Business Information Blog

The latest from our experts

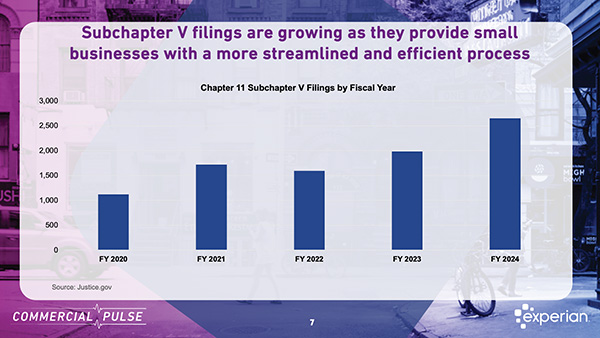

Business bankruptcy among young businesses is on the rise. The Commercial Pulse Report explores these trends for risk management.

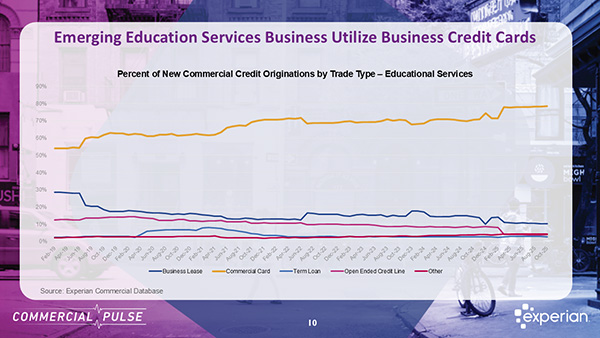

Explore the growth of education services and how they offer stable opportunities for small businesses in today’s lending landscape.

The Experian Small Business Index™ improved by 15.9 points month-over-month and 9.1 points Year-Over-Year Nov 2025 Index Value (Nov): 52.0 Previous Month: 36.1 MoM: 15.9 YoY: 9.1 (Nov 2024 = 42.9) The Experian Small Business Index™ increased substantially in November by 15.9 points to 52.0. This also represents a YoY increase of 9.1 points. There was increased business activity with the end of the government shutdown in November. Business owners saw an increase in new account openings and approval rates, along with an increased number of new business formations. Negative credit conditions improved, with reductions in delinquencies and utilization. The Small Business Optimism Index from NFIB increased to 99.0 from 98.2 in October. There was an increase in the number of new business applications to 535K from 499K in October, the most in a single month since July 2020. Inflation fell in November, to 2.7% from 3.0% in September, the lowest level since July. November unemployment was up to 4.6% from 4.4% in September. The inflation and unemployment rates are likely to influence Federal Reserve policy decisions as they consider whether additional rate cuts are warranted in 2026 after a 25 bps drop in December. Explore Experian Small Business Index Related Posts

Experian explores the impact of rising healthcare premiums on small businesses as incentive programs look to expire by year end.

Report shows tighter credit conditions, with modest delinquency movements, disciplined utilization rates, and accelerating new business starts

The Experian Small Business Index™ declined in October, dropping by 5.0 points month-over-month. Oct 2025 Index Value (Oct): 36.1 Previous Month: 41.1 MoM: -5.0 YoY: -4.6 (Oct 2024 = 40.7) The Experian Small Business Index™ decreased in October by 5 points to 36.1. This drop is attributable to decreased origination activity for small businesses and small business owners, along with an increase in delinquencies for small business owners’ consumer trades. Small business trade delinquency rates have remained stable. The NFIB reported a decrease in small business optimism to 98.2 in October from 98.8 in September, and the University of Michigan reported a drop in consumer sentiment to 51.1 in November from 53.6. Due to the extended government shutdown, several of the economic indicators were not reported for October, but there were signs of positive factors in the macroeconomic environment. US employers reported hiring 283K in October, up from 117K in September, and existing home sales were up 1.2% in October to 4.1M. Explore Experian Small Business Index Related Posts

Experian chats with Giggle Finance Co-Founder about funding gig workers while managing risk and how AI is helping them to scale quickly.

Join the experts from Experian for an insightful discussion about small business performance and the greater economy.

Read the tea leaves on retail inventory risk trends, stock gaps, and rising risk exposure during the critical holiday season.

The Experian Small Business Index™ increased in September by 3.7 points to 41.1, the second straight month of increases.

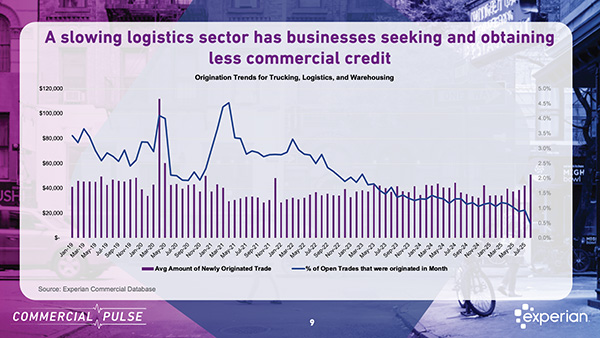

Logistics credit risk is rising according to Experian’s latest Commercial Pulse report, signaling financial strain.

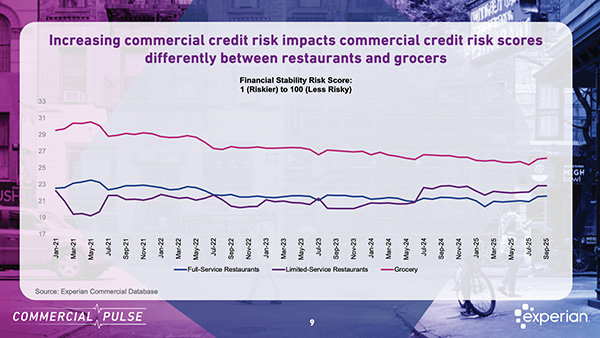

Experian Commercial Pulse Report shows food prices are having a big impact on where and how consumers choose to eat, but also on credit risk.