Should I Use an Insurance Broker to Buy Car Insurance?

Auto insurance is an unavoidable cost that goes hand in hand with owning and driving a car. Premiums vary, but the national average annual expense was about $1,190 in 2018, according to the most recent data from the National Association of Insurance Commissioners.

Premiums can easily result in a costly monthly bill, but a qualified insurance broker could snag you a more reasonable rate that works for your budget. Let's dive into the pros and cons of using an insurance broker to help you find car insurance.

What Is an Auto Insurance Broker?

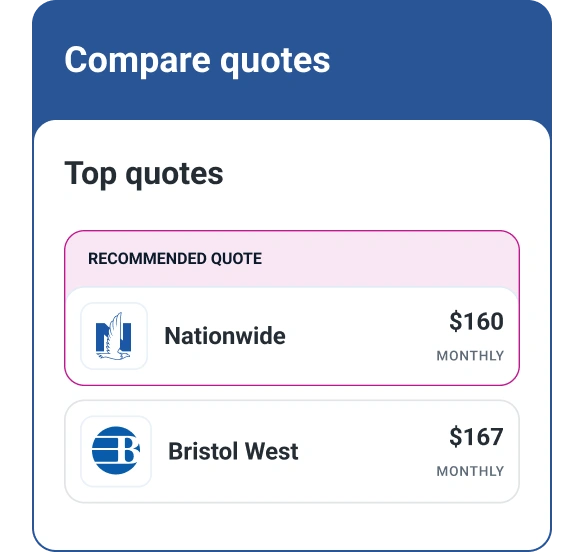

An auto insurance broker essentially acts as a buffer between you and the insurance companies. Brokers can approach insurance companies on your behalf to gather quotes, and compare rates and terms. Once they're done, they'll put their findings all together for you so you're able to make an informed decision. This simplifies the process and allows consumers to review side-by-side comparisons to find the best deal without doing a ton of work. Brokers can also offer expert advice that helps you better understand your policy options and coverage details.

Insurance brokers are not employed by insurance companies, though they may earn a commission from certain insurers if someone purchases a policy through them. That reward serves as motivation for brokers to find you a good policy that you'll stick with over the long haul.

Some brokers may also charge a fee for their services, but any fees should be disclosed upfront so that you'll know what to expect. Fees vary by state, but they're typically based on a percentage of the premium policy. Be sure to weigh your potential savings against any fees you may incur. This will help you determine if it's worth it.

How Do You Buy Insurance Through a Broker?

Once you decide to go through a broker, you'll want to research brokers in your area who are familiar with the ins and outs of auto insurance. To be clear, brokers are different from independent insurance agents. These kinds of insurance professionals represent insurance carriers, and their end game is to match consumers with one of these insurers. Brokers, on the other hand, aren't beholden to insurance companies. While they may receive commission from insurers, they work for the consumer and may cast a wider net when it comes to comparing quotes and policies.

If you decide that a car insurance broker is right for you, it's wise to verify their credentials before moving forward. You'll want to make sure they're properly licensed. (Your state's insurance department is a good place to start.) Reading up on customer reviews and checking the Better Business Bureau can be great resources as well. From there, clarify any fees that may apply if you decide if you think it's worth moving forward.

Pros and Cons of Using an Insurance Broker to Purchase Car Insurance

Like anything else, working with a car insurance broker has its pros and cons. Here are some important things to consider:

Pros

- Convenience: In terms of comparing policies and finding a new insurer, brokers can do much of the heavy lifting for you. In this way, they'll likely save you time and energy. They may also be able to find deals you wouldn't otherwise be privy to.

- Expertise: A skilled auto insurance broker can explain policy details and help you determine the right level of coverage to suit your needs. They can be a trusted source of information if you have questions about your coverage or want input when making a decision.

- Versatility: Unlike independent insurance agents, brokers do not represent insurers. They also provide a wider scope of service when compared to "captive agents," which are agents who work solely with one insurer. Generally speaking, captive agents won't help you shop around with other companies.

Cons

- Potential fees: You may incur fees when working with an insurance broker. The amount you're charged and your timetable for paying can vary from one broker to the next as well as the state you call home.

- The need to vet your broker: You'll want to be sure your broker is fully licensed and able to handle your needs. Ethically speaking, they're supposed to work in your best interest, but there's always a chance that a broker could steer you toward an insurer that offers a higher commission rate.

When Should You Consider Using an Insurance Broker?

Partnering with an insurance broker could be a good option for someone who doesn't have the time or desire to gather quotes from different insurers and compare policies. It can also make sense if you have more in-depth questions about your insurance needs and want a professional in your corner to explain the nitty-gritty details. An added bonus is that they can usually guide you in finding the right level of coverage for your needs. Those with more complex needs such as the desire to insure multiple cars or bundle their auto insurance with other insurance policies may also benefit from working with a broker.

How to Save Money on Car Insurance

Working with a broker is one way to potentially save money on your car insurance, but there are other things you can do on your own that might bring down your costs. This includes:

- Contacting your current auto insurer to see if there are ways to reduce your premium

- Increasing your deductible

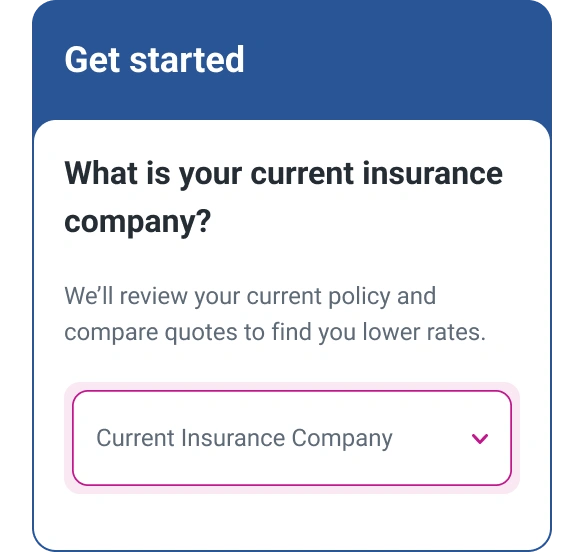

- Using a simple online search tool to compare auto insurance quotes yourself

- Trimming your policy so that you aren't saddled with coverage you don't need—this may be a good option if you have an older car that's already paid off

- Maintaining a solid driving record (many insurers offer safe driving discounts)

- Inquiring about other discounts, like those available to students, retirees and military service members

- Taking a defensive driving course, which could reduce your premium

The Bottom Line

Depending on your state, your credit-based insurance score is another factor that might influence your car insurance premium. Improving your credit score could, in turn, save you money on your premium. Experian provides free credit monitoring so you can better understand your credit health.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Marianne Hayes is a longtime freelance writer who's been covering personal finance for nearly a decade. She specializes in everything from debt management and budgeting to investing and saving. Marianne has written for CNBC, Redbook, Cosmopolitan, Good Housekeeping and more.

Read more from Marianne