What Is a Certified Check?

Quick Answer

A certified check is a personal check that’s verified and guaranteed by your bank. Your bank or credit union will confirm your identity, make sure there's enough money in your account and then sign and stamp the check to mark that it's certified.

A certified check is a personal check that's been verified and guaranteed by your bank, which provides an extra layer of security for the recipient. For this reason, you may be required to pay with a certified check when you're making a large transaction.

Here's what to know about certified checks, what they're used for and how to get one when you need it.

What Is a Certified Check?

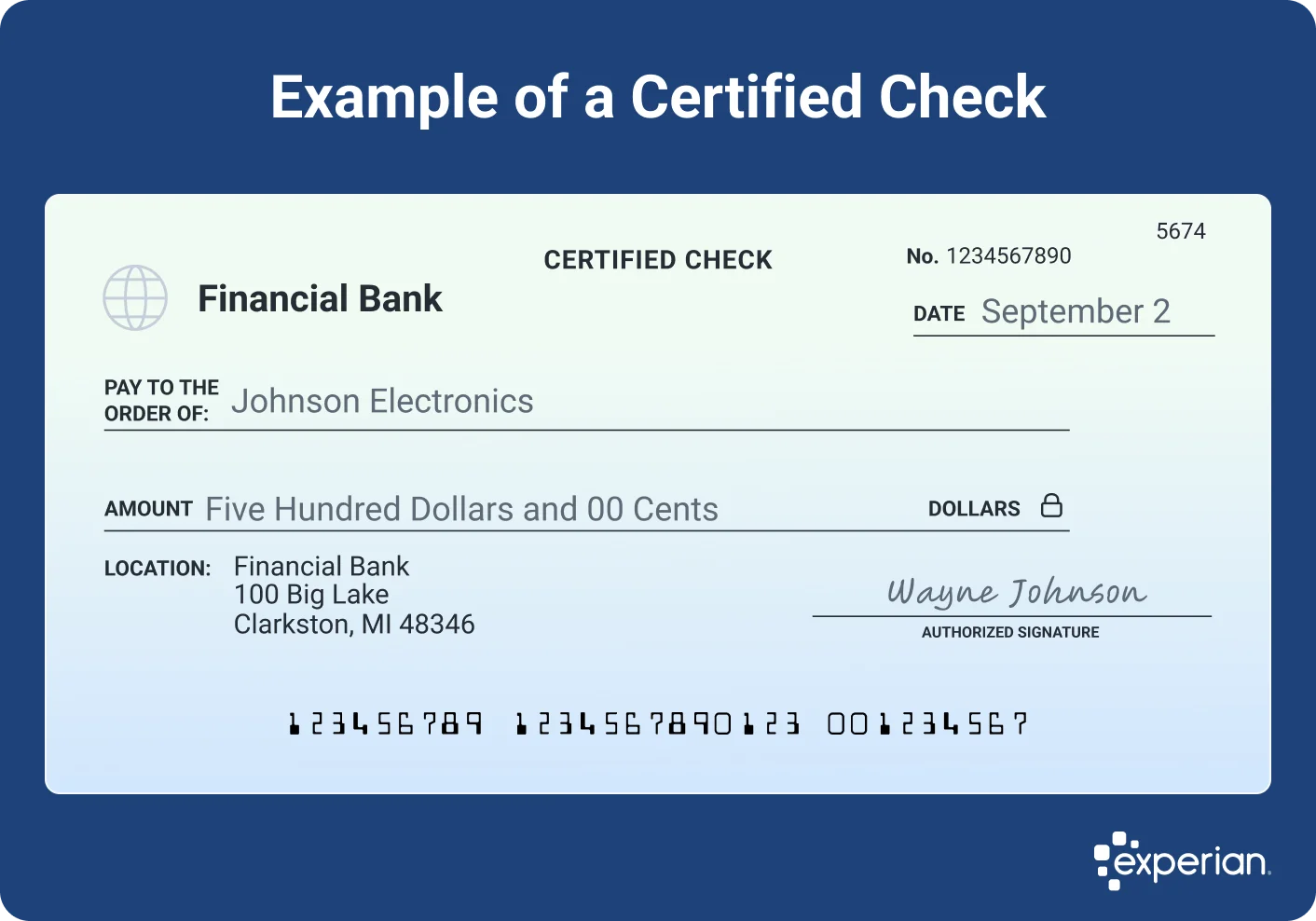

A certified check works like a personal check, in that the money gets withdrawn from your checking account when the recipient deposits it. What sets a certified check apart is that your bank or credit union will verify your identity, make sure there's enough money in your account and then sign and stamp the check to mark that it's certified. Your signature will also appear on the check, and you will be listed as the payer.

Certified checks are more secure than traditional personal checks. That's because the bank has confirmed that the check itself is valid, the signature belongs to the payer, the checking account is active and the account has enough funds in it for the check to clear.

Manage Your Finances

Compare checking accounts

Find a digital checking account with intro bonuses, low or no monthly fees and see current APY on checking.

Featured Account

ADDITIONAL FEATURES

- Build credit by paying bills like utilities, streaming services and rentø

- $50 bonus with direct deposit‡

- No monthly fees, no minimums‡

- Secure & FDIC insured up to $250,000§

- Zero liability for fraudulent purchases¶

- 55,000+ no-fee ATMs worldwide**

- Deposit cash at popular retailers#

- Live customer support 7 days a week

What Can a Certified Check Be Used For?

Certified checks are used in situations where the recipient needs assurance that funds are available—often when you're making large purchases—and that the check is legitimate. Uses for a certified check can include:

- Making a down payment on a car: When buying a car, the seller may ask you to use a certified check to confirm you have the money to pay or because they don't want to handle large amounts of cash.

- Real estate transactions: You may need a certified check for a security deposit when you move into a new apartment or when making a down payment on a house. For very large transactions, such as when paying closing costs during the final steps of buying a home, a cashier's check or wire transfer may be required.

- Making government payments: A certified check may be an acceptable form of payment at local or federal agencies if, for example, you must pay a parking ticket or a fine for a traffic violation. Paying with a check (or cash) can help you avoid service fees, which may be charged for using a credit card or prepaid card.

How Much Does a Certified Check Cost?

Certified checks typically cost between $3 and $10 each. Your bank or credit union may make them available for free to some or all customers, or it may provide a certain number of checks for free. The bank may also charge an extra fee to mail the check for you.

Tip: Some banks and credit unions don't offer certified checks at all. If that's the case with your bank, you'll need to use a cashier's check instead.

Certified Check vs. Cashier's Check

Certified checks and cashier's checks are both verified bank checks. Both give recipients a higher level of security compared with a traditional personal check.

The main difference between certified checks and cashier's checks is that with a cashier's check, you pay the bank or credit union upfront and the bank issues the check itself. That means the funds come directly from the bank. With a certified check, the funds come from your bank account.

Of the two, a cashier's check is safer because a financial institution backs it, so some payees may require a cashier's check rather than a certified check. Cashier's checks are also more widely available than certified checks.

You may see certified checks referred to as "official checks" in your bank's schedule of fees. But official checks could also refer to cashier's checks, depending on the bank's preferred terminology. Confirm your institution's offerings and charges directly with a representative to be sure.

Learn more: What Is a Cashier's Check and How Does It Work?

How to Get a Certified Check

To get a certified check, follow these steps:

- Check availability at your bank or credit union. First, make sure it's possible to get a certified check from the institution where you already have a checking account. If certified checks aren't available, you may need to get a cashier's check instead.

- Visit a bank branch. You can generally only get a certified check in person. Be sure to bring a government-issued ID or other form of identification accepted by your bank.

- Write the check and sign it. In the presence of the bank's representative, you'll make out a personal check to the recipient and sign it.

- Get the check signed and stamped. You'll then present your identification to the representative so they can verify it. They'll confirm your account has enough funds in it and freeze the funds so you can't spend that amount on something else. They'll stamp and sign the check.

- Pay the fee. If the bank or credit union charges for a certified check, you'll pay the amount and then take the check home to pay the recipient. Or you can ask the bank to mail it.

Tip: Some banks may waive certified check fees if you have a high relationship status.

Alternatives to Certified Checks

A certified check is just one of several ways to securely transfer money, and some of the alternatives may be better suited to certain situations.

- Money orders: A money order is a payment method for smaller transactions (up to $1,000) that you can pay for in cash at a post office, retailer or supermarket in addition to banks. You'll have to specify the recipient when you purchase the money order and pay a small fee in addition to the money order's amount. It could be a good alternative if you don't have a checking account or would otherwise have to pay high fees for a certified or cashier's check.

- Bank transfers: You may be able to directly transfer money from one bank account to another with an electronic transfer using the automated clearing house (ACH) network. A transfer can take place on the same day or take several days, and may be free or cost the person initiating the transfer up to 1% of the transfer amount.

- Wire transfers: A wire transfer is another option if you want to move money between two accounts. A wire transfer is often quicker than an electronic bank transfer, but there may be higher fees, especially for outgoing domestic or international transfers. Also, some banks charge fees to both send and receive wire transfers.

- Money-transfer apps: You could use a third-party peer-to-peer payment service, such as PayPal or Zelle, to make quick and secure transfers to friends or trusted companies, typically for free.

How to Avoid Check Fraud

Both cashier's checks and certified checks are a safe way to transfer funds. But scammers can also use their perceived security to commit check fraud.

For example, a criminal might give you a fraudulent certified check as payment for something you've sold on an online marketplace. They may overpay you, and ask you to return to them the extra amount—but you'll later find their check wasn't valid, and you've also lost the funds you sent back to them.

To avoid being the victim of a certified or cashier's check scam, take these steps:

- Don't accept payment for more than you've agreed to when selling an item online.

- Don't agree to make a refund for an overpaid amount by sending gift cards or prepaid cards or making a wire transfer.

- Don't take the bait when a buyer acts with excessive urgency and asks you to agree to terms that don't feel quite right.

- Avoid accepting a check as a payment method from someone you don't know.

- Only accept certified checks from local banks or credit unions that can quickly verify the legitimacy of the payment if you're unsure.

Learn more: The Latest Scams You Need to Be Aware Of

The Bottom Line

Certified checks can be a useful tool when you need to make or accept a verified form of payment. Since they're not as widely available as cashier's checks, you may end up choosing a cashier's check in many situations when you want to be sure a check will clear. The decision often comes down to the requirements of the transaction and what's most convenient, and accessible, for you.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna