Do You Have to Be a Student to Get a Student Credit Card?

College is a time of discovery. You're learning how to study without your parents reminding you, how to prioritize your time, what's the cheapest pizza place that delivers to the dorms, and just how much coffee it takes to keep your eyes open during that 8 a.m. class. And with help from a student credit card, you can also learn how to manage your money wisely.

As the name implies, student credit cards are designed to help college students get comfortable with managing credit. You usually have to be a student to get a student credit card; although there are some exceptions, most student credit card applications require you to prove that you're currently enrolled in school.

Could a student credit card help you on your journey toward becoming financially savvy? Keep reading to find out.

How Student Credit Cards Are Different

Student credit cards are different from regular credit cards in several ways. Since students often have little to no credit history and are considered higher credit risks, student credit cards usually have higher interest rates than the average credit card. Students also tend to have lower incomes than working adults, which means student credit cards also have relatively low credit limits. (Some cards will increase your credit limit after you make a certain number of payments on time.)

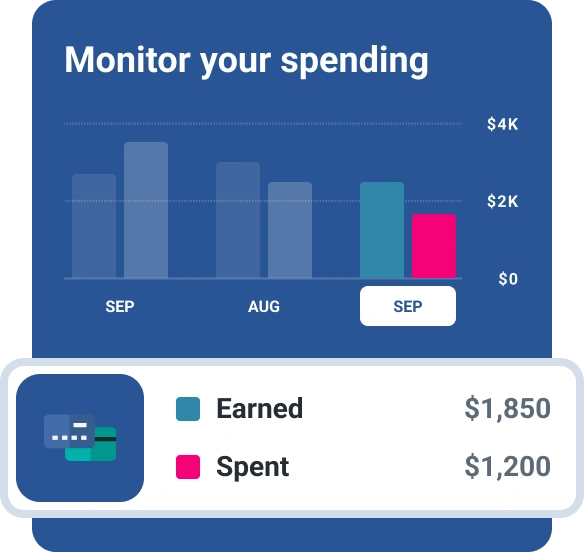

Many student credit cards also offer perks designed to appeal to students. In addition to standard rewards such as cash back, some student cards offer an annual credit to cardholders who maintain a certain GPA. Students with better grades tend to be more conscientious, which can translate into better financial habits. Other perks may include one-time late payment forgiveness, free credit score monitoring or financial education tools.

Qualifying for a Student Credit Card

In order to qualify for a student credit card, you must:

- Be a U.S. citizen or resident with a Social Security number.

- Be 18 or older.

- If under 21, you must show that you earn sufficient income (such as from a part-time job) to meet the card issuer's requirements.

- Prove that you're enrolled in school. Each card issuer has its own definition of what this means. For example, Discover requires you to be enrolled in a "two- or four-year college or university"; State Farm requires you to attend a "postsecondary educational institution."

- Have a good credit score. Making payments on student loans and other credit accounts on time can help you build a credit history even before you get a credit card. If you're not sure what your credit score is, you can get a free credit score from Experian to check it.

Alternatives to Student Credit Cards

If you can't qualify for a student credit card on your own, don't give up. Try these alternative ways to get a credit card and start building a credit history.

- Get a cosigner. Some credit card companies allow a parent or other responsible relative with good credit to cosign on the account with you. The cosigner takes responsibility for making payments on the card if you can't.

- Become an authorized user on a family member's credit card. Ask a parent or other relative with a good credit score to add you to their credit card account as an authorized user. The primary cardholder remains responsible for the payments, but you can use the card (if they allow it). The primary cardholder's payment history gets reported to credit bureaus; since your name is also on the account, you build a credit history too, even if you don't use the card.

- Get a secured credit card. To get a secured credit card, you put down a deposit—usually between $200 and $2,000—which becomes your credit limit. (Essentially, you're pre-paying the card.) By making it impossible to spend beyond your credit limit, a secured credit card can be a good way to show you can use credit responsibly. Some secured credit card issuers will even offer you an unsecured card after you've made a certain amount of payments on time.

- Get a store credit card. Many retailers offer store credit cards, which often have less stringent approval requirements than regular credit cards. However, because these cards typically have high interest rates, this should be your last option. If you do get a store credit card, be sure to make only small purchases and pay off your balance in full and on time every month.

Student Credit Cards Build Credit History

A student credit card can be a smart way for a college student to build a credit history and a strong credit score before entering the world of adulthood, rent and car payments. Just make sure you choose the right credit card for your needs, keep your payments manageable, and always pay your bill on time.

Credit cards for students

Looking to build your credit? Browse credit cards and secured credit cards designed for students. Get started with your FICO® Score. for free

See your offersAbout the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen