What Is Appearance Allowance Compensation?

Quick Answer

Appearance allowance compensation is a lower payout from your car insurance company that you’re meant to keep as payment for living with minor damage to your car. Consider rejecting this money if there’s a possibility that you can get higher compensation from your insurer for complete repairs or the value of the damage.

Appearance allowance compensation is a payout or deductible reduction from an auto insurance company that isn't meant to be used for repairs, but rather to pay the policyholder for living with minor damage. Depending on your state, these payments may be offered when a car is superficially damaged in a way that has no impact on the car's safety or drivability but would be expensive to repair.

Policyholders who can't pay the deductible on their insurance claim may benefit from appearance allowance compensation. But it is optional, and if you'd prefer your insurance company to pay for all the repairs noted in your insurance claim, you may refuse the compensation.

Here's what you need to know about appearance allowance compensation and whether it might be right for you if it's offered.

How Appearance Allowance Compensation Works

If your car has been damaged in an accident or by an unexpected event such as a tree falling, you can file an insurance claim and have an adjuster look over your car. Once their estimate of the damage is completed, you'll be given a list of suggested repairs and quoted a price that the insurance company is willing to pay for the repairs, minus your deductible.

In states where it's legal, your insurance company may offer an appearance allowance instead of or as part of the total claim. The appearance allowance is essentially compensation for living with minor damage that would be expensive for the insurance company to fix. It may be applied as a credit against your deductible or as part of your insurance payout.

What Are the Pros of Accepting Appearance Allowance Compensation?

The biggest pro of accepting an appearance allowance is that you may receive a discount off of your deductible. For folks who don't have the money to pay their full deductible immediately, this can be a big benefit.

Accepting an appearance allowance and forgoing minor repairs could also mean you'll get your car back from the shop faster, especially if there are expected delays in getting parts to fix any minor damage.

What Are the Cons of Accepting Appearance Allowance Compensation?

The major con of accepting an appearance allowance is not receiving the full cost to repair your vehicle.

Instead, you may want to pursue payment for the full cost of repairs. If your insurance company cuts you the check rather than sending it directly to the body shop, you can complete necessary repairs and not the cosmetic ones and keep the difference if you choose. Doing so may put more money in your pocket than the appearance allowance compensation alone would.

It's almost always advisable to have the insurance company either pay for the repairs directly or write you a check for the full repair (which you are legally permitted to pocket if you feel the damages are minor enough to live with). While it can be difficult to come up with a deductible, you'll get more value from your insurance if you take the full payout.

If you decide to live with the damage, your vehicle's value will likely decrease. Depending on the condition of your vehicle otherwise and whether you intend to sell it down the road, this may or may not be a huge consideration.

The Bottom Line

It's important to remember that the appearance allowance is typically offered to save the insurance company money. If you'd prefer to get full compensation for the damage, you can refuse an appearance allowance, pay your full deductible and use the insurance claim payout to repair your car.

If you feel pressure from your insurance provider to accept the appearance allowance when you'd prefer to have your car restored fully, it may be time to shop for new car insurance.

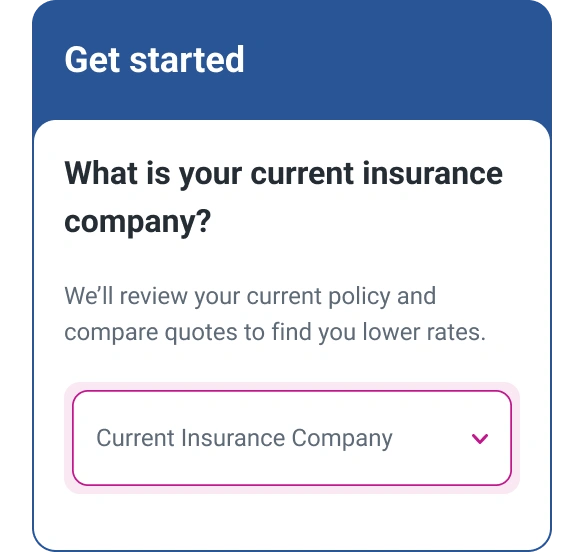

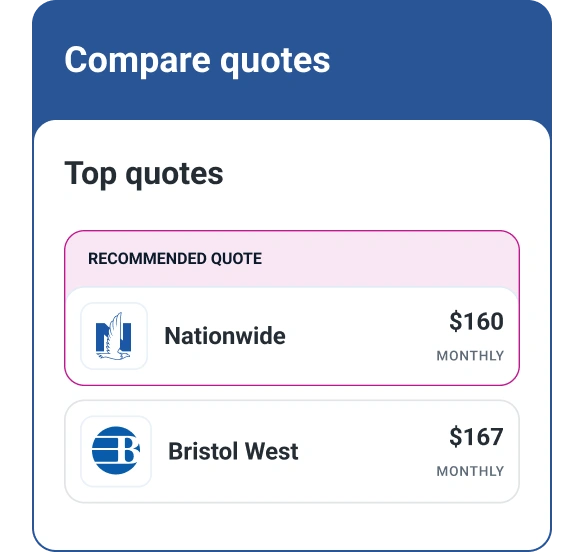

With Experian's auto insurance comparison tool, you can get quotes from up to 40 top insurance providers in minutes. Simply share some information about your current policy to get an apples-to-apples comparison and see which companies offer comparable or better rates.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Emily Cahill is a finance and lifestyle writer who is passionate about empowering people to make smart choices in their financial and personal lives. Her work has appeared on Entrepreneur, Good Morning America and The Block Island Times.

Read more from Emily