How to Place a Fraud Alert

Quick Answer

To place a fraud alert on your credit reports, visit Experian’s Fraud Alert Center and follow prompts to easily complete your request online. Alternatively, you can request a fraud alert through the mail or by phone.

If you believe you have been or may become the victim of identity theft, you have the right to place a fraud alert on your credit reports. A fraud alert is a notification that instructs creditors to take extra steps to confirm your identity before they process applications for credit cards or loans.

Placing a fraud alert can act as an added layer of protection against credit fraud if you suspect you could be the victim of identity theft, or if you're deployed on active duty in the military. Here's what to know about when to use a fraud alert, the different types of alerts and the steps to follow if you want to place a fraud alert on your credit reports.

When Should I Use a Fraud Alert?

Anyone can use an initial fraud alert at any time. Generally, it's a good idea to place a fraud alert if you have reason to suspect your sensitive information could have fallen into the wrong hands.

For example, if you learn that your sensitive information appears on the dark web, you might choose to place an intial fraud alert as a security precaution.

Initial fraud alerts can add a layer of protection without preventing you from applying for credit. You may also have the option of an active-duty alert, which you can place if you're on military assignment, or an extended fraud alert if you've already become the victim of identity theft or fraud.

Learn more: What Is a Fraud Alert?

Types of Fraud Alerts

There are three types of fraud alerts. Note that each type of fraud alert is completely free, and placing a fraud alert does not impact your credit scores.

| Initial Fraud Alert | Extended Fraud Alert | Active-Duty Alert | |

|---|---|---|---|

| Cost | Free | Free | Free |

| When to use it | You're worried that you've been or could become victim a victim of identity theft | You are a victim of identity theft | You're active-duty military and want to protect against credit fraud |

| Do you need to file an FTC or police report? | No | Yes | No |

| How long it lasts | 1 year | 7 years | 1 year |

| Is it renewable? | Yes | Yes | Yes |

Initial Fraud Alert

An initial fraud alert is a measure you can take if you're concerned about potential misuse of your personally identifiable information. For example, if you receive notification that your information has been compromised in a data breach, an initial fraud alert can help provide some peace of mind and guard against others using your information to open credit accounts in your name.

Anyone can place an initial fraud alert on their credit report, whether or not they are a victim of identity theft. An initial fraud alert expires after one year, but you can renew it as many times as you like (more on this below). You can also cancel an initial fraud alert at any time.

Extended Fraud Victim Alert

You can place an extended fraud alert on your credit report if you're certain that you've been a victim of identity theft. An extended fraud alert lasts for seven years or until you cancel it; it can also be renewed.

To place an extended fraud victim alert, you'll need to submit a copy of a Federal Trade Commission (FTC) victim report or a police report showing that you're a victim of identity theft.

Learn more: How to File a Police Report for Identity Theft

Another measure that victims of identity theft have the right to take is placing a credit freeze, also called a security freeze, on their credit. A security freeze limits creditors from accessing your credit report, and access is restricted until you lift the freeze or authorize temporary access to your file. Credit freezes do not expire on their own and must be requested with each credit bureau individually. Because credit freezes aren't as convenient as fraud alerts, it's best to treat them as the more extreme measure.

Active-Duty Alert

When you place an active-duty alert, lenders who check your credit report will be notified that you're a member of the armed forces and are currently away from home on active duty. That can prompt lenders to take extra steps to verify your identity before processing applications for credit in your name.

Like an initial fraud alert, an active-duty alert lasts for one year. You can renew it for as long as you remain on assignment. You can also cancel it at any time.

How to Place a Fraud Alert

Placing a fraud alert online through Experian's Fraud Alert Center is a fast, convenient option. If you request a fraud alert with one of the three national consumer credit bureaus (Experian, TransUnion or Equifax), the other two bureaus will be notified and an alert placed on those reports as well.

- Navigate to Experian's Fraud Alert Center.

- Log in or register for an Experian account to proceed with placing a fraud alert.

- Select which type of fraud alert you want to place. You'll be prompted to confirm your phone number. Experian will include your phone number in your fraud alert, and lenders may use it to verify your identity before extending you new credit. You can choose not to include a phone number by leaving this field blank.

- Follow the prompts on screen to place a fraud alert. Next steps differ depending on which type of alert you place.

If you're placing an initial fraud or an active-duty alert: After you confirm your phone number and hit continue, you'll receive confirmation that a fraud alert has been successfully placed on your credit file.

If you're placing an extended fraud alert: You'll need to follow the instructions in the Experian Fraud Alert Center to upload your supporting documents electronically or submit them by mail.

How to Place a Fraud Alert by Phone or Mail

While Experian's online service is the most convenient way to place a fraud alert, you can also place a fraud alert on your credit report by contacting Experian by mail or phone.

To place a fraud alert through the mail, write to:

Experian

P.O. Box 9554

Allen, TX 75013

Written requests should include the following information:

- Your full name

- Social Security number

- Complete addresses for the past two years

- Date of birth

- Government-issued identification card, such as a driver's license

- Copy of a utility bill or bank statement

To place a fraud alert over the phone, call Experian's toll free phone number: 888-EXPERIAN (888-397-3742)

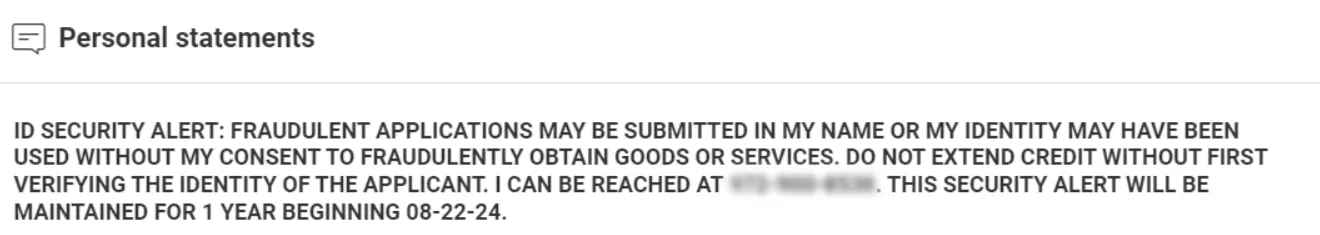

Here's an example of what a fraud alert looks like:

How to Renew a Fraud Alert

You can request a renewal of an existing fraud alert up to three months before it's set to expire. For initial fraud alerts and active-duty alerts, this will extend the alert for an additional year. For extended victim fraud alerts, this will extend the alert for an additional seven years.

How to Remove a Fraud Alert

Initial fraud alerts and active-duty alerts expire one year after you request them, and extended fraud alerts expire after seven years.

If you decide that you want to remove a fraud alert from your credit files before it expires, you'll need to do so with each of the three credit bureaus individually. Each bureau will have its own instructions you'll need to follow to request removal.

To remove a fraud alert from your Experian credit file, you can visit the Experian Fraud Alert Center for instructions on how to complete the request online or by mail.

Frequently Asked Questions

More Ways to Guard Against Fraud

Apart from placing a fraud alert, you can defend against identity theft and fraud with these best practices:

- Avoid sharing your personal information. Never give out your personal information to anyone who contacts you asking for it. Share sensitive information only when you're the one who initiates contact with a trusted institution. Also, avoid traveling with sensitive documents, such as your Social Security card.

- Practice good password hygiene. Create unique, hard-to-guess passwords for all of your accounts. Consider using a password manager to make creating and keeping track of your passwords easier. Beyond strong passwords, multifactor authentication can help prevent unauthorized access to your accounts.

- Keep your devices up to date. Hackers take advantage of holes in software security as access points to compromising your devices. Regularly install updates when prompted on your smartphone or computer to ensure you're staying defensive.

- Avoid public Wi-Fi. While you may be tempted to take care of some banking or log in to your accounts at a coffee shop or at the airport, information you transmit through public Wi-Fi is vulnerable to interception. Avoiding public Wi-Fi or using a VPN can help you reduce risks.

Consider signing up for free credit monitoring through Experian to stay aware of any changes to your credit report and score in real time. Also, you can take advantage of a free one-time dark web scan from Experian to check whether your sensitive information is circulating on the dark web.

Have you been a victim of identity theft?

Add another layer of protection to your credit by notifying lenders to take extra steps to verify your identity before processing new credit.

Add a fraud alertAbout the author

Evelyn Waugh is a personal finance writer covering credit, budgeting, saving and debt at Experian. She has reported on finance, real estate and consumer trends for a range of online and print publications.

Read more from Evelyn