Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

27 resultsPage 1

Webinar

Webinar

Join Ashley Knight, Experian’s SVP of Product Management, and Haiyan Huang, Prosper’s Chief Credit Officer, to discover how:

Report

Report

The fintech landscape is evolving rapidly—and 2025 is a pivotal year. Experian’s State of Fintech 2025 Report delivers exclusive insights into the market forces, consumer behaviors, and credit trends shaping the future of financial services. Learn how leading fintechs are adapting and where the next wave of growth is emerging.

In this report, you’ll discover:

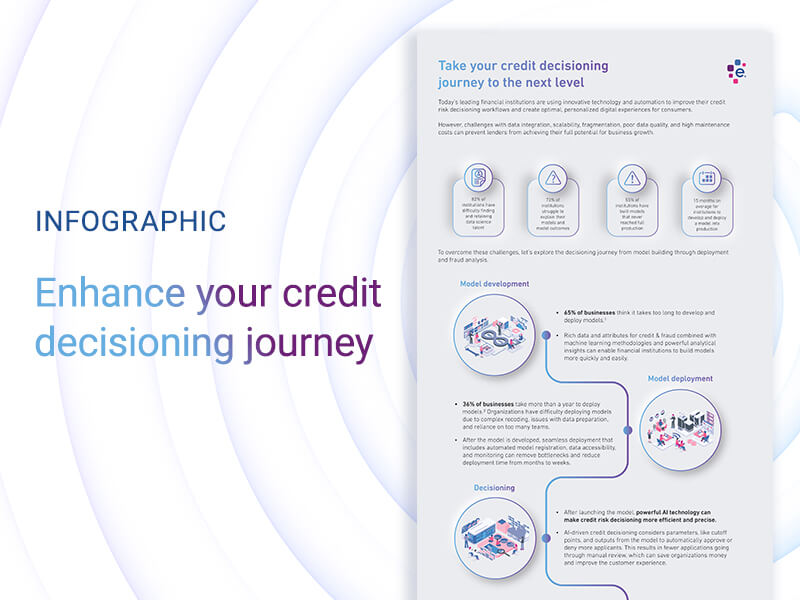

Infographic

Infographic

Financial institutions face several challenges during the credit decisioning process, such as poor data quality, scalability issues, data fragmentation, and high maintenance costs. Experian can help lending institutions enhance their credit decisioning journey at every step, through:

Discover how your organization can take your credit decisioning journey to the next level with the Experian Ascend Platform™.

Webinar

Webinar

Although the U.S. economy remains solid and has resisted a broader slowdown thus far in 2025, the outlook remains highly uncertain. In this environment, it is imperative for businesses to stay on top of the latest economic developments. Experian’s Chief Economist Joseph Mayans, Director of Fintech Gavin Harding and Head of Automotive Financial Insights Melinda Zabritski, will provide a look into:

Webinar

Webinar

Financial institutions face numerous challenges when complying with model risk management regulations. Watch our Model Risk Management for Regulatory Excellence webinar and discover more from our experts Ankit Sinha and Masood Akhtar on how to:

Report

Report

As regulations continue to change, financial institutions must establish robust risk management practices and adopt technology that matches the scale and speed of compliance requirements.

Key priorities include:

Read our full report to learn more about the growing importance of monitoring, transparency, and automation in model risk management.

Webinar

Webinar

Join our speakers Ankit Sinha and Erin Haselkorn to discover how Experian’s AI solutions help financial institutions accelerate the modeling lifecycle, integrate efficient feature deployment, and achieve regulatory compliance.

Learn from our experts about:

Infographic

Infographic

Based on interviews with global financial institutions, the Forrester Total Economic Impact™ study, commissioned by Experian, reveals real customer impact stories and business wins delivered by the Experian Ascend Platform™. This infographic shares some of the key findings.

Key insights include:

eBook

eBook

Instead of relying on reactive, fragmented data, financial institutions need streamlined, governed and integrated feature development capabilities to accelerate model development and enhance transparency.

Experian Feature Builder provides:

Read our latest e-book to discover how your organization can transform raw data into custom, high-value features quickly and easily.