How Does Mileage Affect Car Insurance?

Quick Answer

Car insurance companies use your annual mileage to set your premiums. If you drive above the average annual mileage, you may incur higher car insurance costs.

Mileage is one of many factors car insurance companies use to set your premiums. Since drivers who spend more time on the road are statistically more likely to have accidents, higher annual mileage can mean higher insurance costs. Fortunately, there are steps you can take to reduce your insurance costs.

What Counts as High Mileage?

The average American drives about 13,500 miles annually, according to Department of Transportation data. Although each insurance company sets its own standards for low, average or high mileage, driving less than the average mileage (or in some cases, under 10,000 miles) annually could be considered low mileage.

Insurers may offer lower rates for low-mileage drivers, especially those who drive under 7,000 or 5,000 miles annually. Driving 15,000 miles or more every year is generally considered high mileage; however, you should check with your insurance company to see how the amount you drive might affect your rates.

Compare: Cheapest Car Insurance in the US

How Much Does Mileage Affect Insurance Premiums?

Mileage is just one of many factors affecting the cost of auto insurance. Others include the type and model of vehicle you drive, how much coverage you purchase, your deductible, your age, your gender, your driving record and where you live.

Annual mileage isn't necessarily a major consideration in setting insurance rates. In fact, policyholders driving 30,000 miles per year paid just 1% to 3% more on average than those driving 10,000 miles per year, according to insurance industry site The Zebra.

The exception is in California, where insurers can weigh mileage as one of the top three factors determining insurance premiums (along with driving record and number of years behind the wheel). In California, 30,000 mile-per-year drivers pay an average of 30% more than those who drive 10,000 miles per year or less, according to The Zebra.

If your high mileage is due to rideshare driving, you'll need special insurance, which can increase your premiums.

How Do Insurance Companies Calculate Your Annual Mileage?

Insurance companies typically request your odometer reading or an estimate of your annual mileage when you apply for insurance. To see if you qualify for low-mileage discounts, they'll track your mileage either via an onboard device or by getting an odometer reading from you or a third party.

To estimate your annual mileage, track your mileage during an average month and multiply that by 12. You can also divide the number of miles you've put on your car since you bought it by the number of months you've owned your car to arrive at an average monthly mileage. Multiply that number by 12 to get an annual mileage.

However you determine your annual mileage, don't fudge the numbers. Should you file a claim, an odometer reading would show that your mileage is higher than you stated. Falsifying your insurance application can result in cancellation of your insurance coverage.

What Kinds of Discounts Can Low-Mileage Drivers Get?

Driving 12,000 or fewer miles a year may earn you low-mileage insurance discounts. In general, you'll see the most savings if you drive less than 5,000 miles annually. According to Insure.com, someone who drives 10,000 miles annually will pay 4% less than someone who drives 12,000 miles. Driving 7,500 miles annually could reduce your premiums 10% compared with driving 10,000 miles.

If you drive very little, pay-per-mile or usage-based auto insurance, available from some insurers, could lower your premiums even more.

- Pay-per-mile insurance calculates a base daily rate for every day you drive, plus a per-mile charge for each mile driven. A device placed in your vehicle tracks your mileage, which is used to calculate your monthly premium.

- Usage-based insurance goes a step further, using a device in your car to track not only miles driven, but also driving habits. For example, if you often speed or brake abruptly, that will factor into your insurance rates.

To decide whether pay-per-mile insurance or usage-based insurance could save you money, get a quote based on your driving habits. Keep in mind that if you start driving more, these policies could ultimately cost more than standard insurance.

Other Ways to Save on Car insurance

If driving less isn't practical for you, try these ideas to lower your car insurance premiums:

- Downgrade your coverage: Collision and comprehensive coverage, included in standard auto insurance, covers loss of or damage to your vehicle. The payout is limited to the car's value. Dropping collision and comprehensive coverage for an older car that isn't worth much could save you money, assuming you can afford to replace your car if it's totaled.

- Eliminate extras: Car insurance may include extras you don't need, such as rental cars or roadside assistance.

- Drive safely: Accidents or traffic violations on your driving record tend to raise your rates.

- Raise your deductible: Choosing a higher deductible typically lowers your premiums. Just make sure you can pay the higher deductible if you file a claim.

- Bundle insurance policies: You can lower your premiums by using the same insurance carrier for multiple vehicles or drivers, or by getting homeowners, renters or other insurance from your auto insurance company.

- Ask about discounts: Many insurers offer discounts for membership in certain organizations, taking driver safety courses, going paperless or setting up autopay. It never hurts to ask.

Is paying your insurance premium all at once a smart move? That depends. Drivers who paid their premium in full saved an average of 4.7% on insurance in 2021, according to Zebra. But if paying upfront would sap your savings, it may be better to pay monthly.

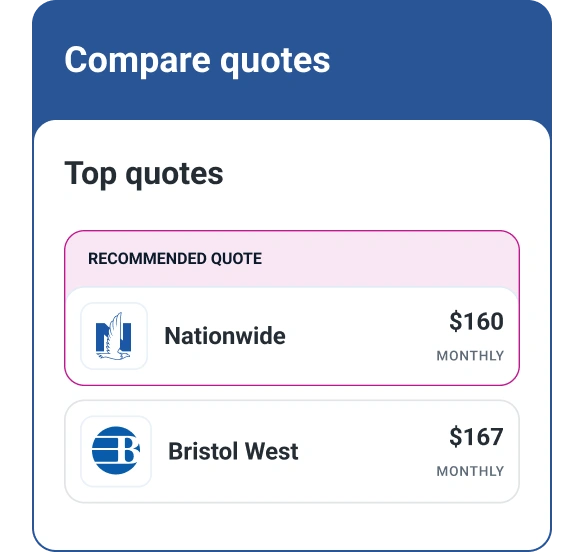

Because premiums vary widely from one insurer to another, shopping around can save you hundreds of dollars. Experian can help you compare auto insurance quotes, which is an easy way to compare rates from a variety of insurance companies.

Insurance companies in most states review your credit-based insurance score when setting premiums. Because this score uses similar information to your FICO® ScoreΘ, maintaining good credit can contribute to lower insurance rates. Check your credit report and credit score regularly and take steps to improve your credit score if it's lower than you'd like.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen