

Review Your Monthly Statements

To protect yourself from unauthorized charges, check your monthly statements for transactions you don't recognize. If you're concerned about forgetting charges, you may be able to set up alerts on your phone for each transaction to ensure you're on top of your account.

Spend Only What You Can Afford to Pay Off

While it may be tempting to spend money to earn more rewards, you'll never get enough back to make up for the money you've lost. And if you overspend too much, you could also end up dealing with expensive interest charges.

In other words, be mindful of how and when you use your credit card, and consider setting up and following a budget to keep your spending in line with your income.

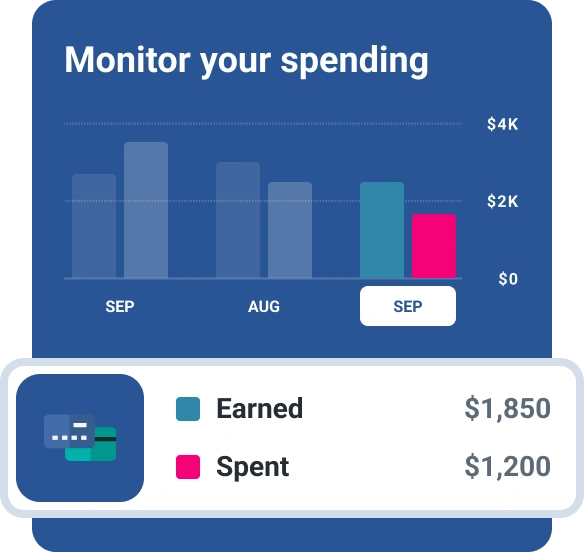

Monitor Your Credit to Track Your Progress

As you work on building your credit with a student credit card, it's important to monitor your credit to understand how your actions impact your credit score and to track your progress toward your goal.

Experian Go™ is a free program that provides tools and insights to help you build your credit from scratch. It also gives you free access to your FICO® ScoreΘ and Experian credit report, along with real-time alerts when changes are made to your report.

Credit cards for students

Looking to build your credit? Browse credit cards and secured credit cards designed for students. Get started with your FICO® Score. for free

See your offersAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben