How Does Accident Forgiveness Car Insurance Work?

Quick Answer

Accident forgiveness is an add-on policy some insurance companies offer to prevent your premium from increasing following an at-fault accident.

After an accident on the road, you might expect your auto insurance premium to rise significantly. This increase stays on your record and, depending on the severity, can continue to affect your rates for up to five years. Some insurers allow you to keep that clean slate even after an accident, however. Accident forgiveness is a coverage feature that protects you from rate increases if you get in an accident. Learn more about how this might help you protect your budget from additional financial stress after an accident.

What Is Accident Forgiveness?

Accident forgiveness coverage is an optional add-on policy many car insurance companies offer that prevents the policyholder's premium from being increased following their first at-fault accident. It's not available in every state and is usually offered to drivers who have had a clean driving record for a certain amount of time.

Some insurance companies, such as Allstate, Liberty and Nationwide, allow you to obtain the additional protection by purchasing the coverage as an add-on to existing plans. Other companies grant it as a reward for being a loyal long-term customer. Progressive, for example, offers accident forgiveness as a loyalty reward to customers who have been accident-free with the company for at least five consecutive years.

Pros and Cons of Accident Forgiveness Coverage

Like with most things when insurance is involved, the value of accident forgiveness coverage will most likely depend on your individual situation.

Pros

The coverage itself can have many benefits, including:

- Prevention of premium increases: The cost of adding accident forgiveness usually does not exceed 5% of your annual premium. Accidents can happen even to the best drivers out there, but this inexpensive add-on can offer additional peace of mind, ensuring your premium will not skyrocket after an incident.

- Could be free: Depending on your insurance carrier, you might be eligible for accident forgiveness without a premium increase thanks to a company's loyalty program. It might take several years of continuous coverage with a single carrier to get there, but once you earn it, there's no reason not to use the benefit to your advantage.

- Peace of mind: While this won't put more money in your pocket, it could help reduce the stress of driving. Accident forgiveness can help you to worry less about what could happen to your insurance costs if you're involved in an accident since even a minor fender bender can cause a rate hike.

Cons

There are some situations which might make you reconsider purchasing accident forgiveness. These include:

- Cost: If you had a clean driving record for a long time, this pattern may continue. Additionally, if you only operate your vehicle occasionally, the likelihood of you being involved in an accident is much lower. Even though accident forgiveness is usually quite inexpensive, the cost does add up over the years.

- Limitations: Earning eligibility for accident forgiveness can be quite a task. If you've had anything less than an impeccable driving history for the past couple of years, chances are your insurance carrier will not offer it to you. Even then, accident forgiveness is meant to protect you against a premium increase from a singular mishap on the road. There are usually limitations on how often you can use this protection.

- No protection against losing coverage: Accident forgiveness can protect you from a premium increase following an accident, but it does not protect you from getting dropped as a customer for engaging in risky behavior. If you were involved in an accident while driving under the influence of drugs or alcohol, for instance, the insurance company can still decide that you're too risky to cover.

Is Accident Forgiveness Worth It?

Accident forgiveness can certainly be a wise add-on for some drivers. If you have had some accidents on your record in the past and you feel like chances are you might potentially have an accident in the future, it might be a good idea to add this coverage if you are eligible. Having to deal with an increased premium from a past accident can be draining enough without worrying about history repeating itself.

Your premium after an accident can often increase by as much as 50%, and the record of the accident can stay on your record for anywhere from three to five years. Accident forgiveness, if purchased, usually amounts to under 5% extra on your insurance payments. Some drivers decide that the slight premium increase is worth the cost if it ultimately saves them from a huge hike.

The Bottom Line

If you are interested in accident forgiveness coverage, check in with your insurance company to see if they offer it, and if so, how to acquire it. Even when your carrier does not offer the coverage, chances are there are several other companies in your area able to offer the coverage at a decent price.

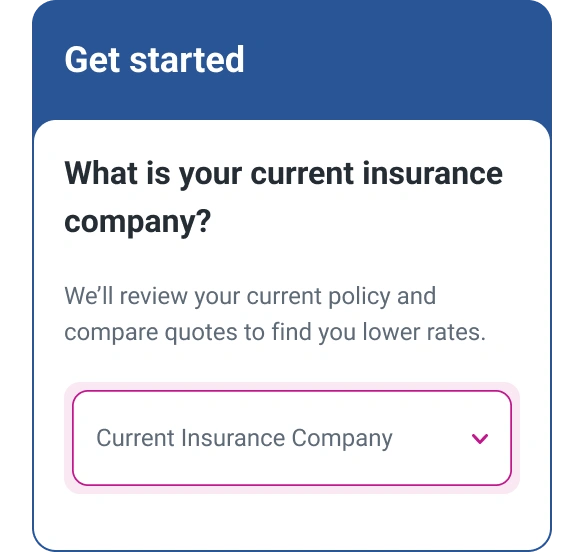

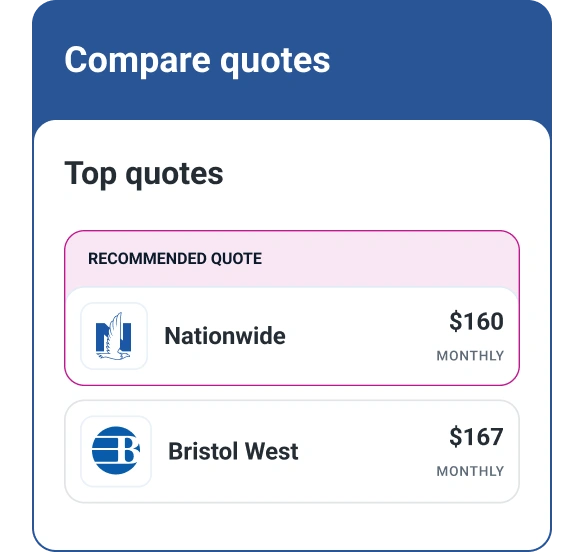

Finding the best insurance for you means knowing your options. You can now avoid the repetitive process of providing your insurance details individually with each insurance company to get a quote. With Experian, you can provide your information just once and get online quotes from over 40 insurance companies, all in one place.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Krystian Sip is a former Gabi Insurance Agency expert, where he authored in-depth guides and answered readers' questions. He joins Experian as a contributor, advising on how to understand and save on insurance.

Read more from Krystian