How to Earn Travel Rewards

Quick Answer

You can earn travel rewards by using your credit card to make purchases, signing up for airline or hotel rewards programs, using online shopping portals or dining out. Using multiple strategies can help you earn rewards even faster.

Whether you travel often or only occasionally, the cost can add up quickly. Travel rewards can help offset these expenses. The best part? You can earn rewards for things you'd be doing anyway. Here's how.

How to Earn Travel Rewards

There are multiple ways to earn travel rewards you can use to redeem for your next trip. One of the most popular is to use a rewards credit card. When you combine the use of your card with other strategies, you'll earn rewards even faster. Here's how.

1. Earn With a Rewards Credit Card

Using a travel rewards credit card is a simple and effective way to earn rewards on purchases you'd make anyway. Here's how they work:

For every purchase you make with your card, you earn a specific number of points or miles you can cash in to pay for travel expenses. Different cards have different reward structures, and many offer bonus points or miles for certain types of purchases, such as dining out or groceries. Many cards also offer welcome bonuses that allow you to rack up tens of thousands of points or miles when you meet a minimum spending requirement within a few months of opening the card.

Travel cards can be used to earn airline, hotel and general travel rewards. As you'd expect, airline miles offered by airline-specific travel cards can be redeemed for flights, but you may also be able to redeem them for hotel stays, cruises, spa packages and other experiences, as well as gift cards and merchandise. However, you usually get the most bang for your buck when you cash them in to cover airfare. The same is true for hotel points earned using hotel loyalty credit cards. Points earned from general travel rewards cards may offer more value across brands because they're not linked to a specific provider.

While a travel credit card is a quick and easy way to earn travel rewards, it's only worth it if you use the card wisely. Consider using it only for purchases you'd make anyway and can pay off each month. By paying your balance in full and on time, you'll avoid late fees and interest that can wipe out the value of the points you earned. Making on-time payments is also a key component to maintaining a good credit score.

2. Earn With Shopping Portals

Some airlines, hotel chains and credit card issuers have shopping portals that work like an online mall with links to major retailers. Shopping through an online portal is an easy way to boost your rewards. When you make a purchase through one, you earn points or miles on eligible purchases―on top of the rewards you earn for using your credit card to pay.

When you make a purchase using the retailer's link in a shopping portal, your account will be credited with the points or miles you earned.

3. Earn by Flying or Staying at a Hotel

You can earn travel rewards even if you don't have a rewards credit card by signing up for airline and hotel rewards programs. Once you're a member, you'll earn miles or points on eligible flights or hotel stays. Plus, you'll receive notifications about promotions that may allow you to earn bonus rewards.

Want to boost your rewards even more? Use a hotel or airline rewards credit card to pay for your flights or hotel stays. You'll often earn more for every dollar you spend with the brand than you will on other purchases. It's an easy and effective way to grow your rewards balance quickly.

FAQs

Want to get started but still have questions? Here are some answers to help you on your way.

The Bottom Line

One of the quickest ways to earn travel rewards is by using a credit card to make purchases you'd already be making. Combining the use of your card with other strategies allows you to maximize your rewards opportunities. You can keep track of how your credit card usage is affecting your credit score by requesting your FICO® ScoreΘ for free for free from Experian.

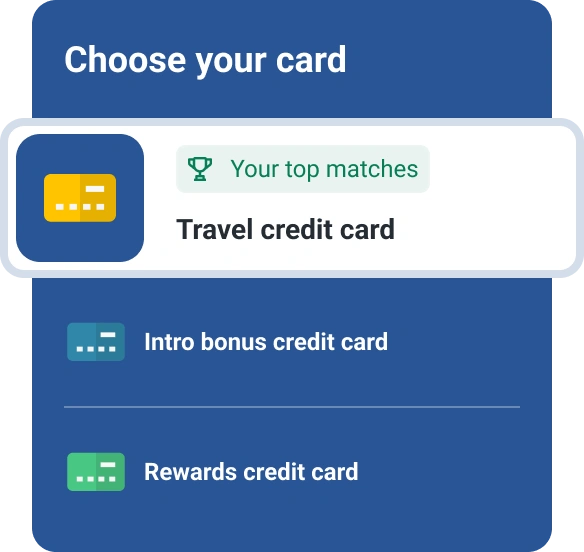

Get the rewards you deserve

Cash back? Miles? Points? Whatever suits your goals, we can help match you to personalized rewards card offers. Start with your FICO® Score for free.

See your offersAbout the author

Jennifer Brozic is a freelance content marketing writer specializing in personal finance topics, including building credit, personal loans, auto loans, credit cards, mortgages, budgeting, insurance, retirement planning and more.

Read more from Jennifer