Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

30 resultsPage 1

Case Study

Case Study

Every lending decision you make relies on data, but what if that data only tells part of the story? Download our use case to meet two borrowers, Claudia and John, and discover how alternative data can help you:

Case Study

Case Study

Our use cases share real-world examples of how cash flow insights help grow portfolios responsibly while expanding credit access. Explore scenarios across borrower types, including:

Case Study

Case Study

Terrace Finance sought out a solution to stay ahead of evolving fraud attacks. They landed on NeuroID’s behavioral analytics — and gained immediate, pre-submit visibility that upgraded their fraud prevention strategy.

Key Results:

Case Study

Case Study

The Forrester Total Economic Impact™ (TEI) study, commissioned by Experian, explores the quantifiable and unquantified benefits of implementing the Experian Ascend Platform™. Based on interviews with global financial institutions, the report provides a comprehensive analysis of how the platform improves credit decisioning, reduces fraud, and delivers significant ROI.

Key insights include:

Case Study

Case Study

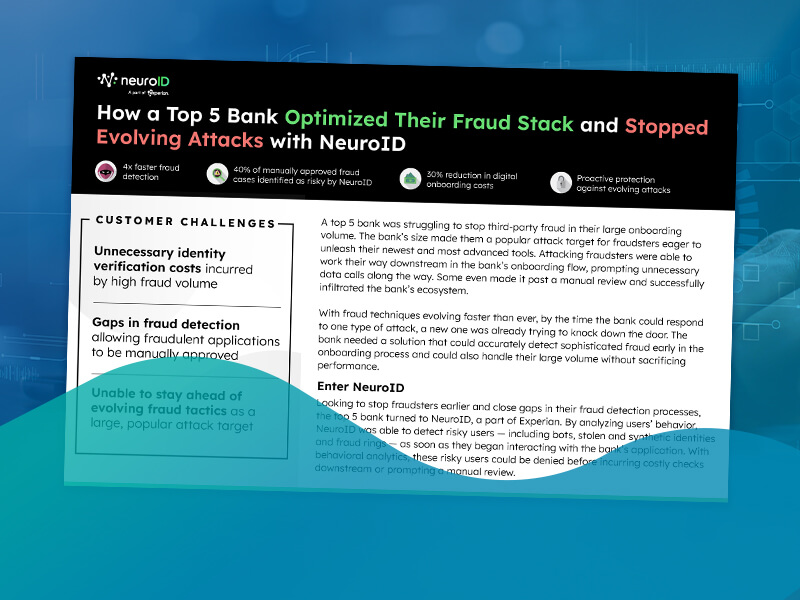

A top bank struggled to efficiently stop evolving fraud attacks. Fraudsters incurred unnecessary expenses as they worked downstream in the bank’s onboarding flow, with some even beating the bank’s defense’s entirely. After implementing behavioral analytics, the bank was able to detect attacks 4x faster and stop sophisticated attacks that their other tools couldn’t.

Key Results:

Case Study

Case Study

Overwhelmed by evolving fraud attacks and a heavy reliance on manual reviews, a leading credit union turned to NeuroID’s behavioral analytics to spot advanced fraudsters and stop attacks in real time.

Key Results:

Case Study

Case Study

Read how Elevate uses behavioral analytics to detect fraud rings and streamline workflows, resulting in a near-total elimination of fraud losses and decreased operational costs.

Key Results:

Case Study

Case Study

With behavioral analytics, Grasshopper Bank supercharges their team’s efficiency through improved top-of-funnel fraud detection and better-informed resource allocation.

Key Results:

Case Study

Case Study

Read how a payment processor used behavioral analytics to close fraud detection gaps — including identifying over 100,000 dormant fraud accounts — without adding friction for its genuine customers.

Case study includes details on: