Is Car Insurance Tax Deductible?

Quick Answer

Car insurance premiums may be tax deductible if you’re self-employed and do business-related driving. You can file an IRS Form 1040 or IRS Form 2106 to write off car insurance on your taxes.

Paying for car insurance goes hand in hand with owning or leasing a car, but you may be able to deduct your insurance payments if you use your car for business-related driving. Understanding how it works could save you a significant amount of money. On average, auto insurance costs $1,765 per year, according to a 2023 AAA report. But you'll need to meet certain requirements to write off this expense.

When Can You Deduct Car Insurance From Your Taxes?

Tax deductions reduce your taxable income, which could bring down your overall tax bill. You can typically deduct some or all of your car insurance premiums if you're self-employed or own a business and drive your car for work. The amount you can deduct depends on how much you use the car for business-related purposes.

If you're an employee rather than a business owner, you might still be able to deduct car insurance if you are:

- A reservist in the armed forces

- A qualified performing artist

- A fee-based government official

Just keep in mind that eligible employees must use their car for business-related purposes. That might include driving to business conferences or client meetings—but your regular work commute doesn't count.

More Car Expenses You Can Deduct

Insurance premiums aren't the only car-related expenses you can deduct. If you fall into one of the eligible categories above, you might also be able to write off:

- Repairs

- Maintenance costs

- Gas

- Oil

- Tires

- Lease payments

- Depreciation

- Registration fees

How to Write Off Car Insurance on Your Taxes

1. Know How to Calculate Your Deduction

There are two ways to calculate car-related business expenses. If you're hoping to deduct car insurance premiums, you'll need to use the actual expenses method.

- Using actual expenses: This involves tallying up all of your car-related business costs, which may include any or all of the expenses listed above. If you also use your car for personal driving, you'll want to keep clear records of business use (more on this below).

- Using the standard mileage rate: In 2024, the IRS allows qualifying taxpayers to write off 67 cents per mile that's driven for business use.

2. Keep Accurate Records

It's important to track how much you're using your car for personal use versus business-related driving as this will factor into the size of your tax deduction. Accurate recordkeeping is always important, especially where the IRS is concerned. This can also come in handy if you ever get audited. Be sure to keep all of your receipts to document any car-related business expenses.

3. File the Right Tax Form

- Self-employed workers and business owners: File IRS Schedule C (Form 1040), or Schedule F if you're a farmer.

- Armed forces reservists, qualified performing artists and fee-based government officials: File IRS Form 2106.

4. Consider Working With an Accountant

A tax professional can clarify whether you're able to deduct car insurance premiums. They can also provide guidance on other business expenses you can write off on your next tax return. You can choose between taking the standard tax deduction and itemizing your deductions—both options are available to you. The best choice is usually the one that adds up to the largest deduction.

In 2024, the standard deduction is:

- $14,600 for single filers

- $21,900 for heads of household

- $29,200 for married couples

Other Car-Related Tax Perks

Apart from business-related expenses, you can also claim a deduction or tax credit for:

- Buying an electric or hybrid vehicle: This could unlock a tax credit for up to $7,500.

- Donating an old car to charity: Under certain circumstances, you may be able to deduct its entire fair market value.

- Using your car primarily for medical reasons: If your transportation costs are essential for medical care, you might be able to deduct your mileage or your actual expenses. The latter might include gas, tolls and parking fees.

The Bottom Line

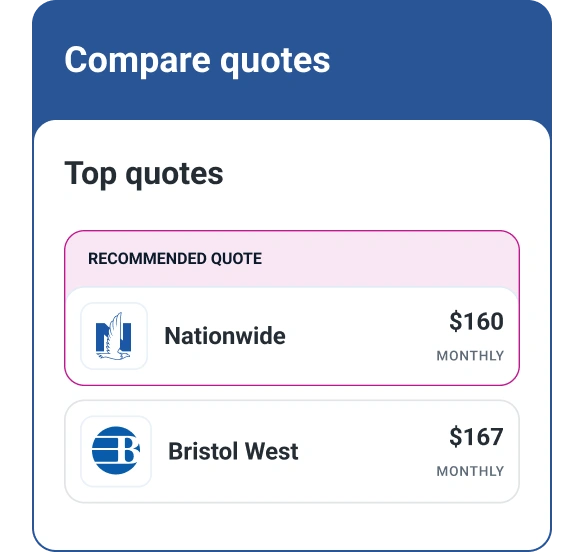

If you're self-employed or own a business, and you drive your car for work, you can probably deduct some or all of your car insurance premiums. You'll have to meet certain IRS requirements, but the result could reduce your taxable income—and, in turn, your tax liability. You can shop for car insurance and compare quotes with Experian.

Don’t overpay for auto insurance

If you’re looking for ways to cut back on monthly costs, it could be a good idea to see if you can save on your auto insurance.

Find savingsAbout the author

Marianne Hayes is a longtime freelance writer who's been covering personal finance for nearly a decade. She specializes in everything from debt management and budgeting to investing and saving. Marianne has written for CNBC, Redbook, Cosmopolitan, Good Housekeeping and more.

Read more from Marianne