Experian CreditLock

Instantly lock and unlock your Experian credit file to restrict access to your credit, keeping fraudsters and identity thieves away.

Try Experian IdentityWorks® Premium free for 7 days, then just $24.99 /month‡

Instantly lock and protect your Experian credit file

Why use Experian CreditLock?

Prevent unauthorized credit activity and receive alerts if someone tries to apply for credit in your name while your credit file is locked.

If you think you have an issue with fraud or identity theft, a fraud resolution agent will guide you with every step until your issue has been resolved.

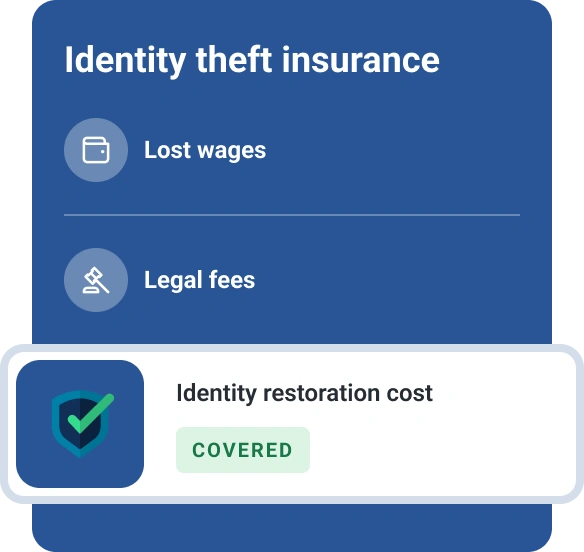

If you become a victim of identity theft, your policy may cover the cost of restoring your identity, lost wages, legal fees and more.

What can you do with Experian CreditLock?

3-bureau credit monitoring

Get alerted to changes to your Experian, TransUnion® and Equifax® credit reports to detect suspicious activity and signs of identity theft.

Lock and unlock your credit file with ease

Lock/unlock your credit file in seconds to block unauthorized credit activity and allow access when you are ready to apply for credit.

Get quarterly 3-bureau updates

You can view your updated three-bureau credit reports and FICO® Scores to stay up-to-date and compare your credit information.

Protect against identity theft and fraud

Take advantage of additional services including identy theft monitoring, alerts, dark web surveillance and privacy scans.

Frequently asked questions

A credit lock is a convenient way to restrict access to your credit report. Experian CreditLock blocks creditors from accessing your Experian credit file preventing them from processing new applications for credit. That can help you avoid fraud by standing in the way of criminals who apply for new credit in your name. Also, Experian CreditLock will notify you if someone attempts to apply for credit in your name—which can serve as an early warning if you’re being targeted by an identity thief. All in all, a credit lock can be a way of increasing security, plus a source of greater peace of mind.

To lock your Experian credit report, you’ll need to sign up for a premium membership and includes identity theft monitoring, three-bureau credit monitoring and identity theft insurance coverage up to $1 million.

Once you’re registered, you can easily lock and unlock your credit instantly. From within the app or on the web, sign in to your Experian account and navigate to the credit tab and scroll to “quick actions.” Next to Experian CreditLock, you’ll see a status indicating whether your credit file is currently locked or unlocked.

From there, click “manage.” Then, you can click to lock or unlock your credit, plus view a list of recent lenders who’ve tried to access your Experian credit file.

Once you’ve locked or unlocked your credit, you’ll receive an email from Experian confirming the change. Credit applications will be blocked until you unlock your file again.

Locking your credit can be a smart preventative measure against credit fraud, and you don’t need to be an active target to benefit from the added peace of mind. Here are some specific scenarios in which locking your credit file may be a good idea:

- You’re the victim of identity theft. If you’ve been targeted by an identity thief, locking your credit can help you put up a barrier to unauthorized credit activity. For instance, if you’re the victim of a phishing attempt, locking your credit can help you limit the scope of the damage.

- You’ve been impacted in a data breach. Learning that your sensitive data, such as your Social Security number, has been compromised in a breach can add uncertainty to your financial life. Locking your credit is one way to take control of your identity.

- You don’t intend to apply for credit in the near future. Even if you don’t have reason to believe you’re being targeted by fraudsters, if you don’t plan to take out new credit anytime soon, locking your file is a savvy way upgrade your security practices.

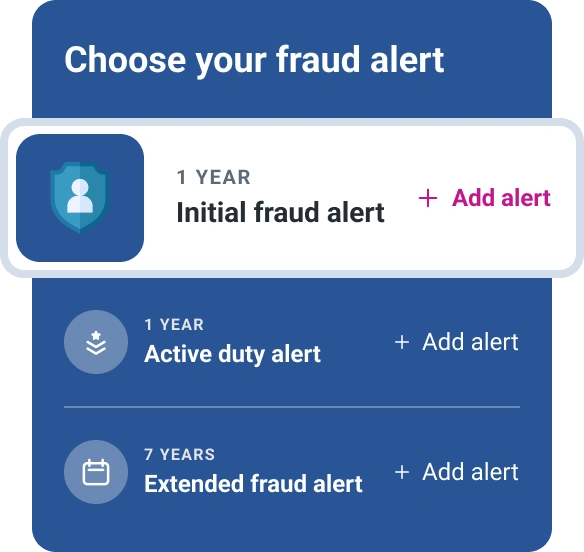

Credit locks and credit freezes (which are also called security freezes) are measures you can take to up your defenses against identity theft and fraud. Beyond the fact that they can help you protect against unauthorized credit applications, here’s a rundown on how credit freezes and credit locks compare:

- Purpose: Both a credit freeze and a credit lock restrict access to your credit reports, preventing new applications for credit in your name.

- Cost: You have the right under federal law to freeze your credit for free at any of the three major credit bureaus (Experian, TransUnion and Equifax). On the other hand, the cost to lock your credit varies and is a paid feature offered individually by the bureaus.

- Scope: Specific to the credit bureau where it’s applied. You must freeze/unfreeze your credit separately at each bureau. Likewise, you’ll need to turn on and off a credit lock through each of the bureaus you apply it through.

- Duration: A credit freeze is indefinite and remains and in place until you lift it. Likewise, your credit file remains locked until you unlock it (or cancel your premium membership).

Locking your credit file restricts access, but some people may still be able to view your report, including:

- You—you can check your credit report for free whenever you want through your Experian account

- Potential employers, if you consent to a credit check during the hiring process

- Insurance companies

- Your current creditors

- Collection agencies acting on behalf of lenders you owe money to

- Companies offering preapproved credit offers (but you can always opt out)

Locking your credit may prevent identity thieves from using your information to open new accounts, because it blocks unwanted inquiries that result in extensions of credit so that potential lenders are unable to process applications in your name. Also, Experian CreditLock notifies you if someone tries to access your credit file while it is locked, so you’ll be immediately alerted that your information may be compromised by a criminal attempting to use your data to commit credit fraud.

Locking your credit is a strong preventive move for those concerned identity theft and fraud. You should plan to use it alongside other security measures, including developing smart anti-fraud habits, safeguarding your personal information and taking advantage of dark web surveillance.

Here are some ways you can protect against identity theft and secure your credit:

- Don’t fall for phishing scams. Criminals use social engineering techniques to trick you into providing them with sensitive information, such as your credit card information or your Social Security number. To resist their attempts, learn about common scams and how to avoid getting phished.

- Set strong passwords. Create unique, strong passwords for each of your accounts. A password manager can help you keep track of your passwords. Also, consider signing up for multifactor authentication (MFA) to add an extra layer of security against hackers.

- Monitor your accounts. Regularly check your financial statements for any signs of fraud. Consider signing up for free credit monitoring through Experian to get alerts to activity on your credit report. If you notice any information you believe is fraudulent or incorrect, you have the right to file a dispute.

If your credit file is unlocked, it means that new creditors will be able to process applications for credit.

Unlocking your credit file is a good idea if you’re considering applying for a new credit card or loan soon. On the other hand, if you don’t plan to take out new credit in the near future, locking your credit file can prevent an identity thief from applying for credit in your name because potential lenders will be blocked from checking your credit.

If you cancel your premium membership while your credit is locked, your credit file will be unlocked at the end of the billing period. That’s because CreditLock is a feature of a premium account.

That said, there are options available through a free Experian account, too. You always have the right to freeze your credit for free, which blocks potential lenders from accessing your report as a proactive measure against fraud.

Learn more about protecting your credit