Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

9 resultsPage 1

Webinar

Webinar

The credit marketing landscape is evolving. As competition intensifies and consumer expectations rise, financial institutions that can predict, personalize and perform at scale will define the next generation of success.

In this webinar, our experts explore how financial institutions can use connected intelligence to find, know and grow the right customers, leading to:

eBook

eBook

Managing credit limits effectively can help financial institutions maintain a healthy, profitable credit card portfolio. Proactively increasing credit limits can enhance your ability to provide excellent customer satisfaction and drive higher revenue.

Lenders can strategically implement proactive credit limit increases to:

Proactive credit limit increases give customers access to more credit, which can positively impact their financial health and help you drive business growth.

Video

Video

Learn how Experian's Retention Triggers can alert you when your customers shop for new credit or improve their credit standing.

By leveraging this solution, you can then:

Report

Report

As we enter 2025, the mortgage industry continues to transform amid political and economic changes. Mortgage lenders must stay updated on trends to serve their customers effectively. Experian data scientists and analysts provide insights into the U.S. housing market's impact on lenders, highlighting recent trends and their implications. We aim to offer a comprehensive overview of the mortgage market, emphasizing key trends, regional differences, and potential growth areas.

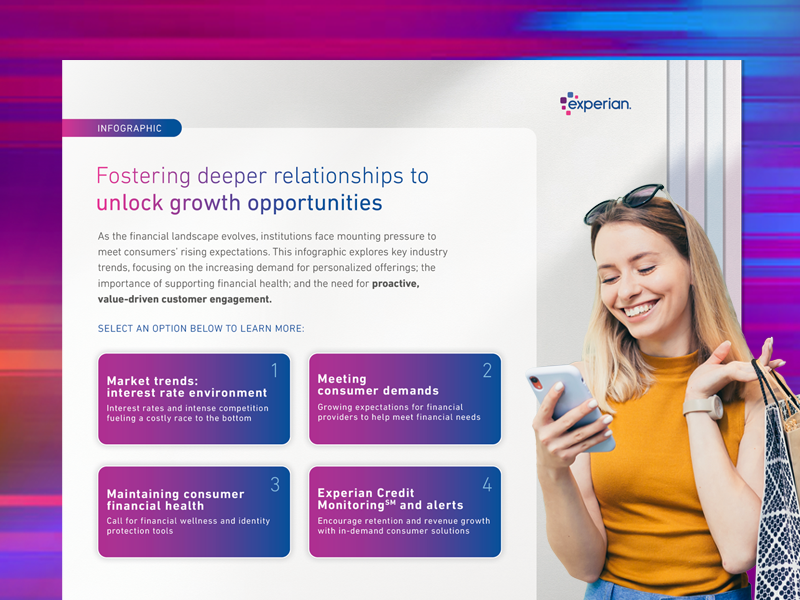

Infographic

Infographic

View our infographic to discover how you can increase revenue and empower your customers to stay informed, avoid delinquencies, and improve their financial well-being.

Here’s a sneak peek of what you’ll find:

Webinar

Webinar

Watch the webinar on-demand for an impactful discussion designed specifically for B2B firms who are looking to drive profitable growth within the small business portfolio. Watch the session to learn how B2B firms can harness Experian's robust data, analytics, and commercial marketing solutions to drive growth specifically within their small business customer segments.

Learn about:

eBook

eBook

With consumers seeking better returns on their deposits and banking relationships, financial institutions must refine their growth strategies to remain competitive. Read our e-book to learn how you can boost deposits, strengthen existing relationships and provide seamless and secure digital experiences.