Industries

Experian Commercial Pulse Report reveals decline in total number of ecommerce businesses, strong revenue, and fewer credit inquiries.

Explore how the rapid rise in new business formation presents a unique opportunity for firms to expand digital relationships, automate small business credit processes, and stay ahead in a transforming economy.

Get the latest Commercial Insights from Experian's October 2024 report—covering inflation, job growth, and why 75% of small businesses remain underinsured.

Discover how business identity theft threatens B2B firms and learn effective strategies to protect your business and clients. Stay informed and secure.

Explore effective marketing strategies for insurance agents and brokers to boost ROI and client engagement.

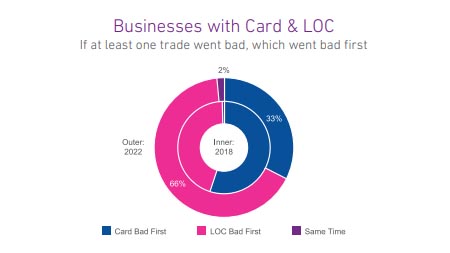

Since January 2021, a seasonally adjusted average of 444K new businesses opened each month, 52% higher than the pre-pandemic 2018-2019 monthly average. In light of the influx of new businesses, and in a higher-interest rate environment, the goal of this week’s analysis was to evaluate if commercial credit usage and payments by product shifted pre- and post-pandemic. Businesses with two different trade types were evaluated as of 2018 (prepandemic) and 2022 (post-pandemic). The two-trade-type combinations observed were Card + OECL (open ended credit line), Card +Term Loan, Card Lease, and Card + LOC (line of credit). Despite more younger businesses entering the market and lenders tightening credit policies over the past two years, businesses with two-trade types had higher lines/loans post-pandemic. Delinquencies also increased post-pandemic for all the two-trade type combinations except businesses with a Card & OECL. Commercial Cards are the most prevalent type of credit for businesses. As businesses grow, they seek additional credit for business needs such as expansion, new facilities, and acquisitions. When businesses seek additional credit, it is most often in the form of commercial loans, leases and credit lines which compared to cards, generally provide higher levels of funding, longer terms and higher monthly fixed payments. For businesses that had two types of accounts, including a commercial card with another commercial credit product, the commercial card stayed current longer and more often the non-card product went delinquent first. Businesses rely on commercial cards for day-to-day operating expenses and lower dollar financing needs. Furthermore, commercial card balances are significantly lower than any of the other commercial trade types allowing for a lower monthly minimum payment to keep the card in good standing. What I am watching: Federal Reserve Chairman Powell stated in last week’s Congressional hearings that the Fed will act slowly and cautiously in terms of cutting interest rates. With inflation declining but still persistent and the labor market still robust, rate cuts may not occur until the second half of the year. Download Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

Experian's Kyle Matthies provides a roundup of international credit report usage statistics showing which regions are surging or declining.

Retail sales reached a 4-year high of over $615B in December 2023 with yearly retail sales growing 4.6%. At the same time, lenders are tightening credit and businesses within the retail sector are showing signs of stress with higher late-stage delinquency rates and falling commercial credit scores. We see retailers seeking commercial credit less often, new originations slowing and lower lines over the past several months. As retail sales continue to rise so does the proportion of online retail sales. Online sales peaked during the COVID-19 pandemic and fell slightly once the lockdowns were lifted. Online retail sales remain approximately 56% higher than pre-pandemic levels and are trending up and may soon exceed 2020 levels. Growth in online retail sales has led to growth in retail returns. Retail returns peaked in 2022 at over $800MM and over 16% of total retail sales. Prior to 2021, retail returns as a percentage of retail sales averaged 8.9%, since 2021 that rate has grown to 14.6%. As returns increase so do fraudulent returns. Retailers have implemented strategies and solutions to address retail returns which resulted in a decrease in return dollars between 2022 and 2023 yet the percentage of returns that were fraudulent increased from 10.2% to 13.7% or over $100B. Increases in both legitimate and fraudulent returns are prompting retailers to identity solutions and operational strategies to slow growth across all returns. What I am watching: The U.S. economy expanded 3.3% in Q4 2023, and 2023 real GDP increased 2.5% over 2022. Strong consumer spending fueled the economy. Multiple sources are expecting The Federal Reserve to cut interest rates up to six times in 2024 with the rate cuts beginning in Q2 2024 and continuing into 2025. Lower interest rates likely means that consumer spending will continue at an elevated rate. As spending continues to increase, specifically in the retail sector, the need for commercial credit could continue to slow as cash-flows satisfy operational capital requirements. Cash on hand should begin to satisfy outstanding delinquencies, improving commercial credit scores resulting in improved access to commercial credit.

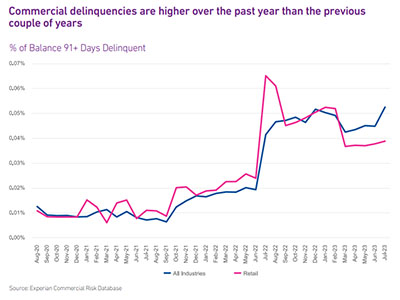

The labor market remains robust with low unemployment (3.8%) and 366K new jobs created in September. Job openings in the U.S. were 9.6MM as of the end of August, an increase of 690K or 5.8% since July. Retail sales in August had a month-over month increase for the fifth consecutive month. As we head into the holiday shopping season, despite headlines of large retailers struggling, the retail industry appears poised for success. It is likely that those retail businesses that survived the difficulties of the pandemic are the most financially sound and are driving the statistics. Over the past year, retailers are seeking less credit and taking on less debt than the previous few years. Despite inflation, consumers are still spending, and retailers are benefitting. Commercial delinquencies have been increasing over the past year. Delinquencies within the retail sector were trending above overall commercial delinquencies until just a few months ago when retailers exhibited lower rates than overall. These are all positive signs heading into the holiday shopping season which tends to make or break a retailer’s year. The September labor report was stronger than expected. Unemployment remained low at 3.8% and 366K new jobs were created which was the highest amount since January. In addition, the jobs created in July and August were revised upward significantly. What I am watching: With the labor market still tight, it will be interesting to see if the retail sector will be able to staff accordingly to support the holiday crunch. If staffing is difficult, retail stores may struggle to keep up with demand. Now that the student loan moratorium has ended, it will be important to monitor the impact to consumer spend. The increased expense of the student loan monthly payments will likely leave individuals with less discretionary income to spend on retail purchases. In addition, business owners who have student loans will have less money to invest in their business