Smarter lending, powered by Experian and Plaid

Unlock a holistic view of borrower financial health – faster. Experian and Plaid have joined forces to help lenders seamlessly integrate real-time cashflow data and proven risk analytics into their workflows, enabling smarter, more inclusive lending decisions.

The future of financial services is open

Open banking is revolutionizing financial experiences, and it’s here to stay. To unlock the potential of open banking, customer centricity and providing customer value are critical. Harness the power of consumer-permissioned data by integrating the right solutions into your decisioning strategies to help drive financial inclusion.

Power your innovation

With open banking practices maturing globally, all signs point to an interconnected, consumer-centric financial ecosystem. Our expertise in data, advanced analytics and technology empowers you to use open banking data effectively to enhance your portfolio. Leveraging machine learning-driven microservices, our solutions provide crucial customer insights, including wealth, income, employment, affordability and default probability, to help you conduct risk assessments and tailor credit offerings to your customers' current financial situations.

Drive financial inclusion

With over 100 million consumers considered unscoreable, invisible or subprime through the traditional credit lens, advancing financial wellness requires a differentiated approach.1 Our open banking solutions combine banking transaction data and innovative technologies to provide a holistic view of consumer creditworthiness — helping you expand fair and affordable credit access while growing your prospect pool responsibly and efficiently.

Make smarter decisions across the credit lifecycle

Harness the power of cashflow data through a suite of scores, attributes and dashboards to gain actionable insights that drive informed decisions in your customer acquisition and portfolio management strategies. Leveraging rich transactional data and advanced predictive analytics, our open banking solutions enable more precise credit risk assessment, optimize account management, and identify personalized upsell and cross-sell opportunities for greater customer engagement.

of consumers would likely share banking data for better loan rates, financial tools or personalized spending insights.

Source: Atomik Research

consumer-permissioned cashflow attributes in our database.

estimated value of the global open banking market by 2031.

Source: Allied Market Research

of banks expected to actively invest in open ecosystems.

Source: Celnet Research

of adult Americans can’t access mainstream credit rates.

Source: Oliver Wyman and Experian

lift in predictive accuracy when cashflow insights are viewed with traditional credit information for a majority of lenders.

Source: Experian analysis based on GINI predictability.

Frequently asked questions

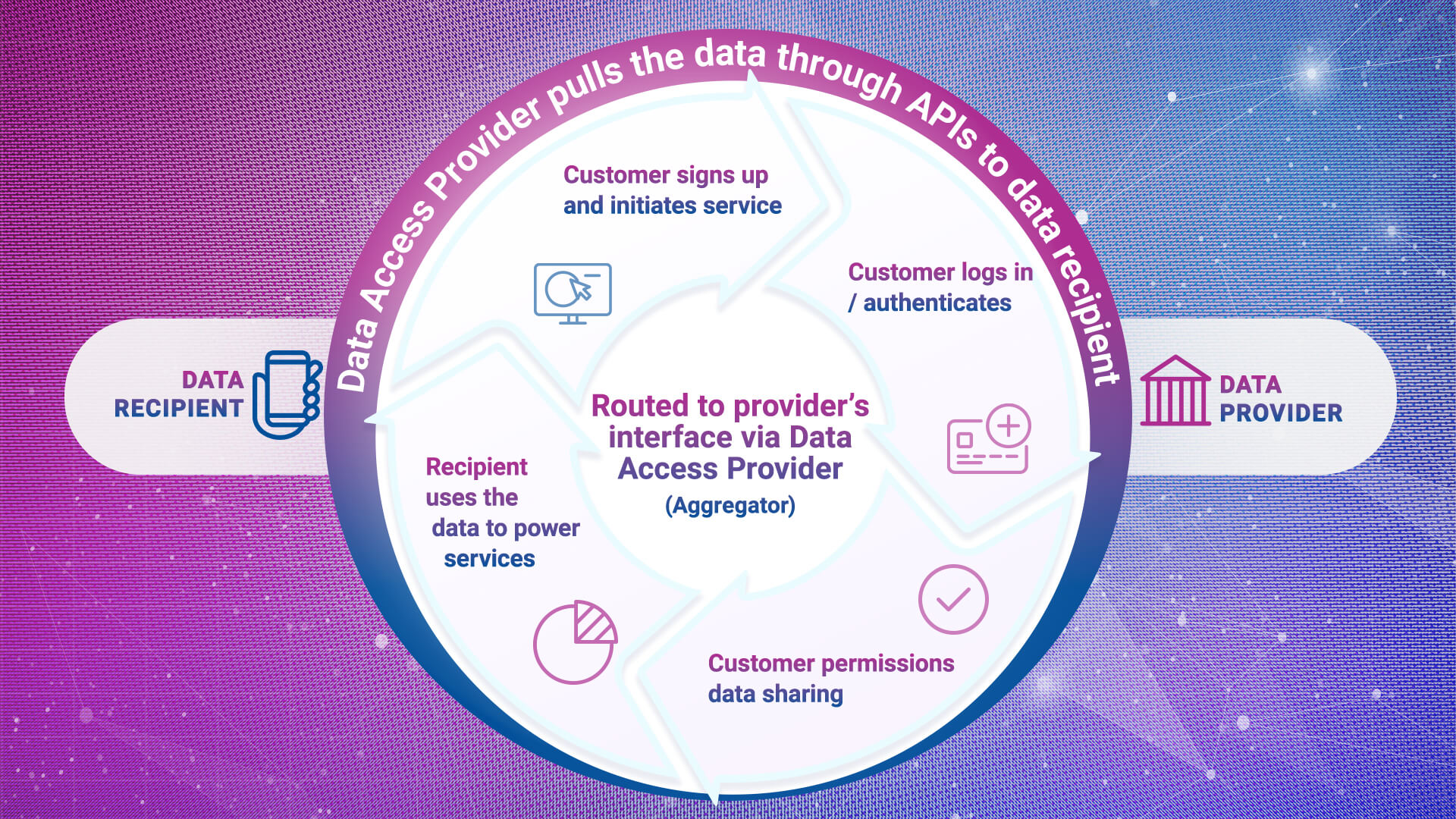

Open banking is the practice of securely sharing financial data, such as bank transaction data, between banks or third parties through APIs. At its heart, it aims to foster a more inclusive, transparent and consumer-empowered financial ecosystem.

Learn more about open banking.

Cashflow data, also commonly referred to as bank transaction data, refers to information related to demand deposit accounts, including transaction histories, balances, account holder details and other relevant financial data associated with these accounts. This data can provide a more comprehensive view of a consumer’s financial standing outside of the credit report.

The CFPB’s 1033 rule is part of the Dodd-Frank Wall Street Reform and Consumer Protection Act. As a foundational element of open banking, this rule mandates that financial institutions must allow consumers to access their financial data and share it with third parties upon consent.

We are unable to address personal credit report and/or membership inquiries via this business form. Visit Experian.com/help or call 888-397-3742 for consumer assistance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

1Source: Experian and Oliver Wyman

- Solutions

- Advanced analytics and modeling

- Collections and debt recovery

- Credit decisioning

- Credit profile reports

- Customer engagement and retention

- Data reporting and furnishing

- Data sources

- Data quality and management

- Fraud management

- Global data breach services

- Identity solutions

- Marketing solutions

- Regulatory compliance

- Risk management

- Workforce management