How to Write a Check: A Step-by-Step Guide

Quick Answer

Writing a check isn’t complicated. But you do need to follow certain instructions when you’re writing a check, such as how to fill out the check’s date and dollar amount.

Writing a check isn't difficult. But you need to follow the correct steps so nothing delays cashing or depositing the check. Here are the seven steps for writing a check:

- Write down the date.

- Put down the recipient's name.

- Fill in the dollar amount.

- Spell out the dollar amount.

- Complete the memo line (optional).

- Sign the check.

- Record the check in your checkbook register.

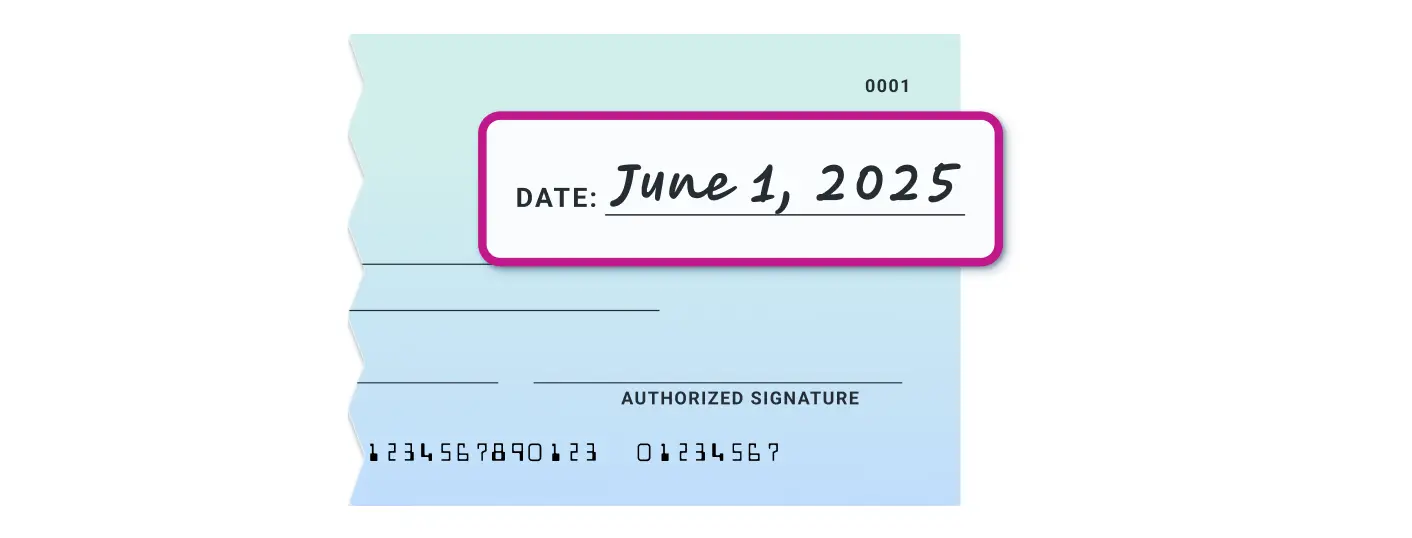

1. Write Down the Date

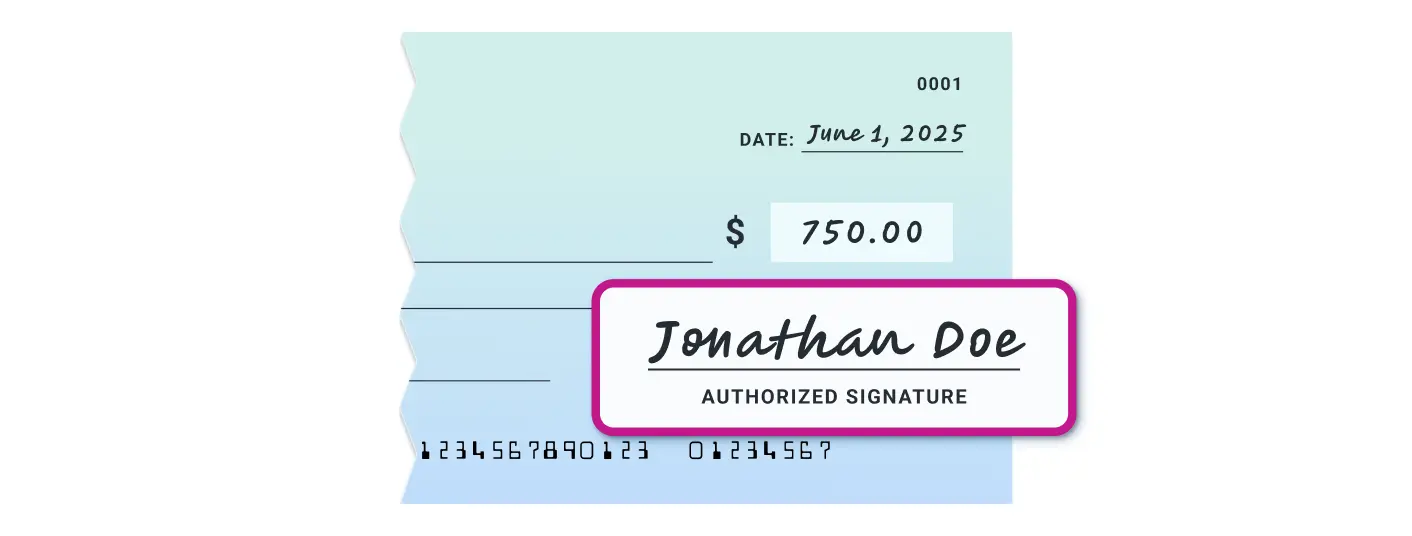

In the upper right-hand corner of the check, you'll see a line where you need to jot down the date. Write out the month, day and year. For example: June 1, 2025.

Tip: You can generally write a check with a future date, known as a postdated check. However, a financial institution might still process a postdated check before the date you've put on the check.

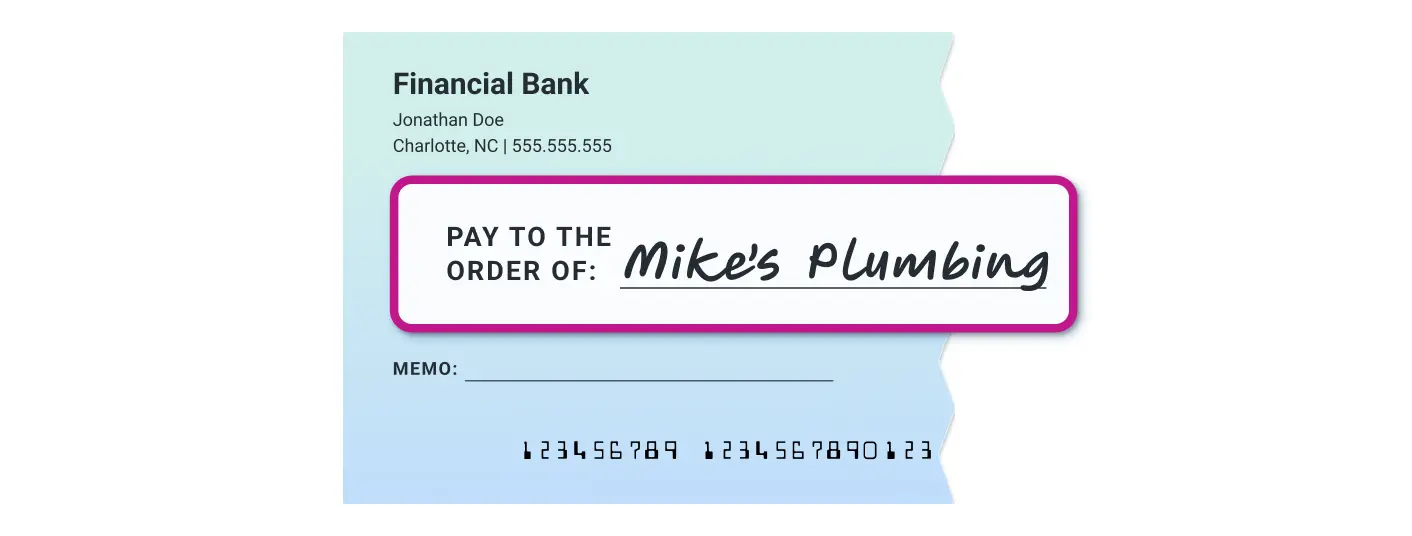

2. Put Down the Recipient's Name

On the left side below your address, you'll spot the words "Pay to the order of," followed by a line. On that line, you'll write the name of the organization or person you're making a payment to.

Example: If you're writing a check to your plumber, you'd fill in the company's name. So, if your plumber is Mike's Plumbing, you'd write that name on the "Pay to the order of" line.

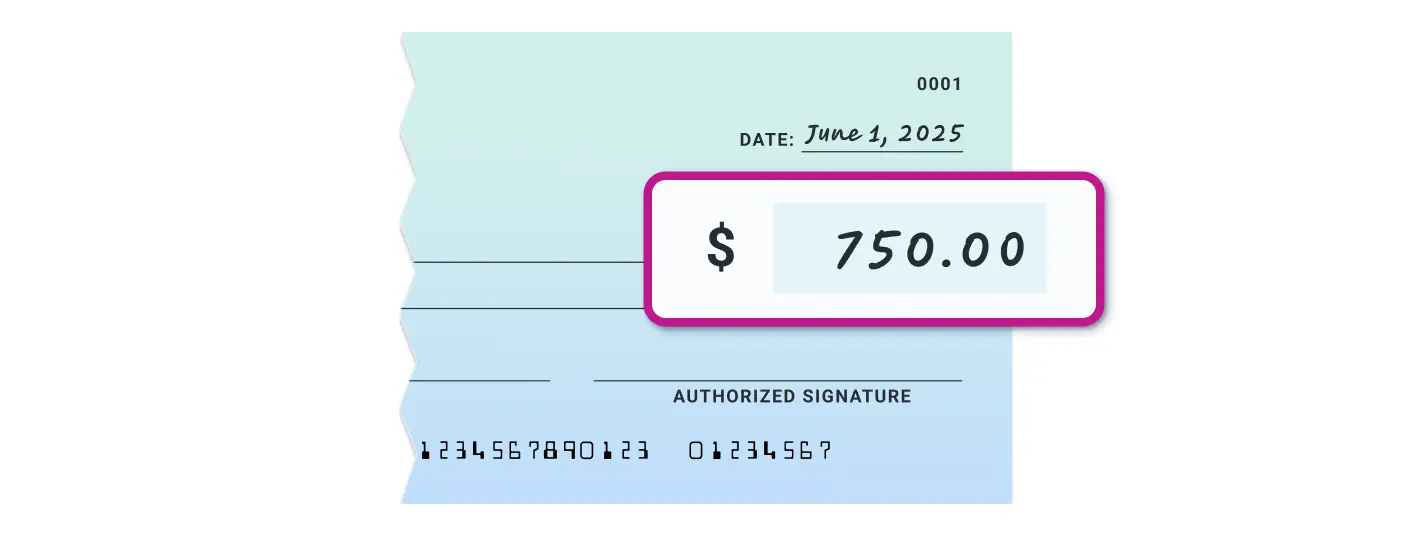

3. Fill in the Dollar Amount

To the right of the "Pay to the order of" line, you'll see a dollar sign and a box. In that box, you'll write the amount of the check in dollars and cents.

Example: If you're writing a check to Mike's Plumbing for $750, you'd put 750.00 in the box.

4. Spell Out the Dollar Amount

Once you've filled in the dollar amount in numerals, you'll need to spell out the dollar amount, noting the cents (if any) in numerals. You'll do this on the line below the "Pay to the order of" line.

Example: To make out a check for a $100.65 cellphone bill, you'd write: One hundred dollars and 65/100 cents.

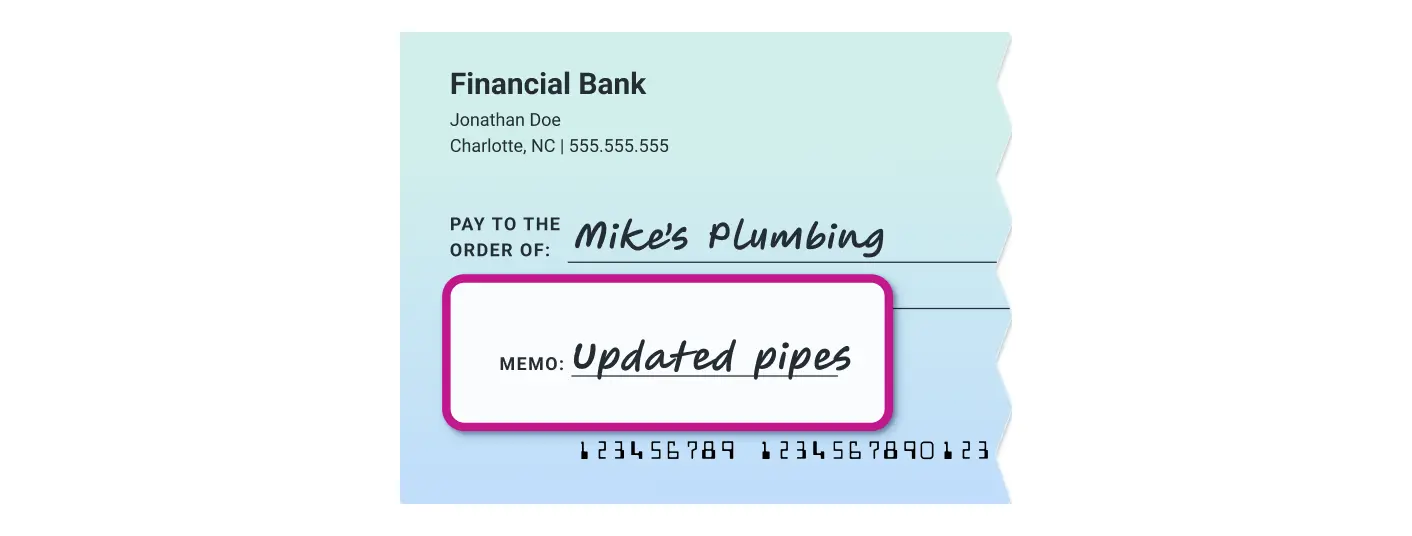

5. Complete the Memo Line (Optional)

It's optional, but you can fill out the memo line in the lower left-hand corner of the check to briefly describe what the check is for. This can be helpful if you're writing a check to a new payee or may not remember the business, person or purpose in the future.

Tip: If you're writing a check to Mike's Plumbing, you could put "drain clog" on the memo line.

6. Sign the Check

In the bottom right-hand corner of the check is a line where you'll sign your name. A bank or credit union typically won't deposit or cash a check that's not signed.

Tip: Sign your name the same way it appears on the check. If your name is printed as Jane J. Doe, for instance, your signature should match that name.

7. Record the Check

If you keep a checkbook register, write down the check in your register to keep track of this and other transactions. If you keep track of payments another way, such as with a spreadsheet, be sure to note it there.

Example: For the check written to Mike's Plumbing, you'll typically include the check number, the date you wrote it, the name of the recipient, the dollar amount of the check and your new account balance.

Manage Your Finances

Compare checking accounts

Find a digital checking account with intro bonuses, low or no monthly fees and see current APY on checking.

Featured Account

ADDITIONAL FEATURES

- Build credit by paying bills like utilities, streaming services and rentø

- $50 bonus with direct deposit‡

- No monthly fees, no minimums‡

- Secure & FDIC insured up to $250,000§

- Zero liability for fraudulent purchases¶

- 55,000+ no-fee ATMs worldwide**

- Deposit cash at popular retailers#

- Live customer support 7 days a week

How to Keep Your Checks Secure

Here are six tips for keeping your checks secure:

- Store your checks in a safe place. Putting your checks in a secure place like a locked drawer, rather than leaving them out in the open, reduces the likelihood that a thief can grab your checks.

- Shred old checks. If you need to get rid of old checks, don't throw them in the trash. Instead, shred them to help keep a fraudster from getting their hands on your name, account number and other sensitive information.

- Look for security features. For instance, see if you can order checks that include embedded holograms. Holograms are hard for counterfeiters to duplicate.

- See if your financial institution offers a bill pay service. You may be able to have the bank or credit union send a printed check on your behalf rather than writing a check on your own. This might help prevent check fraud.

- Consider the ink. When writing a check, try to use a black gel pen. The ink in this type of pen is tough to remove, which can help if a fraudster tries to "wash" your check.

- Be careful when mailing a check. When sending a check by mail, go to a post office rather than sending the check from a curbside or residential mailbox.

Learn more: How to Void a Check

Frequently Asked Questions

The Bottom Line

Although the use of checks continues to decline, you may find that you need to write a check if that's the recipient's preferred (or only) payment method. Writing a check isn't difficult. But you do need to follow the proper steps to ensure your check can be deposited or cashed without any issue.

If you're thinking about opening a new checking account, the Experian Smart Money™ Digital Checking Account & Debit Card can help you build credit without debt by automatically linking to Experian Boost®ø, which gives you credit for eligible bill payments after three months of payments. You'll also pay no monthly fees¶ for Experian Smart Money, have access to more than 55,000 fee-free ATMs worldwide** and could receive your paychecks up to two days early when you enroll in direct deposit†. You can get an Experian Smart Money Account through a free or paid Experian membership, which also gives you access to your FICO® ScoreΘ, Experian credit report and more. See terms at experian.com/legal.

Earn more with a high-yield savings account

Make your money work harder with a high-yield savings account—earn higher returns with easy access to your funds.

Compare accountsAbout the author

John Egan is a freelance writer, editor and content marketing strategist in Austin, Texas. His work has been published by outlets such as CreditCards.com, Bankrate, Credit Karma, LendingTree, PolicyGenius, HuffPost, National Real Estate Investor and Urban Land.

Read more from John