How Much Is a Down Payment on a House?

Quick Answer

While a 20% down payment may be the well-known guideline, there's no one-size-fits-all down payment—especially considering how many homebuyers put down less. Choose a down payment that will make home ownership possible while also allowing you to meet other goals.

While the general rule of thumb is to save 20% of a home's purchase price for a down payment, many homebuyers put down less. There are even loan programs that require no down payment at all, or down payments of just 3%.

There are benefits to putting the typical 20% down. These can include avoiding private mortgage insurance, receiving a lower interest rate and paying less per month. But if that's not possible for you, know that you have options. Here's what to know about making a down payment on a house.

What's the Average Down Payment on a House?

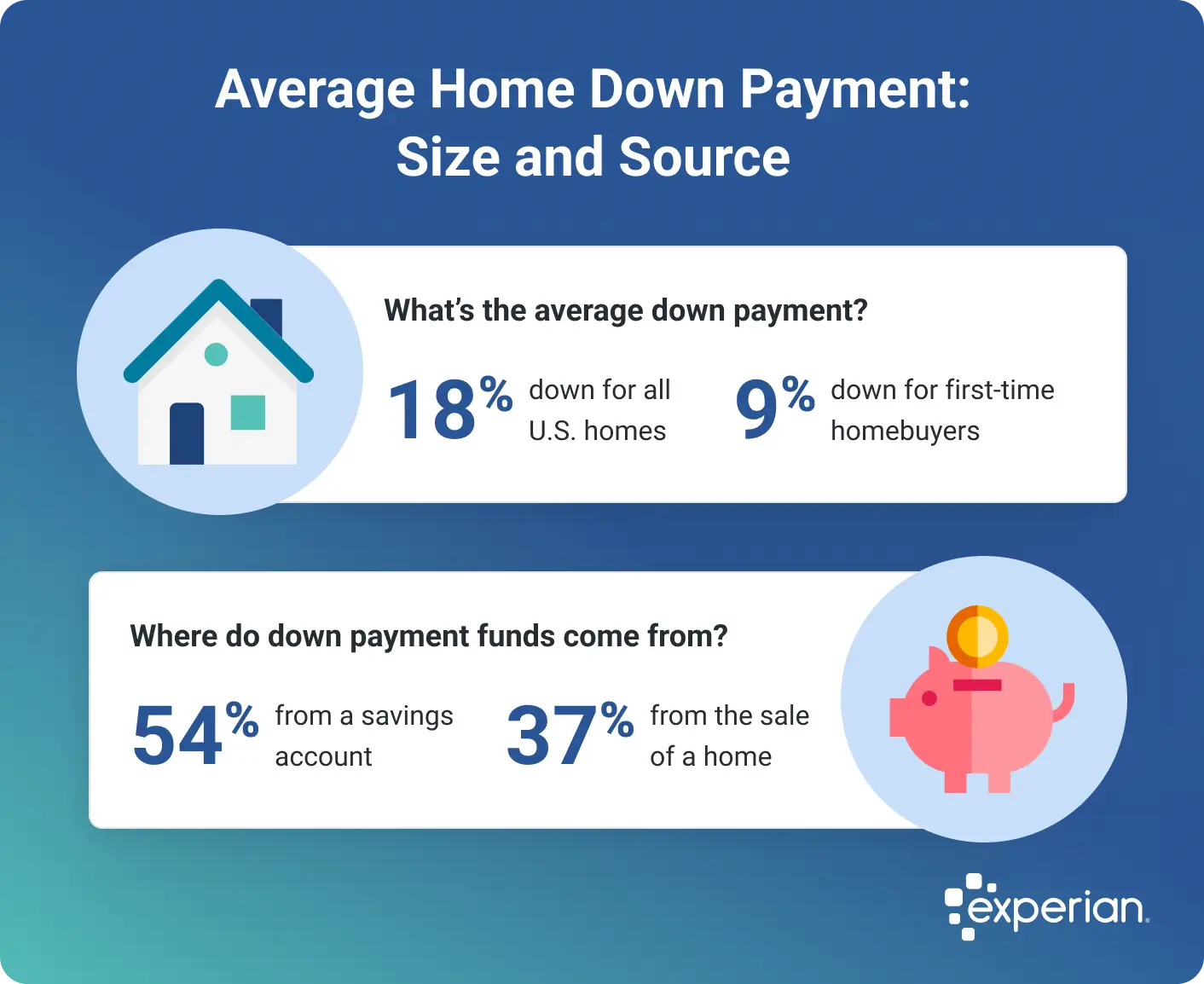

The average down payment in 2024 was 18% for all homebuyers, according to the National Association of Realtors (NAR). But down payments vary widely by type of buyer. Among first-time buyers, the average down payment was just 9%, and among repeat buyers, it was 23%, according to NAR.

Among first-time homebuyers, 69% used personal savings to make their down payment, and 25% used a gift or loan from a family member or friend, according to the NAR report. A significant share of first-time buyers—29%—used an FHA loan from the Federal Housing Administration to buy their home. FHA loans require a down payment of just 3.5% to 10% (more on this option below).

Do You Need to Put 20% Down on a House?

It isn't required to put 20% down on a house, and for many buyers, it's not possible to do so. That guideline came about as a result of down payment requirements for government-backed mortgages dating back to the mid-20th century. Today, while it's no longer obligatory to put 20% down, many lenders charge private mortgage insurance (PMI) if you don't. That incentivizes borrowers to put down at least 20% to avoid PMI, which can cost 0.5% to 2% of the total loan amount per year.

You could also increase your chances of mortgage approval with a bigger down payment, as lenders will likely view you as a good saver and thus a lower credit risk. Also, since a higher down payment reduces your loan-to-value ratio, or the loan amount compared with the home's value, you can usually get lower interest rates from lenders. Finally, a larger home down payment cuts your monthly mortgage bill, leaving you with extra cash for other goals, like investing or retirement savings.

Learn more: Pros and Cons of a 20% Down Payment

Compare mortgage rates

Check today’s rates to find the best loan offers. Staying updated on current rates helps you secure a competitive mortgage and save more over time.

What Is the Minimum Down Payment on a House?

The minimum down payment you're required to make depends on the lender and mortgage type.

For example, FHA loans require you to put down only 3.5% of the home's purchase price if you have a credit score of at least 580 (10% if your credit score is between 500 and 579). If you're a veteran or service member, you could pay 0% down and no private mortgage insurance for a VA loan through the U.S. Department of Veterans Affairs. USDA loans from the U.S. Department of Agriculture offer similar zero down payment loans in eligible suburban and rural areas.

Even some lenders that provide conventional loans, which aren't backed by a government agency, offer low down payment mortgages that require 3% down. Larger jumbo loans typically require a higher minimum down payment. Here are the down payment requirements for several common loan types.

| Loan Type | Minimum Down Payment |

|---|---|

| Conventional | 3%, depending on the lender |

| FHA | 3.5% with a credit score of 580 or higher; 10% with a credit score from 500 to 579 |

| VA | 0% |

| USDA | 0% |

| Jumbo | 10% |

How Much Should You Put Down for a House?

The ideal amount for you to put down on a house depends on your savings, goals and the realities of the market in the location you're considering.

In the current competitive housing market, for example, average down payments are higher than they've been in years. For first-time buyers, the average is the highest since 1997; for repeat buyers, it's the highest since 2003, according to NAR. Additionally, the share of buyers who paid all cash for their homes in 2024 was 26%, the highest ever recorded by NAR. That may show the pressure on buyers to finance as little of a home purchase as possible to compete.

Here's how to decide on a down payment:

- Review your goals. Perhaps the biggest question to answer is how important home ownership is to you. Decide, based on your long-term plans, if you're willing to pay PMI in order to buy a house with a 5% down payment, or if you're fine with renting a little longer so you can get a smaller monthly payment in the future.

- Consider all funding sources. In addition to personal savings, consider whether you have access to gift funds from family and whether you qualify for down payment assistance in your area. If you qualify for a VA loan or USDA loan, you could skip saving for a down payment altogether.

- Calculate your monthly mortgage payment. Use a mortgage calculator to identify how big an impact your down payment will have on your monthly payment in the future. You may decide it's worth it to make a larger down payment now in order to save over time.

- Estimate PMI. If you're thinking about putting less than 20% down, check the cost of PMI charged by the lender you plan to work with. That might be more or less than you expected, influencing whether you wait and save for a larger down payment or not.

- Remember other costs of homeownership. The down payment isn't the only initial cost you'll incur to buy a house. You'll also pay closing costs of 2% to 5% of the home's purchase price once the mortgage is finalized. Plus, taxes, ongoing repairs, utilities and other homeowner costs are important to budget for alongside the down payment.

Mortgage calculator

How to Save for a Down Payment

Here's how to save up for as large a down payment as possible:

- Set a goal. Start thinking far in advance about when you hope to become a homeowner, get an idea of your likely purchase price and commit to saving every month.

- Automate savings. An automatic transfer from your checking to savings account is the easiest way to ensure you save regularly for a down payment. For many buyers, opening a high-yield savings account is a good option.

- Cut spending. Once you have a goal in mind, conduct an inventory of your current spending. Check whether you pay for subscription services or memberships you don't use, shop around for car insurance to see if you can get a better deal, and negotiate down your cable bill.

- Create an ongoing budget. After you've done an initial inventory, start tracking your spending and hold yourself accountable for saving for a down payment. Choose a budget guideline to follow, like the 50/30/20 budget, which suggests spending no more than 50% of your take-home income on necessities, no more than 30% on wants, and 20% or more on savings and debt payoff.

- Leverage the power of gifts. Both conventional and government loans allow for gift funds. To properly document gift funds, both the borrower and the donor have to sign a gift letter. You'll also have to show evidence of the transfer of funds.

- Shop around for a mortgage. Consider multiple mortgage and down payment options when you're searching for a loan. Make sure you're aware of all the government-backed loan programs and state and local homebuyer assistance programs you may qualify for.

Learn more: How Much House Can I Afford?

Frequently Asked Questions

The Bottom Line

While 20% may be the long-touted guideline, there's no one-size-fits-all down payment—especially considering how many homebuyers put down less. Instead, after looking into your mortgage options, local assistance programs and personal savings, opt for a down payment that will make home ownership possible while also giving you the flexibility to meet other long-term goals.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna