How Your Credit Card Can Protect You When Traveling

Quick Answer

A credit card can provide travel insurance benefits such as auto rental collision damage waiver, baggage delay insurance, trip delay reimbursement and trip cancellation insurance to protect you when traveling.

Credit cards aren't just for purchases or earning rewards. Some credit cards offer travel insurance benefits that can protect you while you're away from home—benefits that may mean you can skip buying separate travel insurance. Be sure to read a card's terms and conditions so you understand what's covered and how to file a claim.

Here are six travel insurance benefits that your credit card might provide.

Auto Rental Collision Damage Waiver

A credit card's rental insurance can cover a damaged or stolen car, or can reimburse you for towing services and loss-of-use costs. This coverage can offer cost savings, as a rental car company's collision damage waiver might run anywhere from $25 to $41 a day or more.

If a credit card comes with insurance, it's typically secondary to your auto insurance policy. As a result, you'd need to file an initial claim with your auto insurance company and file a claim with your credit card issuer to cover expenses not paid by your insurer. This benefit might serve as primary coverage if you don't carry auto insurance.

Keep in mind that this travel credit card benefit might not include liability coverage. This coverage kicks in if someone sues you over injuries or property damage sustained in a crash.

Tip: Caps or restrictions on a card's rental insurance benefits might be in place depending on the card, type of car rented, length of the rental and travel destination. Check your card details to see what's covered.

Baggage Delay Insurance

You've traveled for hundreds or thousands of miles and reached your destination, only to discover your baggage has been delayed or is missing.

Baggage delay insurance can help cover the cost of buying replacement items if your baggage is delayed or lost. To get this benefit, your baggage might need to be delayed for at least a certain period of time, such as four hours.

Coverage limits vary from card to card and generally take effect when you're traveling by plane, train, bus or ship.

Trip Delay Reimbursement

Trip delay reimbursement benefits can cover expenses if a scheduled trip is delayed by a certain period of time (such as six hours or more) or if a delay causes you to unexpectedly spend the night somewhere. Covered costs may include meals, toiletries, medication and lodging.

A cautionary note: A card's trip delay benefits might impose per-trip or per-ticket limits, so they may not cover all your losses.

Trip Cancellation and Interruption Insurance

If a covered incident like illness, jury duty or bad weather causes cancellation or interruption of a trip, your credit card might reimburse nonrefundable costs like a nonrefundable ticket. It also can cover costs like transportation to get home.

Covered incidents differ among cards. The trip cancellation and interruption insurance benefit normally applies to trips booked with your credit card taken by you and eligible relatives.

Learn more: Travel Protection vs. Travel Insurance: What's the Difference?

Travel Accident Insurance

Travel accident insurance covers accident-related injuries and deaths. Death and dismemberment coverage kicks in if you or a covered relative dies or loses a limb or eye during a covered trip.

Roadside Dispatch

It's a motorist's nightmare: You're driving along a roadway when your battery dies. In this case, you may be able to turn to your credit card for help.

Depending on your card, roadside dispatch service can connect you to local providers to supply basic services—such as a jump-start, tire change or brief tow—for a certain price. Some cards even cover some or all of the costs of these services.

Learn more: Average Cost of Travel Insurance

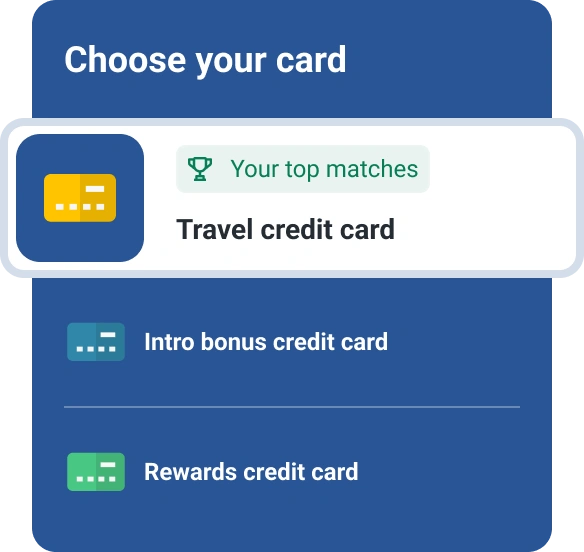

How to Choose the Best Travel Credit Card

If you're shopping for a travel credit card, go over each card's benefits to review which kinds of travel insurance are offered, along with the coverage's features and limits.

In addition:

- Check out a card's annual percentage rate (APR).

- See whether a card offers an introductory 0% APR.

- Find out whether a card charges an annual fee.

- Look for perks such as status in loyalty programs, cash back, points, miles or airport lounge access.

Tips for Using Your Credit Card Safely While Traveling

Here are eight tips for protecting your credit card while traveling.

- Notify your card issuer. Before you head out, alert the card's issuer about your travel plans. This can help stop legitimate charges from being flagged or declined. You usually can inform a card issuer about your travels by logging in to your card's online account or mobile app, or by calling the issuer.

- Set up transaction alerts. A real-time alert can help you detect unrecognized charges. When you do spot a suspicious transaction, contact your card issuer right away.

- Shield your card. You can help prevent your card data from being electronically stolen if you keep your cards in an RFID-blocking wallet or sleeve.

- Stash your card. If you're traveling with extra credit cards, store them in a hotel safe.

- Be careful with public Wi-Fi. Connecting to a public Wi-Fi network is usually safe thanks to sophisticated encryption. But to exercise caution, safeguard passwords for your credit card accounts and be on the lookout for online scams.

- Use a mobile wallet. Instead of carrying a plastic credit card with you, keep your card data in a mobile wallet. Be aware that this may limit the merchants where you're able to pay with your card, however.

- Don't show off your card. When you're in public, be discreet with your credit cards. Otherwise you might send a signal to a nearby thief that you're a pickpocketing target.

- Always take your credit card receipts with you. If you leave a credit card receipt at a restaurant or store, for example, a thief might be able to grab it and figure out how to withdraw cash or make purchases.

Learn more: When Are Travel Credit Cards Worth It?

Compare Travel Credit Cards

Just as you should always shop around for home or auto insurance, you should consider several options if you're in the market for a credit card, particularly if travel insurance benefits are a must-have. You can compare credit cards with Experian to get offers based on your unique credit profile.

Get the rewards you deserve

Cash back? Miles? Points? Whatever suits your goals, we can help match you to personalized rewards card offers. Start with your FICO® Score for free.

See your offersAbout the author

John Egan is a freelance writer, editor and content marketing strategist in Austin, Texas. His work has been published by outlets such as CreditCards.com, Bankrate, Credit Karma, LendingTree, PolicyGenius, HuffPost, National Real Estate Investor and Urban Land.

Read more from John