Case studies and testimonials

Experian helps organizations of all industries and sizes to unlock new potential and meet their future goals

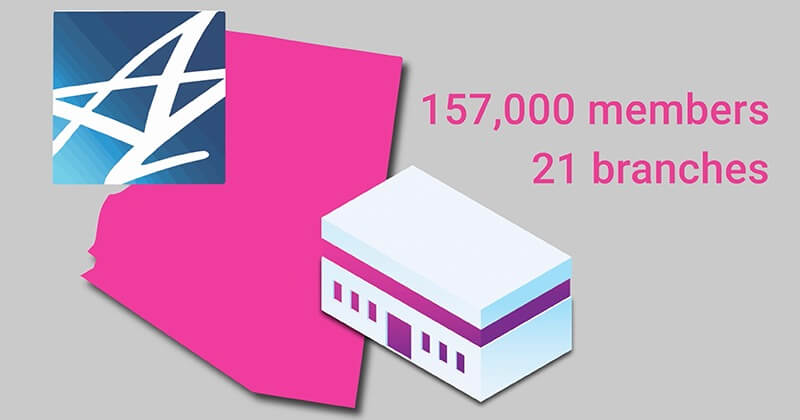

Hear what Desert Financial Credit Union thinks about Experian’s predictive data, financial inclusion efforts and resources dedicated to credit unions.

Discover how Ally Financial has leveraged Ascend Sandbox to optimize their portfolio and reduce their model development timeline.

CIC leverages consumer-permissioned technology to scale and grow in ways previously unavailable. Learn more.

Read how OneAZ Credit Union achieved a 26% increase in loan funding rates and a 25% decrease in manual reviews.