Car Insurance for College Students: 8 Ways to Save

Quick Answer

You can save money on car insurance for your college student by keeping them on your policy, taking advantage of discounts, reducing coverage and more.

Car insurance for college students can be pricey. A lack of experience behind the wheel, increased accident risk and potential poor decision making are factors that drive up rates for young drivers. Though teens and young adults pay more than drivers with more experience, you may be able to help your college student save on car insurance with these eight strategies.

1. Keep Your Child on Your Policy

Adding your child to your current policy is almost always cheaper than purchasing a separate policy for your college student. Because young drivers pose a greater risk to insurance companies than more experienced drivers, providers charge them higher rates. When you add your college student to your policy, your insurer includes your driving history in the rate calculation, which can help keep costs down—if you have a clean record.

However, this strategy only works if your child is eligible to be added to your policy. Rules vary by insurer, but typically the title of the vehicle your child drives must either be in your name or both of your names. Your child also needs to live with you or list your home as their permanent residence even if they live on campus during the school year. If the car is titled only in your child's name or they have a permanent address that's different from yours, they will likely need a separate policy. Check with your insurance provider to find out for sure.

2. Utilize Good Student Discounts

Many auto insurance companies reward college students who maintain a specific GPA. Grade requirements vary by insurer, and your student may need to meet age and school enrollment conditions to qualify. But if they do, it could help you save.

3. Look Into Student Away Coverage

Students who go to college far from home and don't take a car with them may qualify for a discount since they aren't driving for months at a time. Generally, your child must attend school at least 100 miles away and leave their car at home to qualify for this discount. Age restrictions may also apply.

4. Consider Reducing Coverage on Older Cars

The average cost of collision coverage is $290 per year while comprehensive averages $134 per year, according to the Insurance Information Institute. If your child drives an older vehicle that has comprehensive and collision coverage, dropping them can help you save. But before removing them, do the math to ensure it makes sense.

Compare the cost of maintaining these coverages with what the insurance company would pay for repairs minus your deductible. If the cost of coverage is about the same or more than what the insurer would pay, it probably doesn't make sense to keep it. But if the value of the vehicle is more than what you'd pay to maintain comprehensive and collision, you may want to think twice before dropping them.

If you have an auto loan or lease, you'll need to hang on to these coverages—even if you don't want to. Lenders typically require them to protect their financial interest in the vehicle.

5. Exclude Your Child From Your Policy

If your child won't be driving your car after they head off to school, excluding them will likely reduce your premium. However, if they will drive your vehicle when they come home for the weekend or during longer school breaks, it's probably best to keep them on your policy. Although excluding them may help you save on premiums, they won't be covered if they're in an accident while driving your car.

Removing them from your policy also means they won't have continuous coverage, which could drive up the cost of insurance if you try to add them back to your policy in the future or they purchase a policy of their own. Plus, the insurance company may not allow you to exclude them if your child still comes home for breaks.

6. Bundle Home and Auto Insurance

If you have home and auto insurance policies from different insurers, now might be a good time to switch. Many insurance companies offer discounts when you purchase your homeowners and auto insurance from the same provider. Bundling your coverage could help you save hundreds of dollars or more per year.

7. Take a Driver Education Course

Many states require first-time drivers to take a state-approved driver education course before they can get their license. If your college student has completed one of these courses, you may qualify for a discount on your auto insurance.

8. Qualify for a Safe Driver Discount

Some insurance companies offer discounts to teens and young adults who enroll in programs designed to help them improve their driving skills or demonstrate safe driving behaviors. Depending on the program, your college student may need to use an app that monitors their driving habits. If they obey the speed limit, keep enough distance between their car and the car in front of them, avoid at-fault accidents and moving violations and are generally safe when driving, they may qualify for a discount.

How to Find Cheaper Car Insurance

Insurance rates have risen significantly during the past two years. If you're feeling the pinch, there may be things you can do—in addition to the tips listed above—to snag a lower rate for the same coverage. If you haven't already, check out all the discounts your current insurer and other providers offer to see how they may affect your rate. Consider increasing your deductible—it typically lowers your premium. But it also increases your out-of-pocket costs if you need to file a claim, so it's important to weigh the cost savings now with the potential expenses down the road.

You might also be able to lower your premium by paying your bills on time because many insurers use credit-based insurance scores when calculating premiums. These scores help insurance companies predict how likely it is that a policyholder will file a claim. People with higher scores typically get lower rates.

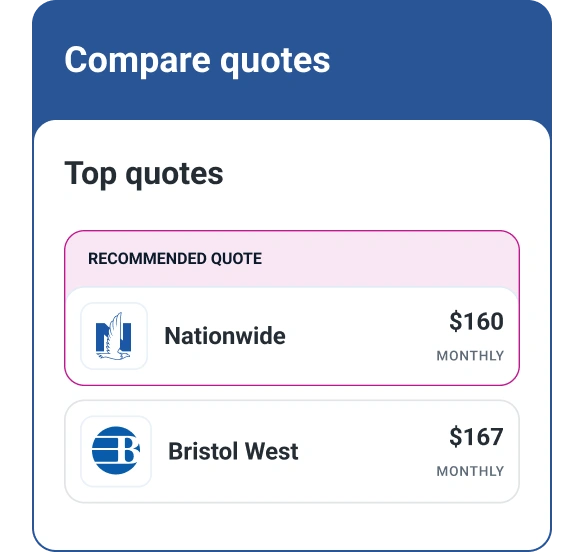

Because rates can vary significantly between providers, shopping around and getting quotes from multiple insurers is one of the best ways to ensure you're not overpaying for insurance. Experian's auto insurance comparison tool can help you compare pricing and find affordable coverage.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Jennifer Brozic is a freelance content marketing writer specializing in personal finance topics, including building credit, personal loans, auto loans, credit cards, mortgages, budgeting, insurance, retirement planning and more.

Read more from Jennifer