Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

22 resultsPage 1

eBook

eBook

Without modern, data-driven strategies, agencies and debt buyers risk falling behind in an increasingly digital-first world.

In this e-book, you’ll learn how to:

eBook

eBook

To strategically market your credit products, you’ll need to connect and engage with qualified consumers, but finding and pitching to them isn’t always easy.

Read our e-book to discover:

eBook

eBook

Instead of relying on reactive, fragmented data, financial institutions need streamlined, governed and integrated feature development capabilities to accelerate model development and enhance transparency.

Experian Feature Builder provides:

Read our latest e-book to discover how your organization can transform raw data into custom, high-value features quickly and easily.

eBook

eBook

Managing credit limits effectively can help financial institutions maintain a healthy, profitable credit card portfolio. Proactively increasing credit limits can enhance your ability to provide excellent customer satisfaction and drive higher revenue.

Lenders can strategically implement proactive credit limit increases to:

Proactive credit limit increases give customers access to more credit, which can positively impact their financial health and help you drive business growth.

eBook

eBook

Lending institutions can gain an edge on the competition by determining what happens when a loan gets booked elsewhere. With loan loss analysis, lenders can learn more about where these lost loans are booked, the average loan amount, the interest rate, the loan term length, and the average risk score.

Analyzing this information can help lenders:

eBook

eBook

Credit risk, fraud, and compliance have long operated in silos, but forward-thinking organizations are unlocking new opportunities through convergence.

Read our e-book to learn how aligning these critical functions can help you:

eBook

eBook

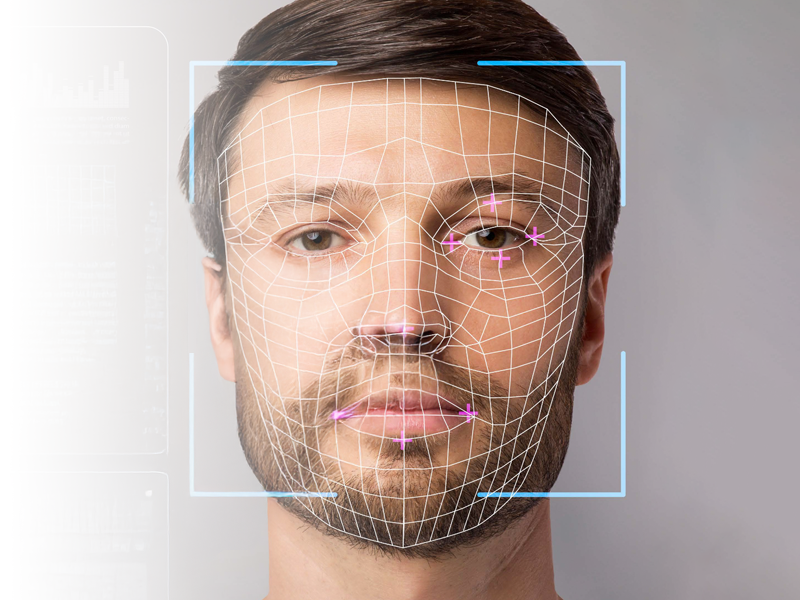

Explore Experian's award-winning AI fraud prevention strategies in Juniper Research’s exclusive Mover & Shaker interview with Keir Breitenfeld, SVP, Fraud & Identity. Learn how cutting-edge technologies like behavioral analytics and dynamic datasets combat evolving fraud threats, ensuring seamless security without compromising user experience.

Experian was recognized as the Platinum Winner of Juniper Research’s Future Digital Awards: Identity Verification Innovation.

eBook

eBook

As a service provider, you may be facing an uptick in delinquencies, making it crucial to optimize your debt collection strategies.

We’ve created a comprehensive free e-book, designed to show how you can bundle our innovative solutions for smarter, more efficient debt collection.

In this e-book, you’ll discover how to: