What Is the Average Credit Score in the US?

Quick Answer

Going into 2025, the average credit score was 715, remaining unchanged from 2023.

For U.S. states, average scores range from a high in Minnesota of 742 to a low of 680 in Mississippi.

Younger generations have average scores in the good credit score range (670 to 739), while older generations have average scores in the very good range (740 to 799).

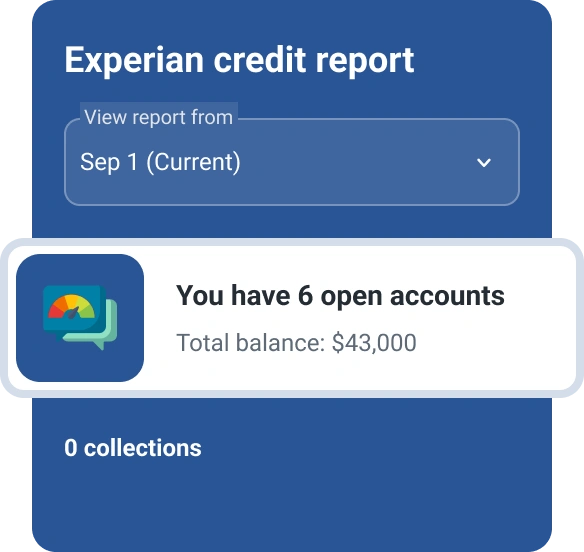

The average credit score was 715 in 2024, according to Experian data. That average, as of September 2024, is unchanged from the same month in 2023. For 11 straight years, the average FICO® ScoreΘ in the United States hasn't decreased on an annual basis. The resilience of the U.S. consumer evident here has arguably been assisted by increased awareness of financial matters, including the power of their credit score.

Consumer credit score highlights include:

- Nearly three-quarters of consumers (71.2%) have a good or better credit score (670 or higher). Good credit is the first step to being reliably approved for loans and credit cards. Although better scores can mean better rates, financial factors outside a consumer's credit score could still limit their options.

- Broadly speaking, average credit scores changed little in most parts of the country. While some smaller states saw a slight uptick in their average credit score, the most populous states saw either no movement or a slight decline.

- Credit card balance increased slowly as average credit card interest rates climbed to a new high. Consumers reduced the financial pressure of added debt and interest in several ways. Many decreased or eliminated additional credit card spending, and borrowers also sought refinancing options such as debt consolidation loans or 0% intro APR balance transfer cards.

In this recap, we'll look at what drove credit scores up, down and sideways in 2024.

Average Credit Score in the U.S. Remains 715

Nationwide, Experian noted no change in the average FICO® Score, which held steady at 715 through the 12 months ending September 2024.

Although credit scores remained stable, that doesn't mean the economic conditions surrounding consumer credit scores were status quo. Monetary policy that was tight for most of 2024 began to loosen with the Federal Reserve deciding to lower the federal funds interest rate by a total of 1 percentage point with three cuts made in October, November and December 2024.

Other economic factors, such as low unemployment rates and subdued inflation, were also largely working in consumers' favor as of late 2024. As price hikes slowed, stopped or reversed, expenses were generally stabilizing for working consumers who likely still have the income to both spend and service debts they currently have.

Average Credit Scores by State

Average FICO® Scores in most states remained unchanged or only moved by one point in either direction in 2024.

Average FICO® Score by State

| State | 2023 | 2024 | Change (Points) |

|---|---|---|---|

| Alabama | 692 | 692 | 0 |

| Alaska | 722 | 722 | 0 |

| Arizona | 713 | 712 | -1 |

| Arkansas | 696 | 695 | -1 |

| California | 722 | 722 | 0 |

| Colorado | 731 | 731 | 0 |

| Connecticut | 726 | 726 | 0 |

| Delaware | 715 | 714 | -1 |

| District of Columbia | 715 | 715 | 0 |

| Florida | 708 | 707 | -1 |

| Georgia | 695 | 695 | 0 |

| Hawaii | 732 | 732 | 0 |

| Idaho | 729 | 730 | +1 |

| Illinois | 720 | 720 | 0 |

| Indiana | 713 | 712 | -1 |

| Iowa | 730 | 730 | 0 |

| Kansas | 723 | 722 | -1 |

| Kentucky | 705 | 705 | 0 |

| Louisiana | 690 | 690 | 0 |

| Maine | 731 | 731 | 0 |

| Maryland | 716 | 715 | -1 |

| Massachusetts | 732 | 732 | 0 |

| Michigan | 719 | 719 | 0 |

| Minnesota | 742 | 742 | 0 |

| Mississippi | 680 | 680 | 0 |

| Missouri | 714 | 714 | 0 |

| Montana | 732 | 732 | 0 |

| Nebraska | 731 | 731 | 0 |

| Nevada | 702 | 701 | -1 |

| New Hampshire | 736 | 736 | 0 |

| New Jersey | 725 | 724 | -1 |

| New Mexico | 702 | 702 | 0 |

| New York | 721 | 721 | 0 |

| North Carolina | 709 | 709 | 0 |

| North Dakota | 733 | 733 | 0 |

| Ohio | 716 | 716 | 0 |

| Oklahoma | 696 | 696 | 0 |

| Oregon | 732 | 732 | 0 |

| Pennsylvania | 723 | 722 | -1 |

| Rhode Island | 722 | 721 | -1 |

| South Carolina | 699 | 700 | +1 |

| South Dakota | 734 | 734 | 0 |

| Tennessee | 705 | 706 | +1 |

| Texas | 695 | 695 | 0 |

| Utah | 731 | 730 | -1 |

| Vermont | 737 | 737 | 0 |

| Virginia | 722 | 723 | +1 |

| Washington | 735 | 735 | 0 |

| West Virginia | 703 | 702 | -1 |

| Wisconsin | 737 | 738 | +1 |

| Wyoming | 724 | 725 | +1 |

Source: Experian data from September of each year

In the short term, there's very little to interpret from individual state changes. If there is a trend to note, it's that the leveling off of average credit scores is quite evenly distributed across the nation. While average scores can range from as high as 742 in Minnesota to a low of 680 in Mississippi, there's been little movement in either state—suggesting that consumer credit conditions at the state and regional levels are similarly as stable as national trends.

Since 2019, average credit scores have improved in all 50 states and Washington, D.C. States showing improvement in average FICO® Scores, including Idaho, Maine and South Carolina, are all states that have received an influx of new residents from other parts of the country. Gains in Northern Plains and Midwestern states were more modest; however, many of these states already had robust average credit scores, leaving them little room for further improvement.

Change in Average FICO® Scores From 2019 to 2024

Average Credit Scores by Age

Most generations increased their average FICO® Score by a single point in 2024, although Generation X, currently carrying more debt than other generations, remained at its 2023 average score. (The Silent Generation, born prior to 1946, has been at a healthy average of 760 for four consecutive years.)

| Generation (Age) | 2023 | 2024 |

|---|---|---|

| Generation Z (18-27) | 680 | 681 |

| Millennials (28-43) | 690 | 691 |

| Generation X (44-59) | 709 | 709 |

| Baby boomers (60-78) | 745 | 746 |

| Silent Generation (79+) | 760 | 760 |

Source: Experian data from September of each year; ages as of 2024

Despite slowing and stalling averages, all younger generations sport average scores in the good credit score range of 670 to 739. Older generations have, on average, very good scores in the 740 to 799 range. Either range of scores generally qualifies consumers for offers of credit, although those with very good scores may receive better terms. Nonetheless, credit scores are not the only factor lenders use to determine whether to extend credit.

Distribution of Consumer Credit Scores by Score Range

FICO® Scores are composed of five score ranges. The vast majority of consumers—71%—have good or better credit scores, according to Experian data.

| FICO® Score Range | 2023 | 2024 |

|---|---|---|

| Poor (300 - 579) | 12.6% | 13.2% |

| Fair (580 - 669) | 15.8% | 15.5% |

| Good (670 - 739) | 21.6% | 21.0% |

| Very good (740 - 799) | 28.1% | 27.8% |

| Exceptional (800 - 850) | 21.9% | 22.5% |

Source: Experian data from September of each year

A credit score is one ingredient that's considered when a credit card application is submitted, although card issuers will likely also consider the applicant's outstanding debt and income before deciding how much credit they're willing to extend. Credit scores in the good range may open doors for obtaining low credit card APRs and also most other types of consumer loans, such as auto loans, mortgages and personal loans.

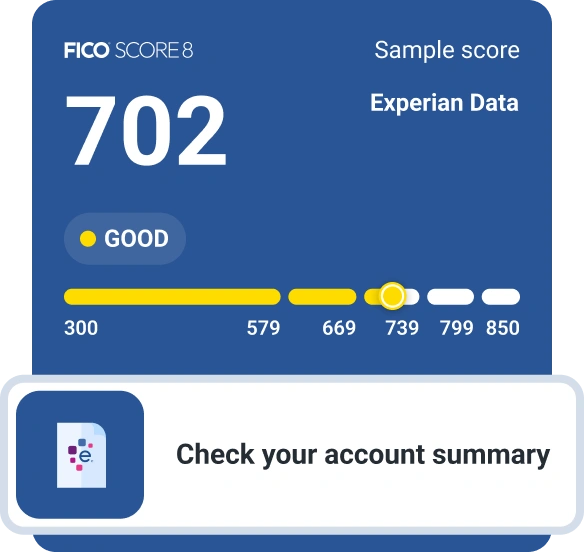

What Are the FICO® Score Ranges?

The base FICO® Score 8, the score most widely used by lenders, ranges from 300 to 850.

| Range | Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very good |

| 800-850 | Exceptional |

Key FICO® Score Factors

There are five factors that build a consumer's credit score:

- Payment history (35%): This is the most influential part of your FICO® Score. Regularly making payments on time is key to building good credit, while even a single late payment can do serious damage.

- Amounts owed (30%): This looks at how much credit you're using in both installment loans and revolving accounts like credit cards. High revolving account balances relative to your credit limits—anything above 30% of the total credit available—can drag your score down.

- Length of credit history (15%): Credit scoring models consider how long your credit accounts have been active—especially the oldest, the newest and the average age of your accounts. Generally, the longer your credit history, the better for your score.

- Credit mix (10%): This reflects the variety of credit types under your name, such as credit cards, auto loans and mortgages. Successfully managing different forms of credit can have a positive effect on credit score calculations.

- New credit (10%): Applying for credit typically results in a hard inquiry that can temporarily lower your score by a few points.

Average Credit Card Usage

One factor that impacts a consumer's credit score is how much credit they're effectively using, particularly when it comes to their credit card utilization. Credit cards have limits, of course, and using a small portion of the amount of credit extended can potentially have a positive effect on credit scores. Many savvy consumers now know this and are mindful about keeping balances low.

| Average Credit Card Utilization Ratio | |

|---|---|

| 2023 | 29% |

| 2024 | 29% |

Source: Experian data from September of each year

As for credit usage data, put another check in the sideways column. Although credit card balances increased slightly in 2024, credit limits were increased proportionally, which left credit utilization levels steady at 29%.

Credit utilization above 30% is the point at which it can begin to have greater negative effects on credit scores, which could impact not only future credit card offers but also mortgages, auto loans and other loan products. In general, the lower the utilization ratio, the better for credit scores.

| Score Range | Credit Usage |

|---|---|

| Poor (300 - 579) | 91% |

| Fair (580 - 669) | 61% |

| Good (670 - 739) | 40% |

| Very good (740 - 799) | 15% |

| Exceptional (800 - 850) | 7% |

Source: Experian, September 2024

Delinquency Rates by Account Type

Delinquency levels increased in the wake of the pandemic. Part of the uptick is likely due to the expiration of pandemic-related safety nets that allowed borrowers—especially those with mortgages and student loans—some additional time and relief in repaying their financial obligations.

Now that economic activity has normalized, relatively speaking, so have the derogatory marks on credit reports that can drastically reduce FICO® Scores. As of September 2024, 2.40% of credit card accounts were 30 or more days past due, according to Experian data. That's slightly lower than September 2023, when 2.45% of accounts were at least 30 days delinquent.

| Account Type | 2023 | 2024 |

|---|---|---|

| Credit card | 2.45% | 2.40% |

| Mortgage | 1.88% | 2.24% |

| Auto loans | 3.51% | 3.68% |

| Personal loans (unsecured) | 3.89% | 3.86% |

Source: Experian data from September of each year

Delinquency rates for auto loans and personal loans were also very similar to 2023 levels. The only major credit category on the rise is mortgages, where delinquency levels increased from 1.88% in 2023 to 2.24% in 2024. But this elevated rate is still below pre-pandemic levels, which were as high as 2.48% in 2019. Even if the delinquency rate rose to 2019's high, however, it still wouldn't be close to levels associated with economic slowdown or recession.

Is This as Good as It Gets for Consumers?

All of these plateaus consumers had collectively reached in 2024—including average credit scores and credit utilization ratios—perhaps show that the borrowing health of consumers is generally good, but possibly at a point where further improvement is unlikely.

We asked Jim Bander, a data scientist with Experian Decision Analytics, for some insight.

While he stopped short of making a prediction, Bander still believes in what many economists have observed over the years: the resilience of the U.S. consumer.

"If there's one thing I've learned from the data about the American consumer, it's that they are incredibly resilient," Bander says. "Credit scores may not improve in the next year or two, but I'm confident that future consumers will be even more creditworthy than today's consumers."

What factors spark confidence exactly? "For one: My analysis shows that consumers in their 20s today show more responsibility than older generations did at the same age, in terms of credit delinquency and utilization," Bander says. "For another: Many millennials will be even more able to pay their bills and control their balances in the future than today. I've seen estimates that the beneficiaries of the upcoming so-called 'great wealth transfer' may inherit $90 trillion within the next decade or so."

Bander also dismisses the idea of credit scores being inflated versus in prior years. "There is a common misconception that a credit score of 720 corresponds to a particular probability of default that should not change over time," he says. "The important thing to know is that a person with a credit score of 720 today is more creditworthy than a person with a credit score of 680 today; just as a person with a credit score of 720 is more creditworthy than a person with a credit score of 680 was in 2010. The credit score-to-risk ratio depends on a number of factors related to the economy, the specific credit product and even the lender's own loan servicing practices."

Where Consumers Stand Heading Into 2025

Economic concerns continue to be front of mind for many consumers. Affordability looms large, not only for everyday items like gasoline and groceries but also big-ticket items like homes and vehicles. Despite wage increases that keep up with inflation, many consumers continue to feel stretched and generally weary of financial surprises. Although not all recent and sudden price increases affected every consumer demographic, nearly everyone was impacted.

- Generation Z, which typically has larger auto insurance premiums than older generations, has seen average car insurance premiums increase 20% over the past year, according to federal data. Meanwhile, rental costs (most independent Gen Zers are renters) increased by more than 30% since 2019 in many housing markets.

- Millennials yearning for their first home are having doubts if they'll ever reach the American dream, as homeownership levels for millennials are lower than for the generations who preceded them when they were that age. Mortgage rates increasing to 7% despite fed rate cuts doesn't make that aspiration any easier.

- Generation X, still carrying the largest debt burden by far, is nearing retirement age, and many would-be retirees' accounts are nowhere near ready for that moment.

- Baby boomers, often considered the most fortunate generation economically, are facing difficult decisions of their own. If they're homeowners, whether to relocate or stay put in retirement may be top of mind. Moreover, suddenly rising home insurance costs in some parts of the country are placing would-be retirees with fixed incomes in precarious financial positions.

Further permutations beyond generational differences certainly exist as well. In no particular order:

- Some regions of the country, which also happen to be three of the most populous states in the nation (California, Florida and Texas) are experiencing property insurance crises, each state in its own unhappy way, though all have a change in perceived risk to property as a root cause.

- In those states as well as others, drivers are having similar issues with automobile insurance, with certain insurers exiting the state market, leaving once-insured drivers at least temporarily stranded.

- And the percentage of uninsured drivers continues to increase, which is a concern above and beyond other, more typical, financial stressors.

Notice that none of these financial concerns have to do with maxed-out credit cards, "YOLO" spending or concerns about not being able to visit Cabo more regularly. If there are financial concerns, they typically don't begin with excessive consumer discretionary spending.

Credit Score Awareness Dips Slightly

According to an Experian survey fielded in December 2024 of more than 1,000 consumers, slightly fewer consumers in 2024 could say they knew their credit score versus 2023. Overall, 72% of survey respondents said they had at least a rough idea of their credit score, down from 78% when we asked the same question in 2023.

Question: Do you know your credit score, either roughly or exactly?

The slight decline in credit score awareness across all ages (except for those ages 65 and over) appears to be statistically significant. And although more than 7 in 10 adults ages 25 to 64 say they are keeping on top of their credit score, there's still a gap between them and younger consumers. Consumers who are still early on their financial journey generally have less awareness about their credit score, perhaps due to not yet needing that first credit card or auto loan.

"Because of credit education [among] other reasons, people have been increasingly responsible with their money," Experian's Bander says. "That's a trend that started more than 10 years ago." Recent economic research also found this to be the case.

Tracking Your Credit Score

Knowing your FICO® Score (or not knowing it) is one thing, but understanding how credit scores work is another animal altogether.

Those who do know their credit scores probably have some sense about what improves or hurts a credit score, by either noting that decreases often coincide with negative credit reporting events, while improvements often happen when a credit card balance is significantly reduced, for example. But there are some core strategies that, when followed, could improve one's credit health:

- Make on-time payments. Payment history is the most important factor in your FICO® Score. Lenders typically report missed debt payments to the credit bureaus when they are 30 or more days late, and your credit can take a serious hit when that happens. Making all your payments on time, with the help of reminders or autopay, can help build strong credit scores.

- Keep revolving balances low. Credit utilization is one of the most important factors in credit score calculations. Keeping overall credit usage below 30% won't by itself generally translate into having at least a good FICO® Score (670 or higher), but those consumers with the highest credit scores (740+) tend to have credit utilization in the low single digits.

- Apply for new credit sparingly. Although considered a credit score factor with less impact on scores, applying for multiple new lines of credit over the course of several months can have a negative impact on credit scores.

You can model several of these scenarios in various online credit score simulators (Experian offers a version as well). However, if you're roughly the 1 in 4 consumers who don't know what their credit score is, or haven't checked recently, there's no time like the present to check. If you know where you stand now, you'll be better positioned to either maintain or improve your score to receive approvals for loans and better rates for offers you do receive.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Chris Horymski leads Experian Consumer Service’s data research for Ask Experian, where he publishes insights and analysis on consumer debt and credit. Chris is a veteran data and personal finance journalist and previously wrote the Money Lab column for Consumer Reports and headed research at SmartMoney Magazine.

Read more from Chris