Follow This Checklist Before You Apply for Credit

Quick Answer

Before you apply for credit, use this checklist to cover all your key bases, such as checking your credit score, reviewing your report, evaluating what type of credit you need and comparing offers before you apply.

Applying for credit like an auto loan, mortgage or credit card can be nerve-racking. After all, you don't know until the process is over whether your application is approved or not. But there are ways to feel like you're more in control. Your application is only as good as the work you put into it, and you can make moves to set yourself up for success.

Before you submit an application for any credit product, review this checklist to help ensure you stand a better chance of your application being approved.

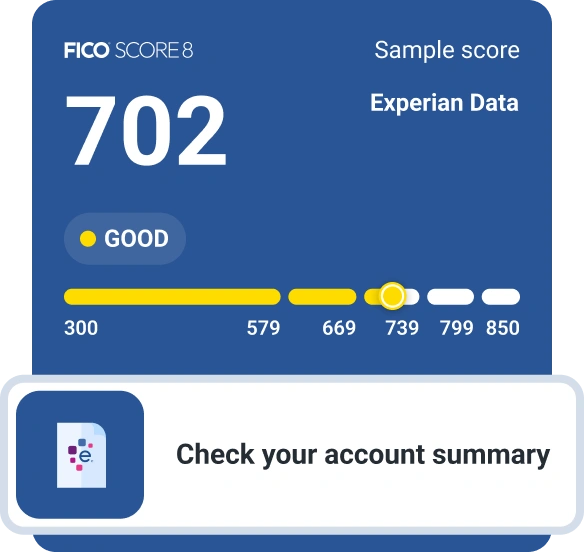

1. Check Your Credit Score

Checking your credit score gives you a good idea of the shape your credit is in as you prepare to apply for a credit product.

You can check your credit score for free on a number of websites. For instance, you can obtain your FICO® ScoreΘ for free through Experian for free through Experian. Many credit card issuers and lenders also give you free access to your credit score. In addition, a nonprofit credit counseling agency frequently can pull your credit score at no cost to you.

While there are many credit scoring models, which means you have many credit scores, they all tend to use similar factors to calculate your scores. The score freely available to you can be a reliable indicator of your creditworthiness even if it isn't the same score your lender will use.

Checking your own credit score won't affect your score, either. By checking your credit score before submitting a credit application, you can potentially spot—and then fix—any issues that might hurt your ability to obtain a credit card, loan or other lending product. If you check your credit score far enough in advance (three to six months is usually wise), it might give you time to lift your score and gain access to better lending terms, such as a lower interest rate.

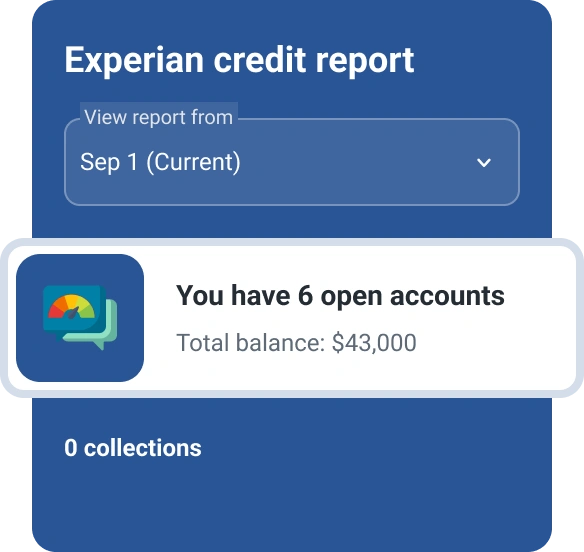

2. Review Your Credit Report

In addition to checking your credit score, you should review the information contained in your credit report. Each of the three major credit bureaus (Experian, TransUnion and Equifax) maintains one credit report per consumer. You can get a free credit report from each of the three bureaus at AnnualCreditReport.com.

If you see something out of the ordinary on your credit report, such as a late payment you believe shouldn't be there, you can file a dispute with the credit bureau on whose report the information appears. The bureau will then check with the company that reported the information to verify it. If it can't be verified, the disputed information could be removed from your credit report or updated so it's accurate. Having negative information removed from your credit report might lead to a rise in your credit score.

3. Decide What Type of Credit You Need

After you've squared away any issues with your credit score and credit report, give some serious thought to the type of credit you need. There are two major types of credit: revolving credit and installment credit. For both types of credit, you'll typically pay interest on the money you borrow.

Revolving Credit

Revolving credit refers to a credit product, such as a credit card, that sets a maximum limit for the amount of money you can spend. Revolving credit includes:

Credit limits for these products vary, but you might get approved for a credit card with a $3,000 limit, a personal line of credit with a $10,000 limit or a HELOC with a $100,000 limit.

With revolving credit, you can borrow and pay off the balance in full each month or you can carry over, or revolve, the balance from one month to the next. Revolving credit can be useful for both day-to-day spending (such as groceries) and major one-time expenses (such as car repairs). If you go with a rewards credit card, you'll accumulate cash back, points or miles that you can put toward other spending.

Installment Credit

Installment credit products are loans that let you make fixed payments over a set time period. For instance, you might be required to pay $350 a month on a 36-month loan; once the 36-month period ends, the loan should be completely paid off.

Types of installment loans include:

Unlike revolving credit, installment credit doesn't allow you to carry a balance from one month to the next. In many cases, installment loans are used to make a major purchase, such as a car or a house.

4. Shop Around for Offers

Whether you're looking for a credit card, loan or mortgage, it's wise to shop around for the best terms, such as low interest rates and low fees. In other words, you might not want to settle on the first lending product that you come across.

Typically, credit checks associated with credit applications result in what's known as a hard inquiry on your credit report, which can temporarily affect your scores. When shopping for the best rate on a loan, these inquiries are combined into one if your applications are submitted over the period of several weeks. This means you can shop around without a big effect on your credit. Unfortunately, this same luxury doesn't apply to credit cards, so it's important you weigh your options carefully before submitting an application.

Whether you're looking for a credit card or personal loan, consider using Experian's card comparison tool in your search for the option that best fits your needs.

5. Review Terms and Finalize Your Decision

Whether you're applying for a credit card, mortgage or other lending product, you should carefully review the terms before turning in your application. Information you should nail down includes:

- Interest rate: You'll typically see this shown as the annual percentage rate, or APR. For example, a credit card might come with an APR of more than 16%, while a personal loan might charge an APR of close to 10%.

- Credit limit: This will be important if you're considering a credit card or other revolving credit account. What is the maximum amount of money you'll be able to borrow?

- Fees: What fees will you pay? For instance, will a credit card hit you with an annual fee?

- Payments: How much will you have to pay every month for an installment loan, such as a mortgage? How much will the minimum required payment be for a revolving credit product, like a credit card?

- Rewards: For any credit card you're considering, be sure to figure out what types of rewards you can earn, such as an intro bonus, cash back, points or miles.

Once you've gone over the terms, it's time to submit your application. In some cases, a lender might make a decision about your application within just a few minutes. In other cases, a decision might not come for days or even weeks.

The Bottom Line

To put yourself in the best position to be approved for credit, be sure to check your credit score and credit report before submitting an application. If you find that your credit score needs some work, consider signing up for Experian Boost®ø. This free service could instantly lift your score by giving you credit for payment of bills for your phone, utilities and streaming services.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

John Egan is a freelance writer, editor and content marketing strategist in Austin, Texas. His work has been published by outlets such as CreditCards.com, Bankrate, Credit Karma, LendingTree, PolicyGenius, HuffPost, National Real Estate Investor and Urban Land.

Read more from John