Do Safety Features Lower Car Insurance?

Quick Answer

Buying a safer vehicle may reduce auto insurance costs, depending on the vehicle’s safety rating and features. Keep in mind that other factors, like driving history and coverage amount, also impact your insurance costs.

Insurance companies use many factors to determine the cost of your insurance premiums, including the vehicle's crash-test ratings and safety features. In some cases, buying a safer vehicle could reduce your auto insurance costs.

Do Vehicle Safety Ratings Affect Insurance Rates?

Safety ratings provided by organizations like the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS) show how vehicles perform in crash tests. They measure the injury risk for a particular vehicle compared to vehicles in the same category.

The highest safety ratings are given to the vehicles with the lowest injury risk. For instance, NHTSA gives a five-star rating to the safest vehicles and the IIHS gives Top Safety Pick and Top Safety Pick+ designations.

Safety ratings are likely a factor you consider when shopping for a vehicle, and they are also important to insurance companies as well. Insurers factor in safety ratings—sometimes based on their own internally developed ratings—in calculating insurance premiums.

Vehicles with higher safety ratings are often generally cheaper to insure because they statistically have fewer and less expensive claims. Insurers may also offer discounts to drivers with safer vehicles.

Safety ratings don't always result in lower insurance rates, however. The safety features that reduce accidents—like mirrors, fenders and bumpers with sensors—can also make vehicles more expensive to repair when accidents do happen. Other pricing factors could offset any savings from safety ratings. We'll dive into those factors below.

Can Added Safety Features Reduce Your Rate?

Besides the vehicle's published safety ratings, there are several features that can cause your vehicle to be safer and lower your insurance rates. Many newer vehicles come standard with safety features that warn you of a potential crash or take action to prevent a crash. These features include:

- Forward collision warning

- Lane departure warning

- Rear cross traffic warning

- Blind spot warning

- Automatic emergency braking

- Pedestrian automatic emergency braking

- Rear automatic braking

- Blind spot intervention

- Adaptive cruise control

- Lane centering assistance

- Lane keeping assistance

- Automatic high beams

- Backup camera

- Automatic crash notification

Determining whether these features are worth it depends on your budget. Contact auto insurance providers to get quotes for the vehicles you're considering. If certain safety features are optional, get quotes for vehicles with and without the optional safety features. The amount of savings, if any, can vary by auto insurance providers depending on the specific features.

Compare premiums to see how much you'd save by choosing one vehicle over another or by adding optional safety features. Consider the difference in premiums and the potential savings over the life of the vehicle. Be sure to factor in how long you plan to keep the vehicle and whether the insurance savings will offset the cost of the safety features.

Factors Beyond Safety Ratings That Influence Insurance Costs

Safety ratings are one of the many factors insurance companies use to determine your premium. A variety of factors that affect your insurance cost include:

- Anti-theft devices: Vehicles with alarms or other tracking devices are less likely to be stolen and less costly to insure.

- Vehicle size: Because of their size and weight, larger vehicles may have better crashworthiness compared to smaller vehicles. This lower risk could result in lower premiums.

- Your driving history: Speeding tickets, accidents and other violations can increase your risk of filing a claim and your auto insurance rate.

- Your driving activity: The more you drive, the higher the chances of an accident, even in a safe vehicle. Using your vehicle for commercial purposes can also raise your insurance costs.

- Where you live: Insurance rates tend to be higher in areas with more congestion or higher crime rates.

- Credit history: Poor credit can affect insurance rates in states where insurers are allowed to use insurance-based credit scores.

- Age: Younger, less experienced drivers have a higher risk of accidents and are more expensive to insure.

- Coverage options: The coverage amounts you choose affect your insurance costs. Some states require a minimum amount of coverage which can influence your insurance cost.

- Deductibles: In general, opting for a lower deductible can increase your insurance rate.

Because of the other factors that go into calculating your insurance premium, buying a safer vehicle won't automatically result in cheaper insurance premiums. For instance, costs may not be lower if you're comparing the cost to a vehicle that's less expensive, stolen less often and has parts that are easier to replace.

The Bottom Line

Owning a car with the latest safety features not only protects you and your passengers from accidents, it can also reduce your insurance costs. Check your owner's manual to learn which safety and security features your vehicle has and ask whether your insurance provider offers discounts for these features. If you're purchasing a new car, weigh the cost of added safety features with your budget and the amount you could potentially save in insurance premiums.

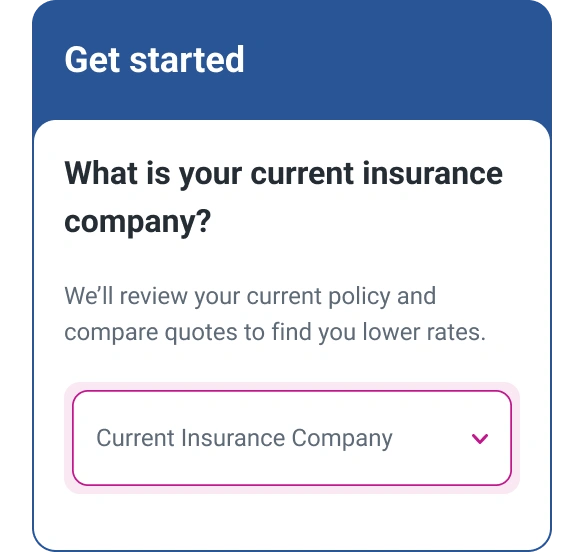

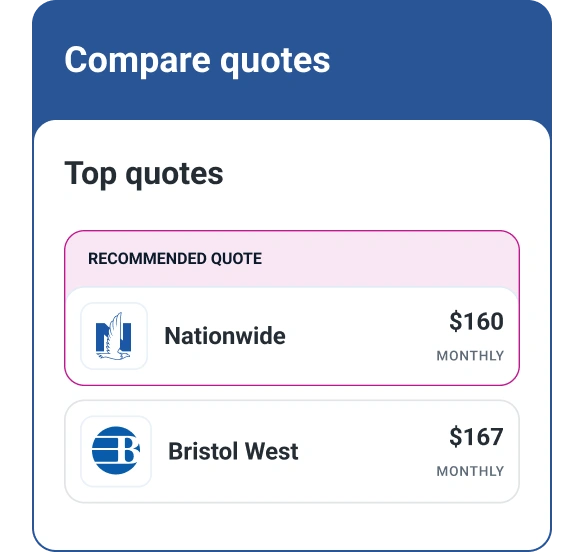

Make sure you're getting the best auto insurance rates by using an auto insurance comparison tool like the one from Experian to get quotes from multiple companies. You can compare personalized quotes from the top insurance carriers side by side to choose the best one for you. Even if you're satisfied with your current coverage, shopping around periodically can help you find new savings opportunities.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

LaToya Irby is a personal finance writer who works with consumer media outlets to help people navigate their money and credit. She’s been published and quoted extensively in USA Today, U.S. News and World Report, myFICO, Investopedia, The Balance and more.

Read more from LaToya