Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

22 resultsPage 1

Webinar

Webinar

The credit marketing landscape is evolving. As competition intensifies and consumer expectations rise, financial institutions that can predict, personalize and perform at scale will define the next generation of success.

In this webinar, our experts explore how financial institutions can use connected intelligence to find, know and grow the right customers, leading to:

Tip Sheet

Tip Sheet

A new year means new opportunities — and new pressure to make every marketing dollar count. Whether your focus is to expand your portfolio, deepen existing relationships or improve marketing efficiency, this checklist will help you prepare to drive stronger, smarter growth all year round.

You’ll discover how to:

eBook

eBook

To strategically market your credit products, you’ll need to connect and engage with qualified consumers, but finding and pitching to them isn’t always easy.

Read our e-book to discover:

White Paper

White Paper

This white paper explores the transformative potential of Home Equity Lines of Credit (HELOCs) in 2025, a year marked by record-high homeowner equity and shifting consumer credit behavior. It offers data-driven insights into how lenders can tap into the $29 trillion in untapped equity by leveraging advanced analytics, behavioral segmentation, and digital innovation to meet evolving borrower needs.

Key Takeaways:

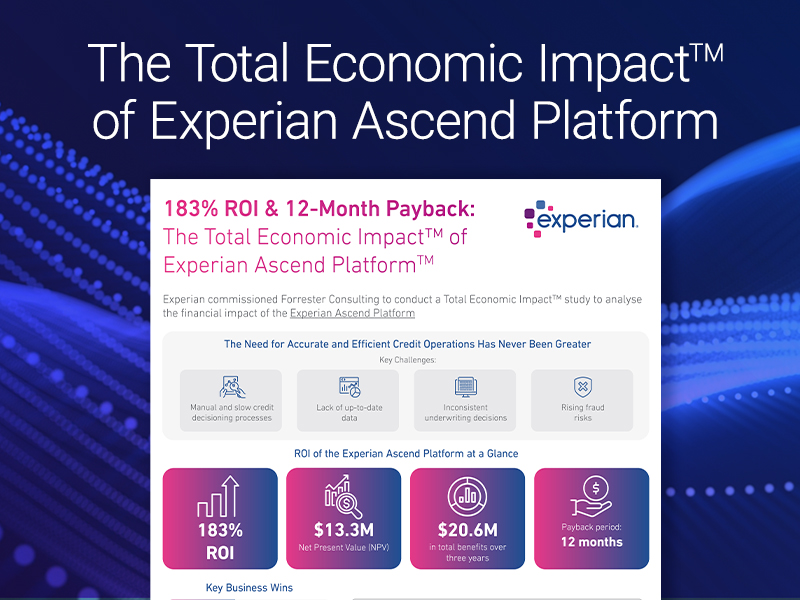

Infographic

Infographic

Based on interviews with global financial institutions, the Forrester Total Economic Impact™ study, commissioned by Experian, reveals real customer impact stories and business wins delivered by the Experian Ascend Platform™. This infographic shares some of the key findings.

Key insights include:

Case Study

Case Study

The Forrester Total Economic Impact™ (TEI) study, commissioned by Experian, explores the quantifiable and unquantified benefits of implementing the Experian Ascend Platform™. Based on interviews with global financial institutions, the report provides a comprehensive analysis of how the platform improves credit decisioning, reduces fraud, and delivers significant ROI.

Key insights include:

Video

Video

Reaching the right consumers with credit offerings can be challenging without the right technology. Our optimized prescreen model and strategy service, Ascend Intelligence Services™ Target, can help organizations identify consumers who meet credit offer criteria, increasing the likelihood of positive responses.

With access to Experian’s historical data, financial institutions can:

By optimizing their prescreen strategies, organizations can reach more of the right consumers to grow their customers bases and drive revenue.