How Do Travel Credit Cards Work?

Quick Answer

Travel credit cards allow you to earn rewards in the form of airline miles, hotel points, transferable points or cash back. Many travel cards also offer unique benefits, including annual statement credits and travel insurance.

Travel credit cards offer rewards and benefits that are geared toward flights, hotels, rental cars and other travel-related redemptions.

So how do travel credit cards work, and how do you choose the right one for your needs? Take a look at the different types of cards available, their unique benefits, and some strategies for maximizing your rewards.

What Is a Travel Credit Card?

Travel rewards credit cards offer points, miles or even cash back on your everyday purchases, which you can use to book flights, hotel stays, rental cars, cruises and more. Although they come in many shapes and sizes, most travel credit cards fall into four main categories.

Airline Miles

These cards are co-branded with a specific airline, such as United Airlines or Southwest Airlines. In addition to offering you miles or points with that airline's frequent-flier program, they may also offer other benefits when you fly with the airline, such as free checked bags, priority boarding, discounts on inflight purchases and even companion certificates.

Hotel Points

Similar to airline credit cards, hotel credit cards are co-branded with a specific brand, such as Marriott or Hyatt. You'll earn points with your purchases that you can use to book hotel stays, cover on-property purchases and more. Additionally, you'll typically get automatic elite status, a free anniversary night and other perks with that particular hotel brand.

Transferable Points

These general travel rewards programs typically allow you to book travel directly through the card issuer, or you can transfer your points or miles to one of the bank's airline or hotel partners. Travel cards with transferable rewards can give you a lot more flexibility with your redemptions and also give you a better chance of maximizing the value of your points or miles.

Examples include American Express Membership Rewards, Capital One Venture Miles and Chase Ultimate Rewards.

Cash Back

Some travel credit cards offer points or even straight cash back that you can use to book travel through the card issuer's portal. Alternatively, you may be able to redeem your cash back as a direct deposit, which you can then use to book travel on your own or use the funds for other purposes.

What Benefits Do Travel Credit Cards Offer?

As with other types of credit cards, the benefits you get can vary depending on which card you choose. As you shop around, though, here are the benefits to consider when deciding which one might be best for you.

- Intro bonuses: Travel credit cards often come with flashy intro bonuses that can be worth a lot of money toward free travel. It's not uncommon to find a card that offers more than $500 in value with its intro bonus, and some have been valued upwards of $1,000.

- Annual credits: Depending on the card, you may get statement credits when you use your card to pay for airline incidentals, such as checked bags and inflight purchases, hotel stays, dining or even general travel expenses.

- Airport lounge access: Premium travel credit cards are becoming more popular, and one of their hallmark perks is access to one or more airport lounge networks. Lounges not only provide a refuge from the hustle and bustle of the airport, but they can also provide complimentary food, drinks, Wi-Fi and more.

- Trip insurance: Travel rewards cards tend to include travel protections such as insurance for rental cars, trip delays or cancellations, as well as lost luggage and accidental death.

- Day-of-travel perks: Airline credit cards come with perks like free checked bags and priority boarding that can make a big difference to your airport experience. Hotel credit cards sometimes offer on-property credits for things like restaurant bills and spa treatments during hotel stays, which can make a vacation that much more enjoyable.

- Expedited airport security screening: Many travel credit cards offer an application fee credit when you apply for Global Entry or TSA Precheck, which can speed up the customs and airport security processes, respectively.

Again, while many travel rewards credit cards offer similar perks, they can vary quite a lot from card to card, so be sure to read the fine print before applying.

Are Travel Credit Cards Worth It?

While the perks that travel credit cards can offer are attractive, it's also important to note that most of them charge annual fees, which typically range anywhere from just under $100 to more than $600.

As a result, it's important to understand a card's rewards program and benefits and how their value compares to its yearly cost. In many cases, a travel credit card can easily make up for its annual fee in benefits alone, but only if you use them.

Think about how often you travel each year. If you don't fly frequently or don't think you'd take advantage of an airline credit card's free checked bag benefits, a hotel credit card's anniversary night certificate or a premium credit card's airport lounge access, it might not be worth applying for one.

Fortunately, a few travel credit cards don't have annual fees, but they also typically don't come with extra perks beyond the rewards program.

One final consideration: Many travel rewards credit cards require potential applicants to have good to excellent credit. Before applying, check your credit score, which you can do for free with Experian, to see if it is high enough to give you good approval odds.

How to Maximize Travel Credit Cards

There are several strategies you can use to squeeze as much value as possible from your travel credit cards. In addition to your other research, here are a few key takeaways to make sure you're getting the most from your rewards card:

- Meet the bonus requirements: Your first step should be to make sure you earn the intro bonus, which can require that you spend thousands of dollars over your first few months with the card. It's not worth it to go into debt to earn a welcome offer, though, so make sure you only apply for a card if you can meet the minimum spending requirement with your regular spending.

- Maximize earning categories: Many travel rewards cards offer higher rewards rates on specific spending categories, such as travel, gas, groceries or dining. Find a card that aligns well with your primary spending categories; if you have more than one card, make sure you use the right card for the right purchases.

- Redeem for the right things: You'll generally get the most value out of your points and miles when you redeem them for travel, particularly if you have an airline or a hotel credit card. If you have transferable points, you can research itineraries with multiple loyalty programs to see which will give you the most value per point or mile.

- Leverage all the benefits: If you have a travel card that offers perks on top of its rewards program, take advantage of its many value-added benefits. It can take some time to familiarize yourself with each perk and its terms and limitations, but doing so can allow you to reap hundreds of dollars' worth of value each year.

- Know your card's comprehensive coverage: Using your travel rewards card for travel purchases also means that its travel protections and coverage will extend to your trip. For this reason, it is also important to use a credit card that includes such protections to pay for a trip. If you don't, you could end up having to pay hundreds or even thousands of dollars if things go awry.

Because there are more travel credit cards available than ever before, consumers have some phenomenal choices. But it also means finding one that might be right for you can be complicated.

Think about which type of travel credit card will earn you the type of rewards you can use the most, what travel-related benefits you are looking for and which card has bonus-earning categories you can maximize with your usual spending habits. Finally, make sure its annual fee is within your budget. With those major factors in mind, you'll be able to find the right rewards card for your needs.

Review Your Credit Before You Apply for a Travel Credit Card

Before you apply for a travel card, it's important to make sure you have good approval odds. As previously mentioned, you typically need good credit, which generally means having a FICO® ScoreΘ of 670 or higher. If you're not there yet or you're just barely above that threshold, it may make sense to work on improving your credit before you apply.

To do this, you can check your credit score and Experian credit report for free through its credit monitoring service. With this information, you'll be able to identify areas where you can improve. Depending on the makeup of your credit file, some fixes may be quick, while others can take more time. Regardless, your efforts will not only make it easier to get approved for the card you want but also open up other credit opportunities in the future.

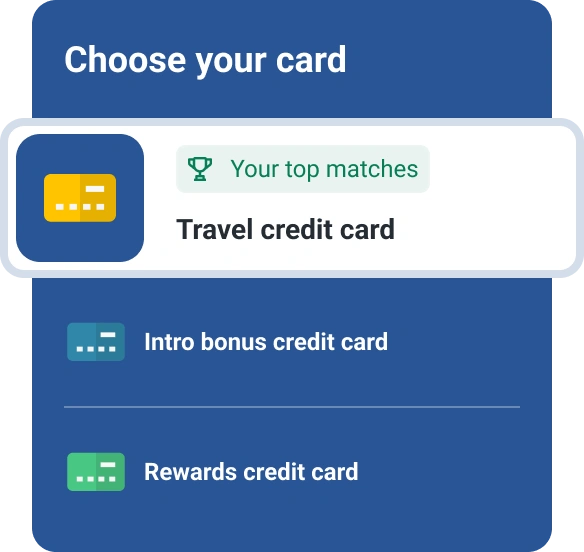

Get the rewards you deserve

Cash back? Miles? Points? Whatever suits your goals, we can help match you to personalized rewards card offers. Start with your FICO® Score for free.

See your offersAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben