How to Write a Letter of Explanation for a Mortgage

Quick Answer

You can write a letter of explanation for a mortgage by providing details about items in your application that concern the lender, such as late payments or employment gaps. Adding context helps the lender better understand your ability to repay.

When you apply for a mortgage, the lender may request a letter of explanation that provides additional information beyond what you submit with your application. They do this to better understand your qualifications and ability to repay your loan on time.

Requesting a letter of explanation isn't uncommon, and providing the information the lender asks for may improve your chances of getting approved. Here's what you need to know about a letter of explanation and how to write one.

What Is a Letter of Explanation for a Mortgage?

A letter of explanation for a mortgage is a written statement a borrower gives a lender to offer additional context about information they provided in their application. When you apply for a mortgage, lenders review your credit and employment history, bank statements, investments, income and more to assess your financial history and creditworthiness. Your mortgage application alone doesn't always tell the whole story, however.

Some things, such as late payments, employment gaps or inconsistent income, may raise questions for the lender and lead them to request a letter of explanation. This gives you an opportunity to explain the circumstances around the item in question and provide evidence that shows you have resolved the situation and currently have the ability to repay the loan.

Compare mortgage rates

Check today’s rates to find the best loan offers. Staying updated on current rates helps you secure a competitive mortgage and save more over time.

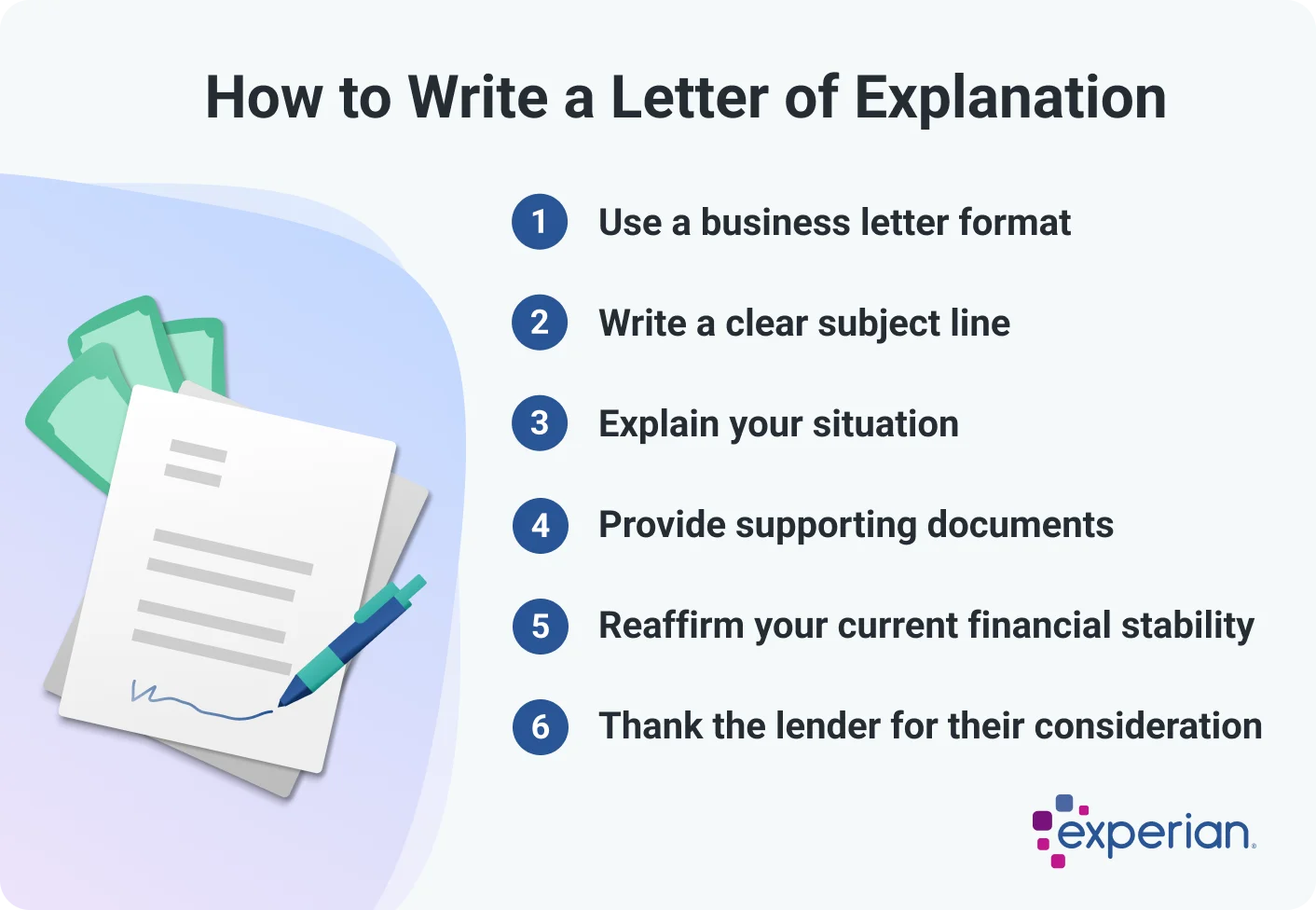

How to Write a Letter of Explanation

1. Choose a Business Letter Format

You're writing a letter to a financial institution, not your best friend, so keep it professional. Remember, the information you provide could mean the difference between qualifying and not qualifying for a mortgage.

Business letters are typically written in block format. If you're not sure what that is, there are plenty of templates online that can help you get started. Be sure to include the lender's name, address, phone number and date.

2. Write a Clear Subject Line

It should be immediately clear in the subject line why you're writing. Include your name and loan application number to make it easy for the lender to pull up and review your file.

3. Explain Your Situation Clearly and Honestly

If a lender requests a letter of explanation, they will let you know why. When providing your explanation, be as specific as possible and include as much information as necessary to address their concern that you may not be able to repay the loan.

Don't talk about matters they didn't ask about. Stick to the facts and be careful to avoid including your emotions and any unnecessary information.

4. Provide Supporting Documents

If you have documents you haven't already given the lender that support your explanation, include them. For example, if your lender asks about a gap in your employment, you might provide a new employment agreement and pay stubs from your current employer.

5. Reaffirm Your Current Financial Stability

A lender's job is to reduce and manage risk. Reassure them that you can make your mortgage payments and reiterate why.

6. Thank the Lender for Their Consideration

Thank them for considering your application and taking the time to review your letter of explanation. Sign the letter, and if you are applying with a co-borrower, have them sign it too.

Letter of Explanation Example

Date

Name of lender

Address of lender

Lender phone number

Re: [your full name] mortgage application #[application number]

To whom it may concern:

I'm writing in response to your request for an explanation regarding a gap in my employment from August 2022 to April 2024. I decided to temporarily leave the workforce during that time to care for my aging parents.

Both of my parents died in 2024, and after taking time to settle their estate, I returned to the workforce. I have been employed by [company name] for the past 12 months, earning a salary of [salary information]. For your reference, I have attached the employment offer I received from [company name] and my most recent pay stub.

I have no intention of taking more time off in the foreseeable future, and my current salary is sufficient to make my mortgage payments and take care of my other financial responsibilities.

Thank you for your time and consideration.

Your name and co-borrower's name (if applicable)

Your mailing address

Your phone number

What Is the Purpose of a Letter of Explanation?

A letter of explanation provides additional context about information in a potential borrower's credit, financial or employment history that may cause concern with the lender about their ability to repay the loan on time. Here are several examples of reasons you might receive a request to provide a letter of explanation.

- Adverse credit history: If you have late payments, charged-off accounts, a bankruptcy or a car repossession on your credit reports, your lender may want to know why.

- Employment gaps: Gaps in employment can often be easily explained, especially if you've taken time off to care for young children or aging relatives, or were laid off. However, lenders often want you to confirm the reason for the gap and verify your current employment situation.

- Inconsistent income: Seasonal workers, sales professionals who receive commission and other workers may have inconsistent income. Explaining why you're not receiving a steady paycheck every two weeks can help address lender concerns.

- Financial transactions: Lenders like to see consistency in your finances, so if you've recently had a large influx of cash or a significant withdrawal, they will probably want to know why. Large deposits may additionally require a gift letter that states the money does not need to be repaid.

- Credit inquiries: Adding new financial obligations to your budget could affect your ability to qualify for a loan and the loan amount you're eligible for. Your lender may want additional information about recent inquiries.

- Lending requirements: If you're getting a loan guaranteed by the FHA, VA, Fannie Mae or Freddie Mac, an explanation letter may be part of their lending requirements in certain scenarios.

Tip: It's a good idea to check your credit history before applying for a mortgage. You can view your credit reports from all three consumer credit bureaus (Experian, TransUnion and Equifax) for free once a week at AnnualCreditReport.com, and you can check your Experian credit report and scores anytime.

Where to Submit a Letter of Explanation

Once you have your letter written, here are a few ways you may be able to submit it.

- To your loan officer or mortgage broker: Ask them if they would like you to email it directly to them. If you applied for your loan in person, you may also be able to deliver it to their office.

- Through the lender's online portal: Many lenders have online portals where potential borrowers can upload documents and communicate with their loan officers.

Frequently Asked Questions

The Bottom Line

While writing a letter of explanation doesn't guarantee your lender will approve your application, it may help you qualify for a loan by providing additional information not included in other parts of your application. If your application isn't approved, even after you submit a letter of explanation, taking steps to improve your credit or financial health may help you qualify in the future. You can monitor your credit for free with Experian to see where you stand as you prepare for the mortgage application process. In addition to getting your credit report and FICO® ScoreΘ, you'll receive alerts when new accounts, changes or inquiries appear on your credit report.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Jennifer Brozic is a freelance content marketing writer specializing in personal finance topics, including building credit, personal loans, auto loans, credit cards, mortgages, budgeting, insurance, retirement planning and more.

Read more from Jennifer