How to Compare Credit Card Interest Rates

Quick Answer

Credit cards typically have different APRs for different uses, and some provide promotional financing options to new cardholders. As a result, it's important to shop around and compare rates based on how you plan to use your new credit card.

Credit card interest rates impact how much you pay to carry credit card debt. While you can avoid interest by paying your balance in full every month, it's still important to consider each card's interest rates before you apply.

Here's what to know about how credit card interest rates work and how to compare them.

Understanding How Interest Rates Work

As with other borrowing options, credit card interest rates are expressed in the form of an annual percentage rate (APR). When it comes to installment loans, such as personal loans and mortgages, the APR can be higher than the interest rate because a loan APR incorporates fees and other finance charges. With credit cards, however, the interest rate and APR are the same.

It's also important to note that credit cards typically offer variable interest rates, which means that after you open your account, your APR can fluctuate based on market benchmark interest rates.

A small number of credit cards offer fixed rates, in which case your rate will be the same as long as your account remains open.

Types of Credit Card Interest Rates

Credit cards typically have multiple APRs that apply to certain uses. Here's a quick summary of each:

- Purchase APR: The rate of interest that you pay on purchases you make with your card. Credit cards typically offer a grace period on purchases, which means that you won't incur interest on your balance as long as you pay it off in full each month by your due date.

- Balance transfer APR: The rate of interest that you pay on balance transfers. It's typically the same as the purchase APR, but there's no grace period.

- Intro APR: Many credit cards offer intro APRs on purchases, balance transfers or both for a set period of time. In most cases, the intro APR is 0%, but some cards may simply offer lower rates during this period.

- Cash advance APR: This is the rate of interest that you pay on cash advances. It's typically higher than the purchase and balance transfer APR, and there's no grace period.

- Penalty APR: The rate of interest you pay if you miss a payment by 60 days or more. It's usually the highest interest rate on a credit card, and it may remain in effect for six months or longer.

Where to Find Credit Card Interest Rates

Federal law requires credit card companies to provide clear disclosures about interest rates and fees. When you're comparing credit card interest rates, you may be able to find a card's purchase and balance transfer APR directly on the card's landing page.

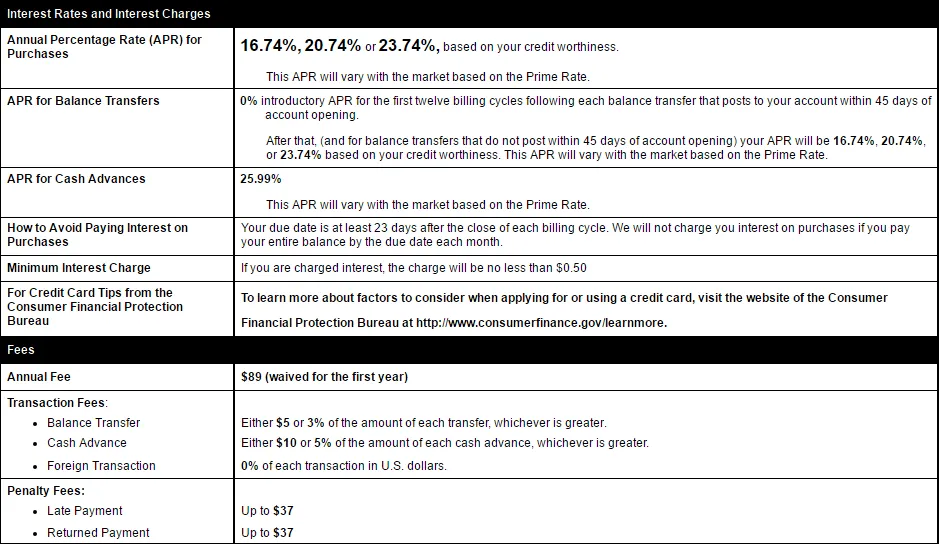

If you want all of the card's interest rate details, however, look for what's called the Schumer box, which you can usually find in the rates and fees section of a card's landing page or on a separate rates and fees page you can navigate to from the card's page.

The top section of the Schumer box displays all of the credit card's interest rates, as well as a minimum interest charge if you carry a balance.

Schumer Box Example

What Is a Good Interest Rate for a Credit Card?

A good interest rate on a credit card is usually below the average interest rate tracked by the Federal Reserve. That average can fluctuate over time, so it's important to compare multiple cards to see what's available.

For the first quarter of 2023, the average interest rate on credit cards was 20.09%, according to the Federal Reserve. But that's up quite a bit from the 14.22% average in 2018.

How to Compare Credit Cards With a Range of Interest Rates

Most credit cards offer a range of interest rates for purchases and balance transfers instead of a single rate for everyone who qualifies. This is due to risk-based pricing, in which lenders offer eligible borrowers different rates based on the potential risk of default each appears to pose according to their credit profile.

If you're looking for a specific type of credit card, such as a travel rewards card, most cards will have similar APR ranges. For example, one may offer a variable APR ranging from 17.99% to 27.99%, while another may offer 18.24% to 26.24%.

A good way to compare these two would be to find the middle rate in the range, which would be 22.99% for the first card and 22.24% for the second. All else being equal, you could save a bit of money by choosing the second card. But if the first card offers much better benefits, it could be a better fit overall.

How Does Your Credit Score Affect Your Interest Rate?

Your credit score is a major factor credit card issuers consider when determining your interest rate because it's an indicator of credit risk. Statistically, the higher your credit score, the less likely you are to fail to make payments. As a result, a card issuer will typically give you a lower interest rate.

If your credit score is just good enough to qualify for the card, however, you may get a higher rate in the card's range of options.

Keep in mind, though, that your credit score is just one element card issuers consider. They'll also look at your income, other debt, available credit on other cards and other factors to determine your APR.

How to Get a Low Interest Credit Card

If your top priority is to get a low interest rate on a credit card—whether it's a low intro APR or a low ongoing APR—here are some steps you can take:

- Deprioritize other benefits. Credit cards that offer a lot of perks, such as big welcome bonuses and travel credits, typically charge higher APRs. You may be able to find a card with a mix of these features, but you may need to give up value in other areas to maximize your interest savings.

- Improve your credit. Again, meeting the minimum requirements to get approved for a credit card won't necessarily give you a low interest rate. Consider taking some time to improve your credit before you apply for another credit card. Check your credit score and credit report to see where you stand and determine which areas of your credit file you can address.

- Consider a credit union. Credit unions often offer lower interest rates than banks, and the maximum APR for a credit union credit card is 18%, which is lower than the starting point for some major credit cards.

Ultimately, a wide range of credit card options exists. Getting prequalified can be a good way to narrow down your available options and better understand the rates that may be available to you if you were to be approved for a new credit card.

Compare All Card Features When Shopping Around

While a credit card's interest rate is an important factor for many consumers to consider, it's just one of the many features you can compare when you're shopping around. And if you tend to pay off your balance in full every month, you may be able to focus more on rewards and other card features than the APR you may never pay.

With Experian's card comparison tool, you can get matched with credit cards based on your credit profile, making it easy to compare your options side by side and determine the best fit for you.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben