How to Endorse a Check

Quick Answer

Endorsing a check often just requires a simple signature on the back of the check before you cash or deposit it. You can use different types of endorsements for security and flexibility depending on your needs.

Endorsing a check is a key step in either cashing a check or depositing it into your bank account. To endorse a check, you'll sign your name in the endorsement area on the back of the check in black or blue ink. You can add information or instructions to make your check more secure.

Here, we walk through the steps of endorsing a check, different types of endorsements and the right time to endorse your check.

What Does It Mean to Endorse a Check?

Endorsing a check means signing your name on the back to authorize your bank to process it. Your signature is confirmation that you're the right recipient and that you approve the transaction.

Once you endorse and submit the check, your bank will verify the check's validity and confirm the payer has sufficient funds to cover the check. After that, your bank presents the check to the issuing bank, which then transfers the money into your bank account.

Manage Your Finances

Compare checking accounts

Find a digital checking account with intro bonuses, low or no monthly fees and see current APY on checking.

Featured Account

ADDITIONAL FEATURES

- Build credit by paying bills like utilities, streaming services and rentø

- $50 bonus with direct deposit‡

- No monthly fees, no minimums‡

- Secure & FDIC insured up to $250,000§

- Zero liability for fraudulent purchases¶

- 55,000+ no-fee ATMs worldwide**

- Deposit cash at popular retailers#

- Live customer support 7 days a week

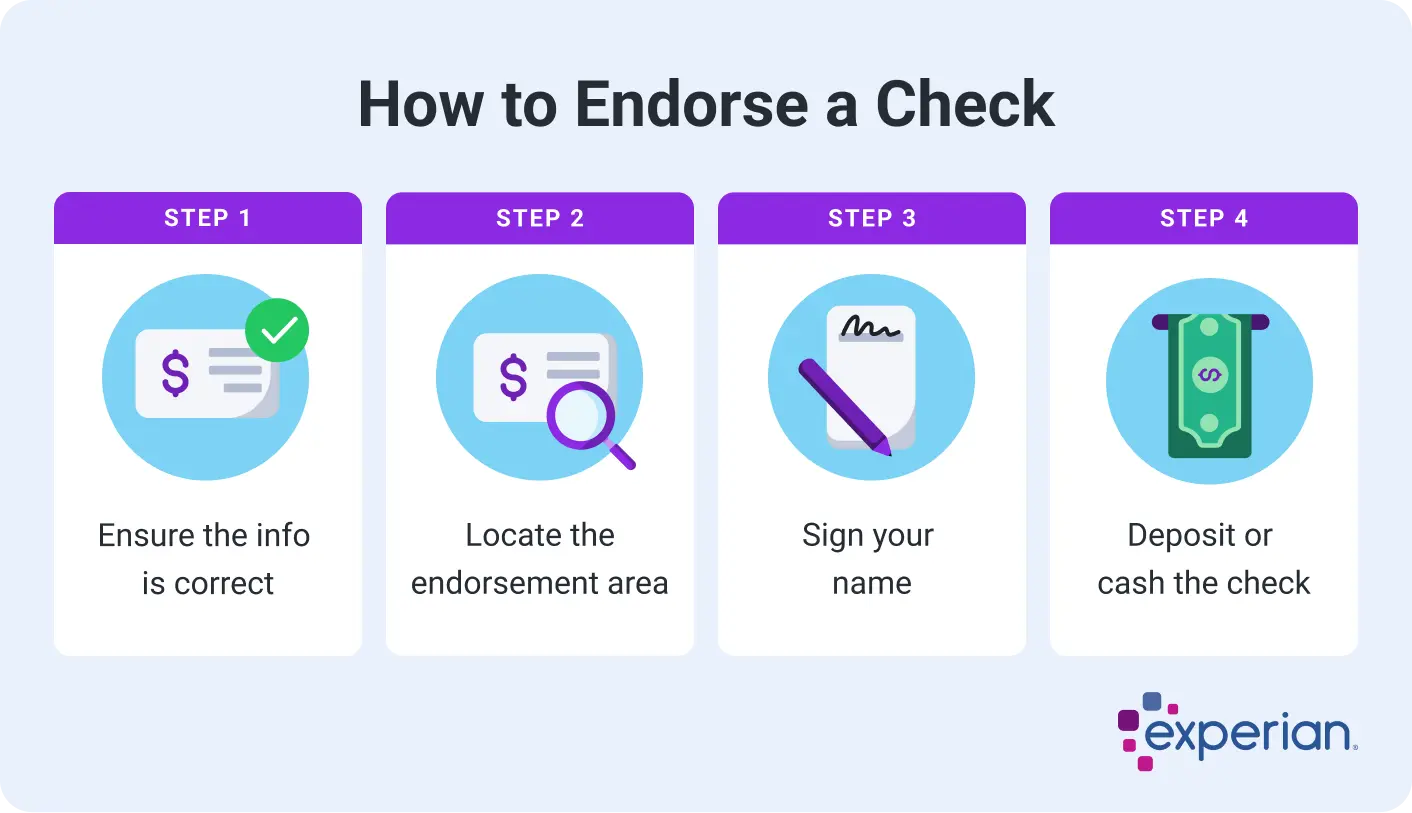

How to Endorse a Check

Endorsing a check is a simple process, but it's important to follow the correct steps to avoid errors or delays. Here's how:

1. Make Sure the Information Is Correct

Before endorsing the check, review all the details on the front.

- Payee name: Make sure your name is spelled correctly and matches your ID or bank account.

- Date and amount: Confirm the check is dated and that the written and numerical amounts match.

- Signature: Make sure the payer has signed the check. If anything is incorrect or missing, ask the payer to issue a corrected check.

Tip: If the written and numerical amounts differ on the check you're endorsing, the bank will use the spelled out amount.

2. Locate the Endorsement Area

Flip the check over to the back. At the top, you'll see a box labeled "Endorse here." This is the section where you should sign your name. Just below that is a section marked "Do not write, stamp or sign below this line." This area must be left blank.

3. Sign Your Name

Sign your name in black or dark blue ink within the endorsement area. Be sure to use the same name that appears on the front of the check.

If the check is made out to two people, look at how the names are listed:

- "John and Jane Doe": In this case, both people must sign.

- "John or Jane Doe": In this case, just one signature is required.

4. Deposit or Cash the Check

After signing, you can deposit or cash the check using:

- Your bank's mobile app

- An ATM that accepts deposits

- A teller at your local branch

Learn more: How to Cash a Check

Types of Check Endorsements

There are several types of check endorsements depending on how you plan to use or deposit the check.

| Purpose | What to Write | |

|---|---|---|

| Blank endorsement | Allows you to cash or deposit a check | Your name |

| Restrictive endorsement | Limits how a check can be used | "For deposit only to the account of [your name]," then your signature |

| Special endorsement | Transfers ownership to someone else | "Pay to the order of [new payee's name]," then your signature |

| Mobile endorsement | Allows endorsement on checks deposited on a mobile device | "For mobile deposit only at [bank name]," then your signature |

Blank Endorsement

This is the simplest type of endorsement. You just sign your name. While this is a quick, easy way to cash or deposit your check in person, there's a risk that anyone can cash the check if it's lost. Avoid endorsing until you're ready to deposit.

Restrictive Endorsement

This is a more secure form of endorsement that adds instructions to limit how the check can be used.

Write "For deposit only to the account of [your name]" and sign below. Use this type of endorsement when you're depositing the check via mobile or ATM. This prevents the check from being cashed by someone else.

Special Endorsement

Use this type of endorsement to transfer ownership to someone else. Write "Pay to the order of [new payee's name]" followed by your signature. Not all banks accept third-party checks, so have the new payee check with their bank in advance.

Learn more: Can You Deposit Someone Else's Check in Your Account?

Mobile Endorsement

If you're using mobile check deposit, you can write "For mobile deposit only at [bank name]" at the top of the endorsement area, then sign below. Review your bank's mobile deposit instructions to verify whether additional information or instructions are needed. For instance, your bank may require your account number.

When to Endorse a Check

The best time to endorse a check is right before you deposit or cash it. Signing it too early increases the risk of someone else using it if it's lost or stolen.

You'll need to endorse a check when you're:

- Cashing the check in person or at an ATM

- Depositing the check into a personal or joint account

- Signing the check over to someone else as a third-party payment

The right time to endorse can depend on how you're handling the check:

- In person: Endorse while you're in line or just before handing it to the teller.

- ATM: Sign right before inserting the check into the machine.

- Mobile deposit: Endorse after launching the banking app and selecting the mobile deposit option.

- Transferring to someone else: Only endorse when you're with the other person and ready to hand over the check.

The Bottom Line

Endorsing a check is a key step to making sure you receive your funds safely and without delays. Choosing the right type of endorsement adds another layer of security or gives your bank specific instructions. By endorsing your check correctly, you can help protect your money, streamline the deposit process and avoid potential issues.

If you're thinking about opening a new checking account, the Experian Smart Money™ Digital Checking Account & Debit Card can help you build credit without debt by automatically linking to Experian Boost®ø, which gives you credit for eligible bill payments after three months of payments. You'll also pay no monthly fees¶ for Experian Smart Money, have access to more than 55,000 fee-free ATMs worldwide** and could receive your paychecks up to two days early when you enroll in direct deposit†. You can get an Experian Smart Money Account through a free or paid Experian membership, which also gives you access to your FICO® ScoreΘ, Experian credit report and more. See terms at experian.com/legal.

Earn more with a high-yield savings account

Make your money work harder with a high-yield savings account—earn higher returns with easy access to your funds.

Compare accountsAbout the author

LaToya Irby is a personal finance writer who works with consumer media outlets to help people navigate their money and credit. She’s been published and quoted extensively in USA Today, U.S. News and World Report, myFICO, Investopedia, The Balance and more.

Read more from LaToya